Sep 15, 2021

Lagarde Says Europe’s Next Economic Test Is Delivering Change

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The greatest challenge facing Europe’s rebounding economy is whether authorities can implement the changes needed to transform its potential, according to European Central Bank President Christine Lagarde.

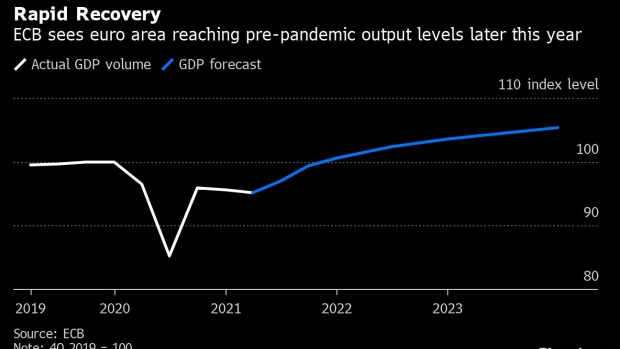

Unprecedented monetary and fiscal aid and more vaccinations have brought the region to a point where it is “recovering more rapidly than we had anticipated,” she said on “The David Rubenstein Show: Peer-to-Peer Conversations” on Bloomberg Television. The euro area is now expected to reach pre-pandemic output levels before the end of this year.

A key test now hinges on how Europe acts to close the longstanding gap between northern and southern countries, reduce inequalities exacerbated by the pandemic, and aid the transition to a more environmentally-sustainable economy, Lagarde observed.

“The single biggest challenge always is to deliver,” she said. “It’s a question of directing the financing to the right investment, making sure that the economies are going to bounce back in the right shape, with the right structural reforms that will improve the productivity of those economies, that will position them to be more digital and to be be greener.”

The president’s remarks revisit troubles bedeviling Europe’s economy even before the pandemic during a decade when weak inflation pressures forced the ECB to keep monetary policy ultra-loose. Lagarde, whose term began in late 2019, then unveiled its single largest stimulus measure yet with a 1.85-trillion euro ($2.2 trillion) crisis bond-buying program.

Crisis Coordination

Praising European governments’ “good coordination” at the height of the emergency, Lagarde expressed hope that they will learn from that experience. She highlighted the region’s unprecedented 750-billion-euro recovery package, featuring a mix of loans and grants intended to stimulate growth.

The fund “is going to help with making countries better converge, and reduce the gap that existed between some of the southern European countries and the northern European countries,” she said. “That is certainly the intention.”

A key challenge will also be to reverse damage to some parts of the labor market, where women and young people were among the most vulnerable to losing their jobs, she said. That echoes concerns at other central banks including the Federal reserve that the global economic rebound will take time to reach those most affected by the crisis.

Last week ECB officials slowed the pace of pandemic bond-buying, judging that the recovery could be maintained with slightly less support. Lagarde warned then it’s still too soon to discuss further steps to reduce support as the economy continues to face uncertainty due to coronavirus variants and global supply shocks.

©2021 Bloomberg L.P.