Dec 15, 2020

Kanye West’s Beloved Drum Machine Maker Is Going Public Again

, Bloomberg News

(Bloomberg) -- While electronic hardware typically lingers in the shadows of the pop music world, Roland Corp.’s TR-808 Rhythm Composer has achieved enduring, household-name status.

The drum machine flopped commercially after its early 1980s release but has altered the musical landscape for decades with its booming bass. It’s gone from being name-checked by the Beastie Boys to having its sound used by modern artists like Billie Eilish. Kanye West even paid homage with his groundbreaking album “808s & Heartbreak.”

The man behind the 808 was Roland founder Ikutaro Kakehashi, a Japanese engineer who developed a string of highly praised musical instruments. Kakehashi built Roland into a success, until the magic began to fade and the company retreated from the stock market in the wake of the financial crisis.

Now Roland is set to relist after a turnaround and amid an upsurge in aspiring musicians stuck at home during the pandemic. For a company focused on creating just the right beat, its return looks particularly well timed. Roland shares will begin trading on the Tokyo Stock Exchange on Wednesday, just weeks after Japan’s benchmark index posted its best month in over seven years.

The strong market has helped secure a nice partial return for Taiyo Pacific Partners LP, which took the company private in 2014 after several years of losses. Taiyo is selling about a 45% stake in Roland in an initial public offering worth 36.3 billion yen ($350 million).

While Roland won’t get any proceeds, its stock could get a lift from passive buying on its addition to the Topix. Shares of musical instrument-making peer Yamaha Corp. have jumped 23% since the start of November, outpacing the 13% gain in the benchmark gauge after better-than-expected results.

“Roland turned things around over the last six years,” said Oshadhi Kumarasiri, a LightStream Research analyst who publishes on Smartkarma. “It makes sense for Taiyo to cash in on a portion of that success via this IPO, in a time when valuations are inflated.” While the IPO price tag looks high and fails to account for the next possible downturn in the musical instrument market, Roland’s shares are more attractively valued than Yamaha’s, he said.

Hip-Hop, Grunge

Roland was started in 1972 by Kakehashi, a music electronics pioneer who was awarded a Technical Grammy in 2013 for his work on MIDI -- a standard for connecting musical instruments and computers. His synthesizers and rhythm machines were used across the musical spectrum in the 1980s, a decade that saw the company expand and go public for the first time in 1989.

The 808 went out of production after just a couple of years, but music makers soon discovered the machine’s quirky beats, produced by special transistors that had originally been rejected as defective. It caught on with hip-hop progenitors like Run-DMC, before spreading to pop hits including Whitney Houston’s “I Wanna Dance With Somebody.”

The Beastie Boys used the machine on their 1986 debut “Licensed to Ill” and paid tribute to it with a line in the opening track of “Hello Nasty” 12 years later: “Nothing sounds quite like an 808.” Rather than fading away like most pop trends, the sound of the 808 has proliferated, featuring in club music and hits by artists like Ariana Grande and Cardi B, though these days it’s typically made with widely available software emulators.

Among Kakehashi’s numerous other creations was Boss, a subsidiary whose “stompbox” effects pedals defined the guitar sound of late ’80s shoegaze bands like My Bloody Valentine and the ’90s grunge of Nirvana.

Roland’s fortunes nosedived as the financial crisis took a toll on the musical instruments industry, which is highly sensitive to economic trends. For Hamamatsu-based Roland, the difficulties were compounded by a strong yen and tough competition, as well as some product missteps.

Kakehashi was “the brilliant founder who stayed on too long and was a detriment,” said Brian Majeski, editor of Music Trades, a data and marketing service for the music products industry. After moving into a series of honorary roles, Kakehashi got the company involved in some “complex and time-consuming projects,” such as combined keyboard and video devices and an electronic accordion.

‘Perfectly Positioned’

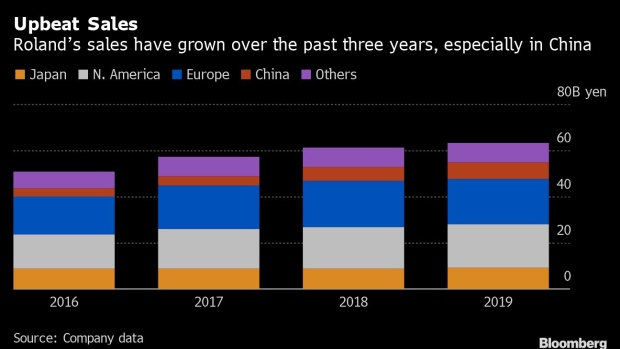

The management-led buyout under Taiyo and Chief Executive Officer Jun-ichi Miki was unsuccessfully opposed by Kakehashi, who left the company and died a few years later in 2017. That deal marked the start of a turnaround, as unprofitable and non-core businesses were shed. Sales grew at a compound annual rate of 7.6% over three years, reaching 63.2 billion yen in 2019, boosted by Chinese demand.

The coronavirus has had a mixed impact on instrument makers. Lockdowns crushed physical-store sales, helping push Guitar Center Inc. into bankruptcy, while social-distancing mandates halted live performances and school music programs.

But there has been an upside: online sales have climbed as people stuck at home gained more time for hobbies. Guitar maker Fender Musical Instruments Corp. recently told Business Insider it’s on track for record sales in 2020.

Roland forecasts a 3.2% revenue increase this year as it works through backlog orders following virus-driven factory halts and difficulty getting parts. Portable digital pianos and small amplifiers have sold particularly well during the pandemic, while shipments of higher-end instruments, drum kits and equipment for live events suffered.

LightStream’s Kumarasiri said the company may have been able to better withstand the negative impact of the pandemic because it “shifted from its historical target market of professionals to mostly recreational users.” He cautions that the stay-at-home boost could be temporary.

Some of Roland’s more recent moves, including compact updates of the 808 and other classic products, have left hardcore music gear fans cold. But its broad array of offerings make the company “perfectly positioned” to serve people making music at home, said Music Trades’ Majeski, who estimates the global musical instrument market was worth about $17 billion last year.

Majeski notes that while many of the newly minted musicians may not stay with it for very long, some may be starting a lifelong hobby. “Maybe somewhere between 60% and 70% quit within a year, but the remainder stick around and they keep buying more stuff.”

©2020 Bloomberg L.P.