Oct 4, 2022

Key European Bond Market Suffers Record Dry Spell With Zero Deals

, Bloomberg News

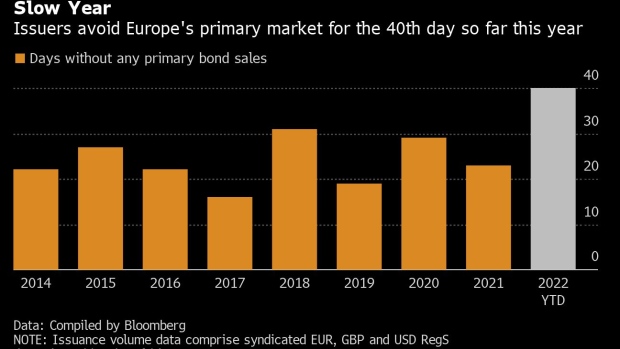

(Bloomberg) -- Europe’s major funding market just hit the unwanted milestone of 40 no-deal days this year, setting the scene for a reckoning as borrowers struggle to raise debt in volatile markets while their costs continue to rise.

Monday marked 40 blank-slate days in Europe’s entire public bond market -- a number that far exceeds the prior record of 31 days during the whole of 2018, according to data compiled by Bloomberg going back to 2014. The tally has soared in recent weeks, with 12 no-deal days since the start of August amid a renewed stock-market selloff, hawkish messaging from central banks and Europe’s escalating energy crisis. That number is set to rise further when earnings blackouts and the seasonal Christmas shutdown hit.

Coupled with borrowing costs at the highest in two-and-a-half years, the rising number of no-deal days is bad news for firms that need to raise debt, in what’s already the worst year on record for issuance from non-financial companies, according to Bloomberg data. Global volatility has pushed the cost to borrow in euros to well above double where it was at the start of the year, making it ever-tougher for those who need to refinance existing debt, or raise fresh funds, to pick the right time to do a deal.

“In previous downturns, the all-in rate to fund was relatively behaved and would have made investment decisions still viable under a moderate growth rate,” said Shanawaz Bhimji, a fixed-income analyst at ABN Amro Bank NV. However, the rising cost of debt is such that it’s a struggle “to make investments work, especially as growth is pretty much out of the question.”

Borrowers’ caution comes amid fears that central banks’ policy tightening will tip the world’s economy into recession and hit corporate profits. And the backdrop of soaring inflation means that bonds and stocks have fallen in tandem this year, with Europe’s benchmark Stoxx 600 Index down about 18% and the S&P 500 losing about 23%.

With so many risks to consider -- from inflation data to war in Ukraine and UK political developments -- prospective issuers and the banks arranging their deals may be struggling to pick a good moment to do deals, and are often seeking to avoid days with planned economic data releases, central bank meetings and announcements that could sour the mood.

The high number of no-deal days has pushed Europe’s marketwide debt sales about 19% behind the same stage of 2021, with the usually-busy month of September proving underwhelming this year. Marketwide sales in Europe reached just over €150 billion ($148 billion) last month -- well below the more than €200 billion euros sold last September, Bloomberg data show.

“We don’t expect to be in an environment any time soon where corporate yields come down or primary conditions are materially better,” said Matthew Bailey, a credit strategist at JPMorgan Chase & Co. “This environment is here to stay.”

Elsewhere in credit markets:

EMEA

Sales in Europe’s primary market picked up on Tuesday with the European Financial Stability Facility, Smith & Nephew Plc and Energias de Portugal SA among eight issuers raising at least €7b, amid more stable market conditions as investors wager central banks may slow the pace of monetary tightening.

- Sustainability-linked bonds let companies borrow cheaply if they meet environmental, social, and governance targets. A Bloomberg News analysis found those goals are weak

- Shares in Credit Suisse Group AG plummeted 12% to an all-time low on Monday after a weekend of fevered Twitter speculation about its financial health, before they regained almost all of the losses later in the day; the volatility also resulted in huge distortions in the price of credit derivatives protecting against a default by the Swiss lender

- The share of companies failing to pay debt on time could soar more than threefold in the next year due to a liquidity squeeze and worsening trading conditions, according to Moody’s Investor Services

- NatWest Group Plc has tightened its affordability tests on buy-to-let mortgages to reflect growing economic turbulence, meaning some British landlords might find it impossible to secure a loan

Asia

Asian dollar debt joined a rally in risk assets on Tuesday after weak US manufacturing data prompted an easing of bets on the Federal Reserve’s hawkishness.

- Australia staked out an outlier position among major central banks, becoming the first to break with outsized interest-rate increases as it delivered a quarter percentage-point move

- In Indian credit markets, Uttar Pradesh Power Corp. is to sell INR34.88b of notes at 9.95% on Tuesday after pulling a similar deal more than two months ago.

Americas

Two utilities and a real estate investment trust combined to price $2.25 billion on Monday, kicking off fourth quarter new issue supply. The wild swings in risk assets continued with major stock indexes surging nearly 3% and bonds rallying more than 20bps across the curve after manufacturing data came in cooler than projected.

- The pain is just beginning for investors in US credit markets after Federal Reserve tightening and recession angst sent investment-grade bonds, high-yield debt and leveraged loans spiraling in September

- Pacific Investment Management Co. is bolstering the oversight of its Pimco Total Return Fund and several other funds as Scott Mather, one of the firm’s longest-tenured executives, takes a personal leave of absence

- One of Canada’s largest pension funds is boosting its exposure to bonds, citing attractive yields after the worst selloff in a generation

- Florida cities looking to rebuild from the devastation of Hurricane Ian will be financing their efforts during the worst environment for municipal borrowing in more than a decade

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

(Updates to add credit market sections.)

©2022 Bloomberg L.P.