Feb 1, 2023

Korea’s Inflation Quickens, Keeping Rate-Hike Option Alive

, Bloomberg News

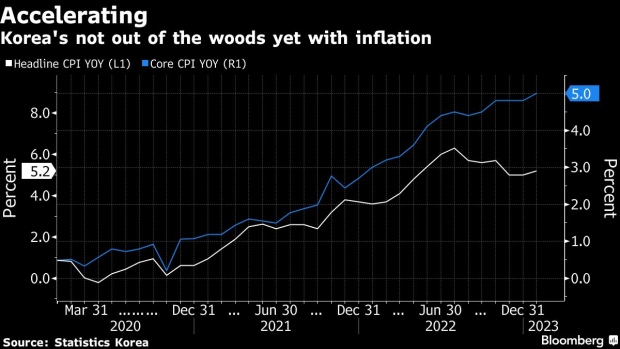

(Bloomberg) -- South Korea’s inflation accelerated again in January, keeping open the possibility of further central bank policy tightening even as the nation’s economy weakens.

Consumer prices advanced 5.2% from a year earlier, quickening from 5% in December, the statistics office reported Thursday. Core inflation, which excludes agricultural and oil-related products, came in at 5%, picking up from 4.8% and suggesting that underlying pressure remains strong.

The Bank of Korea said after the release that inflation would likely stay around 5% in February, adding that upward pressure on international commodity prices could increase if China’s economic reopening fuels demand.

Stubbornly elevated inflation reinforces BOK Governor Rhee Chang-yong’s warning after last month’s interest-rate increase that markets shouldn’t rush to call the end of the current tightening cycle.

The central bank meets for its second decision of the year in three weeks and given two board members dissented over January’s quarter percentage-point hike, speculation has been growing the BOK will pause this time.

“The inflation number was a surprise,” said Cho Yong-gu, a strategist at Shinyoung Securities. “Still, product prices are growing at a more moderate pace and service costs may follow as they tend to be behind economic trends.”

Following 18 months of tightening, the BOK is increasingly concerned about the impact on growth and financial stability of its rate hikes. Other risks to the economy range from an export slump to slowing consumption, two factors that drove Korea’s first economic contraction in more than two years last quarter.

Rhee said earlier that inflation would remain elevated through February before showing further signs of cooling. The BOK has been clear that it will stay on a path of policy tightening as long as inflation remains in the 5% range.

In a meeting attended by Rhee, Finance Minister Choo Kyung-ho said Thursday that inflation was expected to remain elevated “for some time.” He also pointed out that the export slump was adding to economic difficulties and uncertainties.

The BOK hiked by 50 basis points at two meetings last year, seeking to narrow a rate gap with the Federal Reserve and rein in the won’s inflation-fueling depreciation. The BOK’s rate currently stands at 3.5%, compared with 0.5% in August 2021 when the current tightening cycle began.

Fed Chair Jerome Powell said overnight that US policymakers expect to deliver a “couple” more rate hikes and acknowledged inflation has started to abate. Both the BOK and the Fed have an inflation target of 2%.

Today’s inflation report also showed:

- From the prior month, consumer prices advanced 0.8% in January, exceeding economists’ estimates

- Utility costs for housing, water, electricity and fuel jumped 8% from a year earlier. Korean households predominantly use natural gas for heating, and almost all of it is imported.

- Food and beverage prices rose 5.8% from a year earlier, while transportation costs advanced 3%

(Adds Bank of Korea forecast.)

©2023 Bloomberg L.P.