Jan 30, 2023

Kenya Unexpectedly Holds Rate as Inflation Pressures Seen Easing

, Bloomberg News

(Bloomberg) -- Kenya surprised most analysts by keeping its benchmark interest rate unchanged for the first time since July, as it sees inflation declining in the near term.

The monetary policy committee held the rate at 8.75%, Governor Patrick Njoroge said Monday in an emailed statement. Only two of five economists expected the rate to remain unchanged.

The pause will allow a 50-basis point hike in November to transmit in the economy, the governor said. That and government measures to allow limited duty-free imports on specific food items are expected to moderate prices and further ease domestic inflationary pressures, he said.

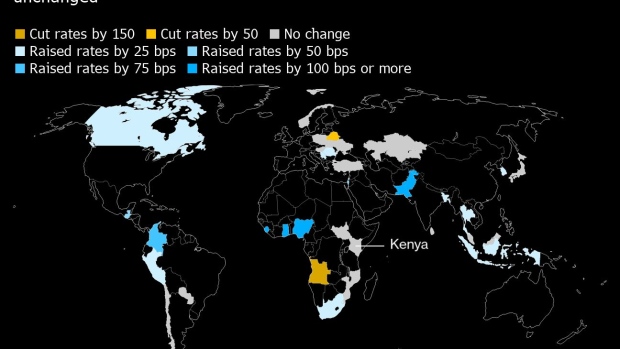

Kenya joins more than a third of global central banks from Hungary to Chile in pausing their tightening campaigns as inflation shows signs of cooling and economies slow down.

The rate of price growth in East Africa’s largest economy while remaining above the 7.5% upper limit of the MPC’s target since June has dropped for two straight months to 9.1%. A median estimate of five economists surveyed by Bloomberg expect data from the statistic agency on Tuesday to show inflation quickened to 9.3% this month.

Key Insights:

- Prices of most food items are expected to decline or remain unchanged next month, according to a survey of the agriculture sector.

- The economy is predicted to have grown 5.6% last year and remain resilient in 2023, supported by the services sector and expected recovery in agriculture, despite global uncertainties.

- Foreign-exchange reserves of $7 billion, or 3.92 months of import cover, continue to “provide adequate cover and a buffer against any short-term shocks in the foreign-exchange market.”

- The current-account deficit is estimated at 4.9% of gross domestic product in 2022 and is projected at 5.4% of GDP this year.

- Growth in private-sector credit increased to 12.5% last year, compared with 8.6% in 2021, signaling improved demand as economic activities increase.

- The ratio of gross non-performing loans to gross loans was 13.3% in December, compared with 13.8% in October.

--With assistance from Zoe Schneeweiss and Simbarashe Gumbo.

(Updates with more details from paragraph thre)

©2023 Bloomberg L.P.