Oct 28, 2021

Lagarde Pushes Back Against Bets for ECB Rate Hike Next Year

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

European Central Bank President Christine Lagarde pushed back against market expectations of interest-rate hikes next year even if inflation will prove more enduring than originally anticipated.

Within hours of data showing surging price increases in Spain, and after investors doubled down on bets for tightening, the institution’s chief reiterated its house view that no such move in borrowing costs is currently envisaged. She said that comparisons with global central banks currently withdrawing stimulus are “odious.”

“Our analysis certainly does not support that the conditions of our forward guidance are satisfied at the time of liftoff as expected by markets nor any time soon thereafter,” she told reporters during a virtual press conference in Frankfurt. “While the current phase of higher inflation will last longer than originally expected, we expect it to decline in the course of next year.”

A meeting slated as a quiet prelude to December’s showdown over the future of emergency stimulus became more fraught this week when financial markets signaled disbelief at the ECB’s commitment to ultra-low interest rates.

Money markets are betting the ECB will hike interest rates 10 basis points by August and 21 basis points by the end of next year. The euro touched an intraday high against the dollar.

The Governing Council on Thursday maintained prior language heralding plans to moderate monthly purchases from the roughly 75 billion euros ($86.9 billion) deployed from March through September. They also promised to keep the 1.85 trillion-euro program, known as PEPP, running until March 2022 or later if needed.

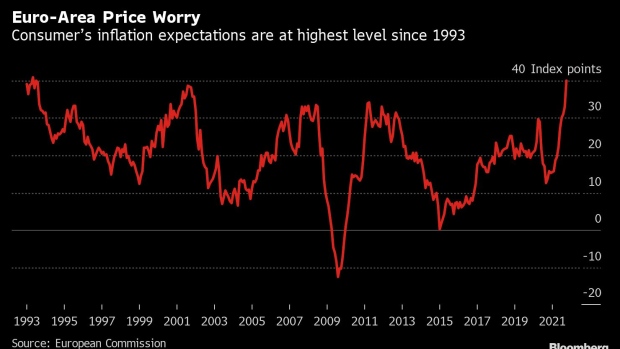

While inflation accelerated to 5.5% in Spain and a faster-than-anticipated 4.6% in Germany, data in the coming 24 hours is due to show a pickup in elsewhere in the region. Price expectations in the euro-zone already have meanwhile reached the highest since 1993.

Follow the press conference on our live blog

What Bloomberg Economics Says...

“Higher inflation is unlikely to persist as long as significant slack remains in the labor market. And, once the unemployment rate is adjusted for people on furlough, it remains considerably above its pre-pandemic level.”

-David Powell and Maeva Cousin. Read the ECB REACT.

A major policy overhaul is expected in the forthcoming meeting, when new economic projections will give officials a better view on future stimulus needs. Economists predict the central bank will then lay out a path for its pandemic emergency purchase program -- known as PEPP -- and end it after March 2022, as currently envisioned.

The ECB’s path of continued emergency stimulus contrasts with the focus of central banks from New Zealand to the U.K. which have begun raising rates or signaling plans to do so in response to rising prices across the globe stoked by higher energy costs and acute supply bottlenecks. That backdrop has encouraged investors to ask if the Frankfurt institution might not end up following suit.

©2021 Bloomberg L.P.