Jun 22, 2022

Junk Bonds Point to a 50% Chance of a Recession, Citi Says

, Bloomberg News

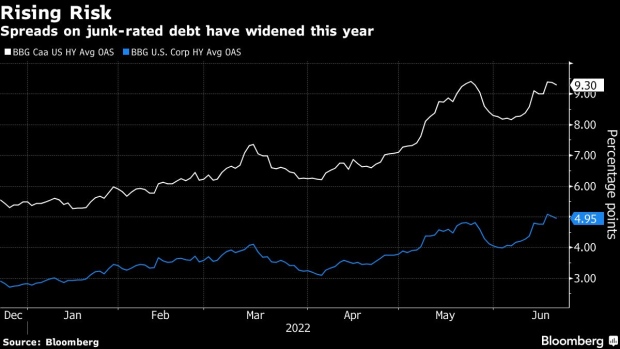

(Bloomberg) -- Junk-rated debt is indicating that the chance of a recession is essentially a coin flip as risk premiums on high-yield corporate credit touch levels last seen in October 2020, according to strategists at Citigroup Inc.

Spreads on US high-yield bonds are currently hovering around 500 basis points, while risk premiums on some of the lowest-rated corporate debt is closing in on 1,000 basis points, which is considered a distressed level.

Risk premiums -- which measure the extra yield investors demand to hold the debt instead of US Treasuries -- at this level “should cause investors to become more cautious and reset expectations,” Michael Anderson and Philip Dobrinov wrote in a note Wednesday. “The market is well on the way to pricing a recession consistent with the Dotcom and Pandemic downturns.” However, given the underlying strength of banks, a repeat of the Global Financial Crisis is less likely, they added.

While wider spreads could translate to higher returns, Citigroup cautions that there is much higher volatility ahead as 500 basis points is neither cheap enough to be a clear market bottom nor tight enough to indicate easy financial conditions supporting continued strong performance.

“Buying when spreads exceed 500bps increases expected returns, but does not increase the chance of making money,” they wrote. The risk premium “lies firmly in no-man’s land.”

Federal Reserve Chair Jerome Powell said Wednesday the central bank will keep raising interest rates to tame inflation following the steepest hike since 1994. The Labor Department’s consumer price index rose 8.6% last month from a year earlier, a four-decade high.

“We anticipate that ongoing rate increases will be appropriate,” Powell said in the text of his semiannual testimony to the Senate Banking Committee.

The strategists reaffirmed their expectations for junk-bond spreads to widen further to 550 basis points by the end of the year, citing the Fed’s hawkish plans and an unlikelihood of near-term dovish relief.

©2022 Bloomberg L.P.