Nov 19, 2020

Korea Set to Crack Down on Chaebols With Corporate Reform Steps

, Bloomberg News

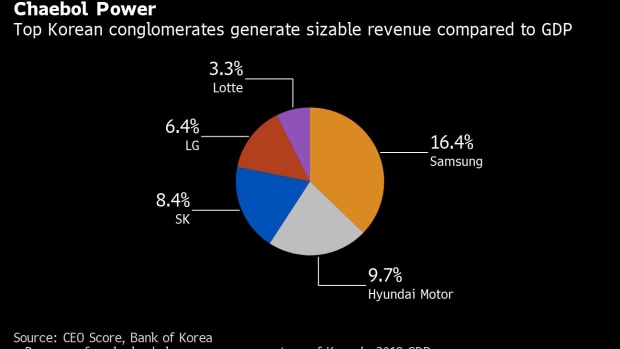

(Bloomberg) -- South Korea is pushing for its most significant reform of corporate governance since President Moon Jae-in took office, a move that could add transparency to top decision-making at large conglomerates that dominate the economy.

The conglomerates, known as chaebols, propelled South Korea’s rise as an export powerhouse. The semiconductors and cars made by the likes of Samsung Electronics Co. and Hyundai Motor Co. have also helped the country emerge from the pandemic slump quicker than many major economies.

Critics say the dominance of chaebols, where key decisions often rest on a handful of large shareholders, hampers fair business practices, stifles the competition crucial to economic growth and can facilitate the transfer of company power and wealth within families despite opposition from some shareholders.

Pushed by the ruling party for passage this year, the proposed revisions to commercial and fair trade acts would make it harder for the largest shareholders to appoint auditors who share their interests. More companies will be scrutinized for any undue business favors to their affiliates. The proposals are dubbed “fair economy acts” by supporters, but denounced as over-regulation by opponents.

“Corporate governance reforms pave the way for long-term growth in national wealth by reducing the chance of costly business blunders,” said Yang Yong-hyeon, an economist at the Korea Development Institute. “More transparent governance also helps attract foreign funds that could enrich a national economy.”

Moon, who was elected three years ago on a progressive platform that included overhaul of chaebol business practices, asked lawmakers to approve the bills during an Oct. 28 speech. While previous reform efforts have made little headway, chances are higher this time given the ruling party’s solid majority in parliament since the election in spring.

Businesses have expressed strong opposition, saying the changes add uncertainty at a time when the coronavirus has upended investment plans. A coalition of associations from the Chamber of Commerce and the Federation of Korean Industries have called the bills “an anachronistic galapagos of regulations” that would also undermine the competitiveness of Korea Inc.

“There’s more to lose than gain,” said Yoo Jung-joo, an official at the Federation of Korean Industries in Seoul. “Private funds could use their seat on the board to shake down and blackmail the companies, trigger disputes over managerial power and take issue with decisions, just to advance their own interests.”

The proposals would require auditors to be chosen from outside the corporate board for most companies, whereas the current law allows them to be picked from within -- a practice that has raised criticism of rubber-stamping. The voting power of the largest shareholders and their families in naming an auditor would be limited at 3%.

The bills would also make it tougher for companies to funnel business orders to an affiliate that family members have large stakes in, while widening the range of individuals and organizations allowed to seek the prosecution of companies for violating fair trade rules.

While there may be disagreements on the appropriate scale of reform, there is more of a consensus on the need to improve chaebol governance and lessen the economy’s reliance on a few large corporate groups. Many see the chaebol-led growth model as hindering the rise of new, smaller companies that are essential to boost the economy’s growth potential.

Corporate Cleanup in South Korea Fails to Impress Foreign Funds

Lack of transparency in corporate governance is also cited as a factor for the chronic discount of Korea’s $1.8 billion stock market. The benchmark Kospi is trading below its book value, compared with 2.5 times for its global peers, the widest gap in a decade.

Inefficient capital management is one outcome of poor governance, such as large-scale expansions, investment plans that appear to lack commercial logic or the practice of hoarding cash while paying stingy dividends.

“Reform does not come risk-free,” said Paul Swiercz, a management professor at George Washington University. While messy shareholder battles can emerge for older companies struggling to adapt to major changes in the economy, greater transparency also tends to increase risk aversion, he said.

Still, it’s a confidence-building necessity for investors, customers and employees, he said. “Transparent corporate governance is an essential ingredient to successful global capitalism.”

©2020 Bloomberg L.P.