Jul 15, 2020

Kremlin Plots Pullback from Stimulus Despite Rising Infections

, Bloomberg News

(Bloomberg) -- Russia is already looking for ways to pare back its frugal pandemic stimulus package even as infections continue to climb by more than 6,000 a day.

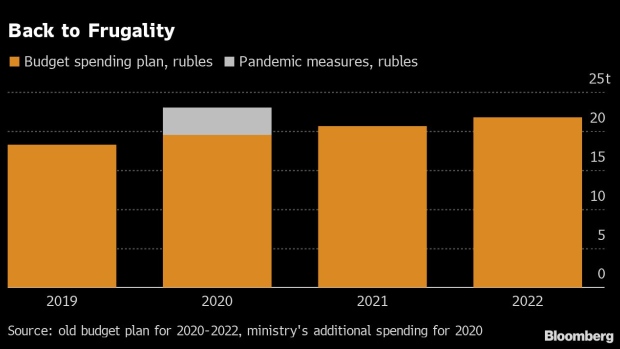

Next-year’s outlays will be below this year’s planned 23 trillion rubles ($325 billion), according to two people in the government, who asked to remain unnamed as discussions are not public yet. A final decision hasn’t been taken yet on the size of next year’s budget, but it will likely be around 20 trillion rubles, one of the people said.

Russian President Vladimir Putin has been reluctant to waste too many resources on the pandemic in case he needs them to fight a bigger crisis in the future. A strict lockdown in Moscow ended abruptly after two months even though infections were still high. People and businesses were running out of money, a risk to the Kremlin ahead of Putin’s constitutional referendum.

“Russia’s stimulus is on the small side, compared to other countries, and inevitably there will be fiscal consolidation next year,” said Elina Ribakova, deputy chief economist at the Institute of International Finance in Washington. “The government is worried about a potential new external shock.”

The government isn’t planning for a second wave of the pandemic, according to another person close to discussions. Russia currently has the fourth-highest infection rate in the world, with cases nearing 750,000, though the country’s conservative calculation of the death toll is below 12,000.

Keeping the stimulus to this year risks further drawing out the recovery from two months of lockdown and a slump in global demand for oil, Russia’s biggest export earner. The economy is already on track for its biggest contraction in more than a decade.

This week Putin agreed to push back completion of a $400 billion investment and development program that was meant to be the highlight of his current term in office. The projects that were meant to be completed by 2024 require adjustment because “we will have to work in conditions of stricter budget restrictions” due to the coronavirus, Prime Minister Mikhail Mishustin said in a televised meeting.

The central bank has said that budget tightening will have a major impact on monetary policy. Interest rates were slashed by 100 basis points last month and Governor Elvira Nabiullina has said more easing is likely.

Some of the stimulus measures introduced this year were specifically targeted at helping families and businesses survive lockdown. Others were offered in the run-up to the July 1 referendum endorsing constitutional changes that allow Putin to serve for two more terms when his current one ends in 2024.

“The third package of the support measures, so conveniently announced right before the referendum, will be the last one most likely,” said Alexandra Suslina, a budget specialist at the Economic Expert Group, a Moscow think-tank. “Russia is curtailing its support measures, which were not that large in scale to begin with, quicker than in other countries.”

The cautious approach puts Russia at odds with other countries, which are increasing borrowing to fund vast stimulus programs. A 5 trillion ruble borrowing plan outlined in this year’s budget will be cut in 2021, Konstantin Vyshkovsky, the head of the Finance Ministry’s debt department said in an interview earlier this month.

Such tight budget policies may result in further strengthening of the ruble, which gained more than 10% against the dollar in the second quarter, according to Natalia Orlova, chief economist at Alfa-Bank in Moscow.

“If Russia is carrying out a tight fiscal policy, while other countries are printing money, the ruble will still be attractive,” Orlova said. “A stronger ruble would make it harder for the economy to recover.”

©2020 Bloomberg L.P.