Sep 22, 2021

Key U.S. Oil Price Weakens With Post-Hurricane Supply Recovery

, Bloomberg News

(Bloomberg) -- Prices for one of the most important grades of U.S. crude oil slid for a second day as production begins to resume in Gulf of Mexico wells shut by Hurricane Ida more than three weeks ago.

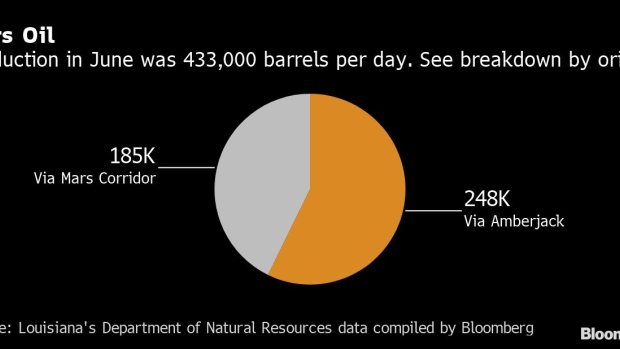

Royal Dutch Shell Plc restarted the Amberjack pipeline that transports Mars crude to the Louisiana coast. The conduit is crucial for hauling oil from Chevron Corp. platforms that include Jack/St. Malo, Tahiti, Big Foot and Genesis. The Amberjack system handles about 57% of the entire supply of Mars, a medium-weight, high-sulfur type of oil favored by many refiners.

The discount at which Mars trades to New York Mercantile Exchange futures for October delivery widened to $1.50 per barrel, according to data compiled by Bloomberg. Earlier this week, the discount shrank by as much as 70% after Shell warned that a key Gulf installation will be offline for the rest of this year.

Meanwhile, the other main conduit for Mars crude remains shut because of “significant structural damage” inflicted by Ida. The idling of Shell’s West Delta-143 transfer station has created a bottleneck that is preventing oil from the Ursa, Olympus and Mars platforms from flowing ashore. As recently as June, that cluster was producing 185,000 barrels of oil daily.

©2021 Bloomberg L.P.