Jun 12, 2019

KKR Settles for Less in Germany

, Bloomberg News

(Bloomberg Opinion) -- Closing a leveraged buyout in Germany can be as painful as pulling teeth. That isn’t deterring KKR & Co. as it tries to grab a stake in the country’s most influential publishing business.

The U.S. private equity firm’s 6.8 billion-euro ($7.7 billion) deal to take Axel Springer SE private with its founding family comes with some big compromises. They only highlight the lengths to which firms have to go to deploy their burgeoning pools of capital.

This is far from a conventional LBO. Friede Springer, of the newspaper publisher’s founding family, and Mathias Doepfner, its chairman and CEO, aren’t selling their combined 45% holding and will stay in the driving seat.

KKR is bidding for a minimum 20% stake. If it succeeds, the next step would be to delist Axel Springer. The U.S. firm would be left with only a simple minority stake and joint control of the business alongside the founding family.

The management, strategy and capital structure are unlikely to change dramatically. KKR may be able to apply leverage to the vehicle that holds its shares, using dividends paid by Axel Springer to fund the interest payments on the debt. That wouldn’t provide much of a lift to the private equity firm’s returns.

The path to a decent gain here most likely lies in expanding Axel Springer’s classifieds businesses and bringing the company back to the market at the sort of valuation commanded by the likes of Rightmove Plc and Auto Trader Group Plc. Shares of the two companies trade at more than twice the 11 times estimated Ebitda multiple ascribed to Axel Springer in this transaction. Throw in some acquisitions in listings, and the publishing arm, which includes newspapers Bild and Die Welt, would become marginal from a financial perspective.

Classifieds generate roughly 40% of Springer’s revenue, but the division’s margins significantly lag those of rivals in the listings market. Boosting them will require hefty spending on marketing and digital functionality. A profit warning accompanying the deal only rams home the message that the performance of this company is going to get worse before it gets better.

Still, this isn’t a big outlay for KKR. Buying out all the minorities, excluding other family members, would cost roughly 3 billion euros. Debt funding might cut that by a third. Without the turbo-boost of leverage, making a 20% internal rate of return will be tricky: essentially, the value of Axel Springer’s unlisted shares would have to double over the next five years.

The question is whether KKR has done enough to get this over the line. The takeover of German healthcare group Stada Arzneimittel AG was a tortuous affair. A private equity bid for Scout24 AG, another German classified ads business, foundered after failing to win sufficient support from investors.

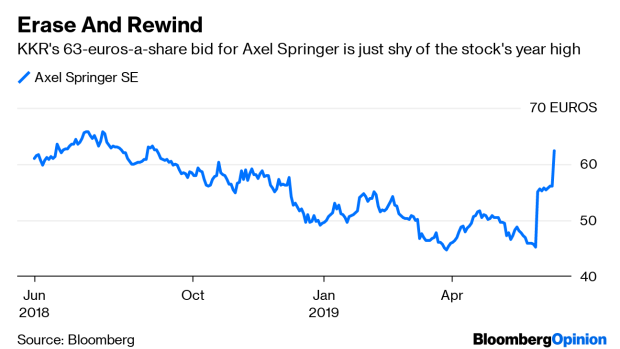

The 40% premium the buyout firm is offering over Axel Springer’s undisturbed stock price will be hard for minority shareholders to resist – all the more so given a counter-bid is unlikely to emerge at this stage given the involvement of the family in the sales process.

That may make KKR’s job of sealing the deal easier. That’s just as well. It will need to save its energy for getting the investment to make money.

To contact the author of this story: Chris Hughes at chughes89@bloomberg.net

To contact the editor responsible for this story: Edward Evans at eevans3@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Chris Hughes is a Bloomberg Opinion columnist covering deals. He previously worked for Reuters Breakingviews, as well as the Financial Times and the Independent newspaper.

©2019 Bloomberg L.P.