Oct 3, 2022

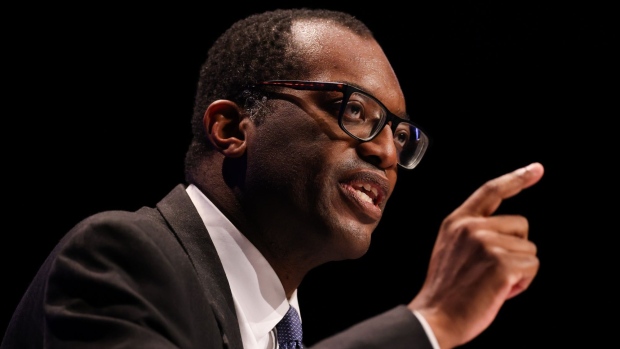

Kwarteng to Bring Forward UK Fiscal Plan to Calm Markets

, Bloomberg News

(Bloomberg) -- Chancellor of the Exchequer Kwasi Kwarteng is due to bring forward the announcement of his medium-term fiscal plan as he seeks to reassure financial markets about his economic strategy.

Kwarteng, who was previously set to publish the proposal alongside a set of economic forecasts on Nov. 23, will now announce it sooner, according to two people familiar with the matter, who spoke on condition of anonymity because the plan isn’t public. The exact date for publication is yet to be confirmed, one of the people said.

Top Bankers Tell Kwarteng to Communicate More to Calm Markets

Kwarteng has been under pressure to flesh out his economic strategy -- including independent forecasts to back the plans up -- since announcing the biggest package of tax cuts in half a century on Sept. 23. That sparked a sell-off in UK assets on concerns the British government was boosting borrowing to pay for unfunded fiscal measures.

Speaking to the Conservative Party’s annual conference on Monday, Kwarteng said he would publish the plan “shortly,” and made no reference to the timing he’d previously set out. The announcement will “set out how we plan to get debt falling as a percentage of GDP over the medium term,” Kwarteng said. “We will act in a fiscally sustainable and responsible way.”

Some of Truss’s Top Team Say Her UK Project May Already Be Over

The move was welcomed by Treasury Select Committee Chairman Mel Stride, who’s been pushing Kwarteng to accelerate the announcement -- and in particular the forecasts from the government’s fiscal watchdog, the Office for Budget Responsibility -- in order to calm rattled markets.

“Provided the OBR forecast and new fiscal targets are credible then bringing these forward should calm markets more quickly and reduce the upward pressure on interest rates to the benefit of millions of people up and down the country,” Stride said in a statement. He said publishing the details before the Bank of England’s next interest rate decision on Nov. 3 “should help to reassure our rate setters that they can go with a smaller base rate increase than would otherwise be the case.”

It’s another significant concession by Kwarteng as he seeks to allay concerns about his management of the economy, coming after he backtracked on a headline promise to abolish the 45 pence top rate of tax. Kwarteng had previously said he wasn’t going to shift from the Nov. 23 date, so that the necessary analysis could be done properly.

On Sept. 28, executives at some of the City of London’s biggest firms told Kwarteng that he couldn’t wait until November to reassure markets about his fiscal plans.

(Updates with comment from Treasury Select Committe Chairman in fifth, sixth paragraphs)

©2022 Bloomberg L.P.