Nov 25, 2019

Kirkland Lake to buy Detour Gold for $4.9 billion in stock

, Bloomberg News

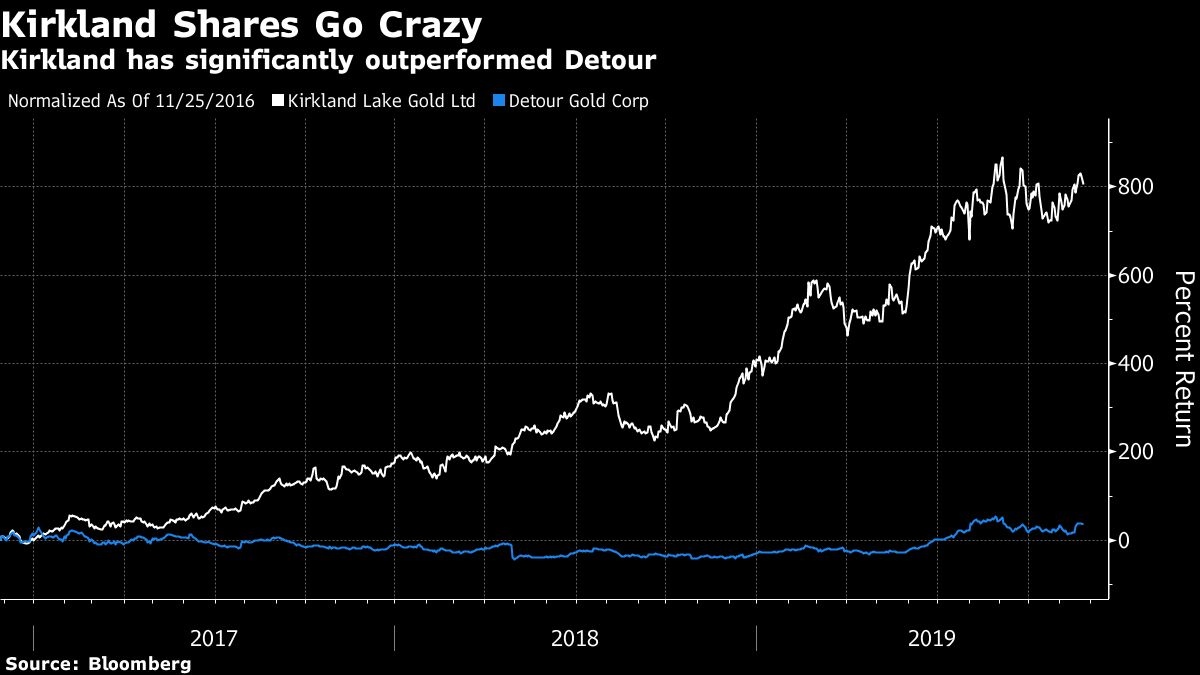

Kirkland shares sink on news of Detour acquisition

Canada’s Kirkland Lake Gold Ltd. agreed to buy Detour Gold Corp. for $4.9 billion, furthering an M&A spree that’s swept the gold mining industry.

With an all-share deal, Kirkland will take advantage of a record stock price to acquire the company, which operates the Detour Lake mine in northeastern Ontario. The agreement values Detour at $27.50 a share, a 24 per cent premium to the closing price on Friday.

There’s been constant speculation about gold mining acquisitions after huge deals rocked the industry in the last year: Newmont Mining Corp.’s acquisition of Goldcorp Inc. and Barrick Gold Corp.’s takeover of Randgold Resources Ltd. The two combinations created companies that dwarf the rest of the industry and mean that smaller miners feel the need to consolidate if they’re going to stay relevant to shareholders.

“The addition of Detour Lake provides an opportunity to add a third cornerstone asset that is located in our backyard,” Tony Makuch, chief executive officer of Kirkland, said in a statement.

Detour shareholstateders will receive 0.4343 share of Kirkland, according to the statement. After the deal is completed, existing Kirkland shareholders will own 73 per cent of the new company, with Detour owners holding the rest.

Kirkland’s stock price has surged in the past three years, climbing more than 800 per cent, as profits soared. That’s put the company in a strong position to expand.

The Detour Lake gold mine is expected to produce for more than 20 years and can generate 600,000 ounces a year. It’s about the same size as Kirkland’s biggest project, the Fosterville mine in Australia.

Detour shares have almost doubled this year, helped by a rally in gold prices. Paulson & Co. led an overthrow of the board in 2018 after a bitter proxy battle, in which he called for the company to put itself up for sale.

The new entity would have gold production of about 1.5 million ounces in 2019 and free cash flow of US$700 million, Kirkland said.