Nov 29, 2020

Kiwi’s Edge Over Aussie Dollar to Vanish as RBNZ Tailwinds Fade

, Bloomberg News

(Bloomberg) -- The New Zealand dollar’s months-long reign over its Australian counterpart may be nearing an end.

Signs are emerging that the Aussie could post a stronger finish heading into the year-end as tailwinds for the kiwi fade and Australia’s labor market shows signs of a recovery. Technicals also point to the Aussie’s outperformance.

Both commodity-linked currencies have been buoyed by an improving global outlook but the kiwi has gotten an extra lift as traders pare bets for a negative cash rate. With investors having now unwound almost all pricing for more easing from the Reserve Bank of New Zealand, the kiwi may be starved of fresh catalysts that are needed to help it retain its dominance over the Aussie.

Commonwealth Bank of Australia is among those that expect the Aussie to beat the kiwi, predicting that the cross will rise to 1.0725 by year-end. It was trading at around 1.0505 on Friday.

“New Zealand exports are more exposed to the U.K., the euro zone and the U.S. than Australia,” said Martin Whetton, head of fixed income and currency strategy at Commonwealth Bank of Australia in Sydney. “The lockdowns in these three economies will impact their demand for N.Z. products. As a result, we expect gains in the kiwi will lag the Aussie.”

Data on Australia’s third-quarter economic growth due Wednesday may provide traders with further cues. If the report shows the economy gained momentum after a record 7% plunge in the second quarter, the Aussie could catch a bid against the kiwi.

Fading Tailwinds

The New Zealand dollar has rallied about 5% since touching a two-year low against the Aussie in August. The gains have come as investors all but erased bets for negative rates in 2021.

Finance Minister Grant Robertson added fuel to the fire last week when he suggested the central bank take into account house prices in setting policy, with the move seen as diminishing the chances of further easing.

Markets now expect the central bank to leave its official cash rate unchanged at 0.25%, with overnight index swaps pricing in a 30% probability of one 25-basis point reduction by end-2021. Just a month ago, they almost fully priced in a -0.25% cash rate next year.

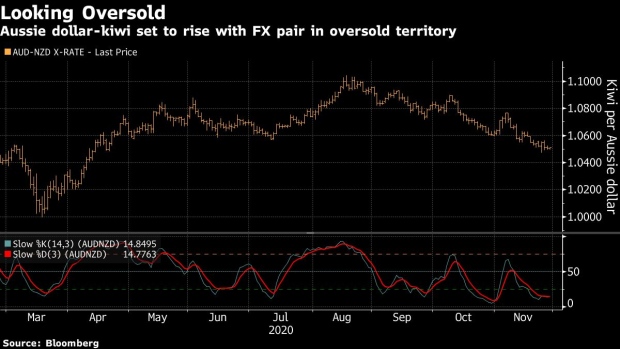

Technicals show the kiwi’s rally against the Aussie is looking stretched as slow stochastics, a momentum indicator, indicates the New Zealand dollar is in overbought territory. This suggests that the Aussie’s decline against the kiwi may have run its course.

Below are the key Asian economic data and events due this week:

- Monday, Nov. 30: Australia 3Q inventories and company operating profit, China manufacturing and non-manufacturing PMIs, South Korea industrial production, Japan industrial production and retail sales, Thailand BoP current-account and trade balances

- Tuesday, Dec. 1: Australia 3Q BoP current-account balance and building approvals, RBA cash rate decision, China Caixin manufacturing PMI, Japan jobless rate and 3Q capital spending, South Korea trade balance and 3Q GDP, Indonesia CPI, Thailand business sentiment index

- Wednesday, Dec. 2: Australia 3Q GDP, RBA Gov. Lowe speaks, New Zealand 3Q terms of trade, South Korea CPI

- Thursday, Dec. 3: Australia home loans and trade balance, New Zealand building permits, Japan services PMI, China Caixin services PMI

- Friday, Dec. 4: Australia retail sales, RBI rate decision, South Korea BoP current-account balance, Philippines CPI, Singapore retail sales, Thailand CPI

©2020 Bloomberg L.P.