May 24, 2022

Lagarde Says ECB Won’t Rush as Consensus Shuns Half-Point Hike

, Bloomberg News

(Bloomberg) -- European Central Bank President Christine Lagarde said officials won’t rush into withdrawing stimulus as her French colleague echoed her to insist there’s no consensus for a half-point interest-rate hike.

A day after the ECB chief’s timetable of two quarter-point increases irked hawkish officials wanting the option to act more aggressively, she and Bank of France Governor Francois Villeroy de Galhau emphasized to Francine Lacqua on Bloomberg Television that tightening needs to proceed gradually.

“I don’t think that we’re in a situation of surging demand at the moment,” Lagarde said in an interview on Tuesday at the World Economic Forum in Davos, Switzerland. “It’s definitely an inflation that is fueled by the supply side of the economy. In that situation, we have to move in the right direction, obviously, but we don’t have to rush and we don’t have to panic.”

Lagarde spoke out after publishing a blog post effectively laying out a path for the ECB’s next three scheduled decisions that will put the institution on track to finally exit subzero monetary policy and align more with global peers already acting against the threat of inflation. Villeroy’s remarks signaled that he and other officials currently assent to her timetable.

“A 50 basis-point hike is not part of the consensus at this point, I am clear,” the governor said. “It will be a normalization of our monetary policy, it’s not a tightening” and “interest rate hikes will be gradual,” he said.

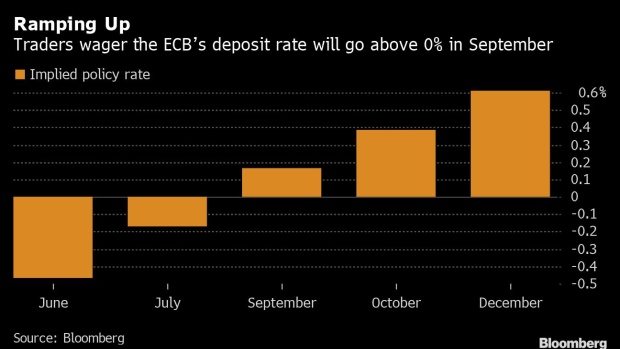

Under Lagarde’s calendar, the ECB will end bond purchases in June, and hike once in July and once in September, bringing its deposit rate from -0.5% up to zero. That timetable riled colleagues who want to keep open the option of acting faster, according to people familiar with the matter.

“When you’re out of negative, you can be at zero, you can be slightly above zero,” she said, refusing to be drawn on whether the central bank might consider a 50 basis-point move. “This is something we will determine on the basis of our projections, on the basis of our forward guidance.”

The euro pared gains following Villeroy’s comments, retreating to around $1.0714 after earlier remarks by Lagarde drove it to a one-month high of $1.0736.

Both Lagarde and Villeroy see rates proceeding higher to reach a level deemed to be neutral, which could be between 1% and 2%.

The French governor outlined a vision to reach that band “some time next year,” implying a whole series of rate hikes within the next 18 months. Traders are wagering on four 25-basis-point hikes by the ECB by end-2022.

The ECB president downplayed the risk of a slump taking hold in the region, saying that “for the moment, we are not seeing a recession in the euro area.”

She cited unemployment “at rock bottom rates,” large household savings and the prospect for a strong summer for the tourism industry as forces that will offset negative shocks from the war and record inflation. Villeroy concurred.

“When we look at activity it is still resilient in Europe,” he said. “We will still have significant growth this year.”

Supporting their view, surveys of purchasing managers released on Tuesday pointed to continuing growth. Services recorded the second-strongest expansion in the last 8 months in May with consumers driving growth in tourism and recreation, according to S&P Global.

As the ECB begins to raise rates, it will be careful to avoid an “unwarranted” widening of spreads in the euro area, Villeroy said, noting the central bank’s intervention with the PEPP asset purchase program in 2020.

“We have the will to act and the capacity to act if necessary,” Villeroy said. “Nobody should expect the ECB to be absent in the case of fragmentation.”

©2022 Bloomberg L.P.