Mar 29, 2023

Kenya Set to Hike Rates to Counter Currency Slump

, Bloomberg News

(Bloomberg) -- Kenya’s central bank is poised to raise interest rates to an almost four-year high to fend off a selloff in its currency and contain sticky inflation.

Five of six economists polled by Bloomberg forecast the monetary policy committee will lift the key rate by 25 basis points to 9% on Wednesday, while the other predicts a hold. The increase would be the first since November after a hold in January.

“We expect the MPC to increase the central bank rate as it seeks to anchor inflation, given that its main role is maintaining price stability,” Nairobi-based Cytonn Investments said in a research note.

Central banks across the globe from Ghana to the US are still increasing interest rates to fight high inflation.

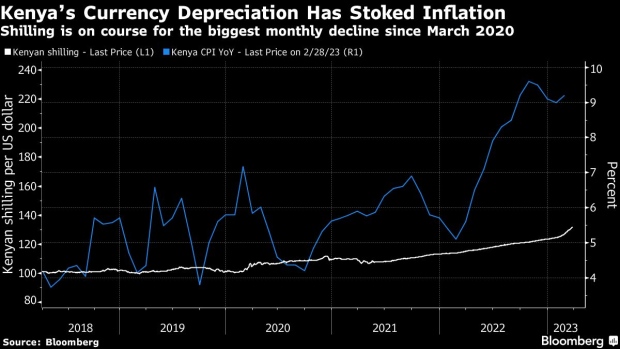

Kenya’s annual inflation rate of 9.2% has breached the ceiling of the central bank’s 2.5% to 7.5% target range for nine months. Continued weakness in the shilling that’s on course for its biggest monthly decline since the coronavirus outbreak was declared a global pandemic in March 2020 has stoked inflation and become a political issue.

In the past week, several protests organized by opposition leader Raila Odinga, who narrowly lost the presidential vote to William Ruto in August, have taken place. Protesters are calling for the government to do more to bring down the prices of food and other staples, as well as a rerun of last year’s election.

The depreciating shilling has prompted the central bank to revive the nation’s interbank currency market — it plans to provide more details at a briefing on March 30, a day after its MPC meeting.

Read more: Dollar Trading in Kenya Improves as Central Bank Changes Stance

It’s also led Ruto’s administration to implement a plan to nationalize fuel imports. It’s striking deals with state-owned suppliers like Saudi Aramco and the Abu Dhabi National Oil Co. which will enable the Kenyan government to defer payments by at least six months.

The currency has weakened amid diminishing foreign-exchange reserves, a deteriorating balance of payments, and rising global interest rates that have raised the cost of debt servicing.

“This puts pressure on the central bank to pursue additional policy measures to slow the accelerated depreciation of the shilling,” according to Cytonn.

Complicating the calculus is the impact a rate hike will have on economic growth. East Africa’s largest economy is expected to expand 5.1% this year, compared with 5.3% in 2022, according to International Monetary Fund estimates.

©2023 Bloomberg L.P.