Mar 24, 2022

Kiwi Home Owners Face Soaring Mortgage Repayments as Rates Jump

, Bloomberg News

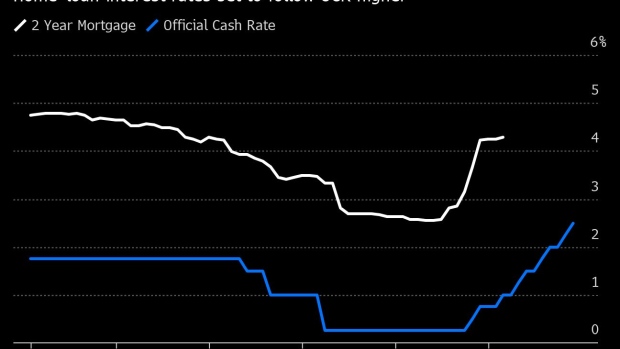

(Bloomberg) -- New Zealand mortgage rates are set to rise above 5% for the first time in seven years, damping economic growth and exerting further downward pressure on a cooling housing market.

The interest rate on a two-year fixed mortgage may rise as high as 5.5% by the end of this year, according to a survey of economists at New Zealand banks by Bloomberg News. One-year fixed mortgage rates are also expected to climb above 5%, more than doubling from their lows last year.

New Zealand households are already being squeezed by the fastest rise in living costs in more than 30 years. The jump in mortgage rates will further reduce spending power just as falling house prices make consumers feel less wealthy, increasing the risk of the economy stalling.

“The New Zealand economy has been famously described as the housing market with an economy attached, it has massive implications for how households behave,” said Sharon Zollner, chief New Zealand economist at ANZ Bank in Auckland. “There’s a wealth impact on consumers’ willingness to spend.”

Soaring house prices last year saw buyers taking on record amounts of debt, making increases in interest rates more painful.

New Zealand’s average house price surged from NZ$800,000 ($560,000) at the start of 2021 to more than NZ$1 million by December.

The vast majority of mortgages are on fixed-term rather than floating rates, and more than 80% of current owner-occupier fixed-term mortgages are due to be re-fixed in less than two years, according to Reserve Bank data.

The jump in borrowing costs means that someone who took a NZ$600,000 mortgage at 2.6% in early 2021 could see repayments increase by about NZ$800 a month if they renew their rate at 5%.

Monetary Tightening

Economists expect the Reserve Bank to raise the official cash rate at every policy meeting this year, taking it to at least 2.5% by November as it tries to rein in inflation.

The RBNZ’s monetary tightening has already pushed mortgage rates significantly higher from last year’s lows, with the two-year rate rising to 4.5% today from less than 2.6% in 2021.

ASB economists expect the two-year rate to rise to 5.5% by year end, and the one-year rate to reach 5.2%. ANZ sees the rates hitting 5.4% and 5.3% respectively, while Kiwibank economists predict rates of between 5% and 6%. Westpac forecasts a two-year rate of 4.7%, while the Bank of New Zealand declined to comment on its mortgage rate expectations.

Shorter term fixed rates haven’t been above 5% since 2015, unless the purchaser has less than a 20% deposit and is required to pay a higher rate.

Most economists predict house prices will fall, with both ANZ and BNZ now forecasting a 10% decline this year.

“A slowdown in the housing market is hardly surprising given all that’s been thrown at it,” said Mary Jo Vergara, an economist at Kiwibank, which expects prices to fall 5% this year. “Rising rates will continue to weigh on housing demand and the market more broadly.”

©2022 Bloomberg L.P.