Aug 16, 2022

Largest Bitcoin miners lost over US$1B during crypto crash

, Bloomberg News

Mike Philbrick discusses The Bitcoin Fund

The three-largest US publicly traded Bitcoin mining companies lost more than US$1 billion in the second quarter after taking a series of impairment charges spurred by the collapse of cryptocurrency prices.

Core Scientific Inc., Marathon Digital Holdings Inc. and Riot Blockchain Inc. posted net losses of US$862 million, US$192 million and US$366 million, respectively, in the three months ended June 30, recent quarterly earnings reports show. Other significant miners such as Bitfarms Ltd. and Greenidge Generation Holdings Inc., which reported results Monday, were also forced to write down the value of their holdings in the wake of the almost 60 per cent drop in the price of Bitcoin during the quarter.

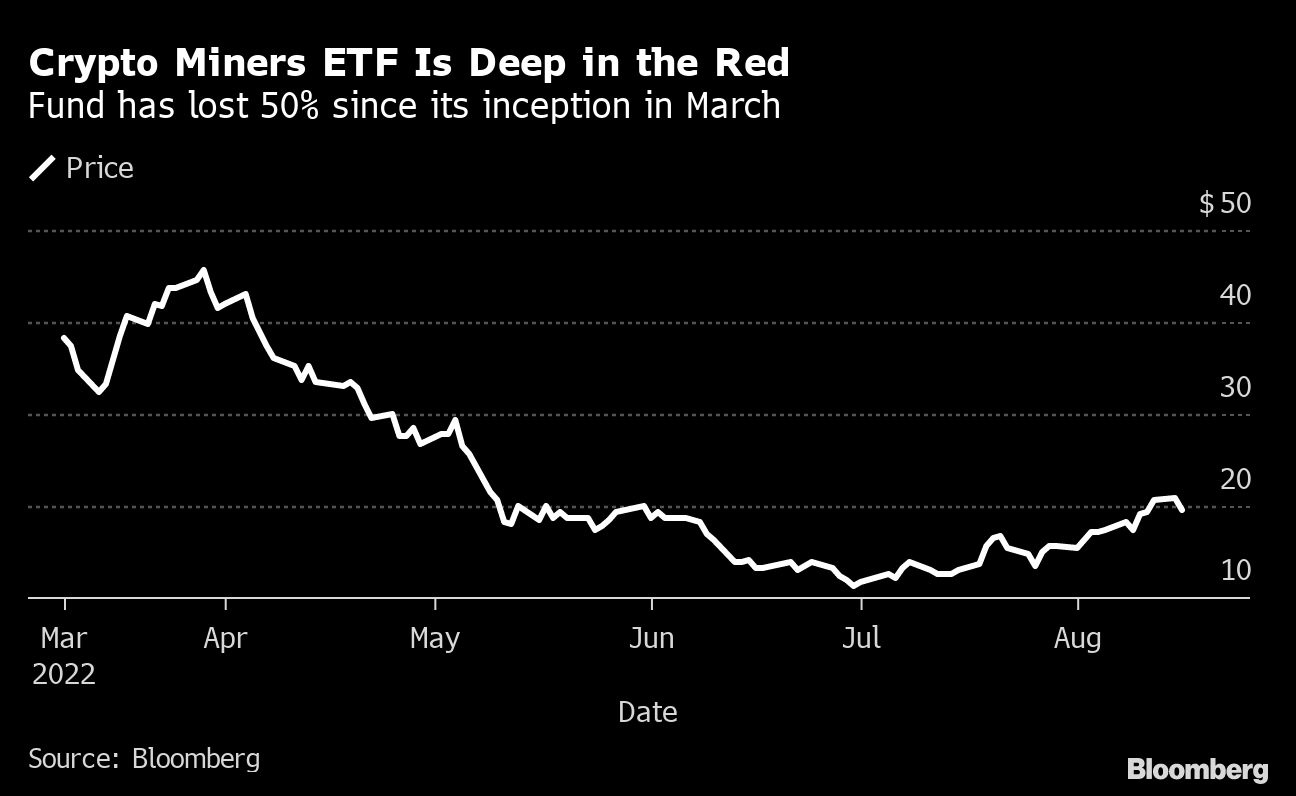

While the shares of crypto-mining companies have enjoyed a respite in recent weeks, they are still deep in the red this year. The miners had to shift from their Bitcoin-hoarding positions and sell coins as they struggled to repay debt and cover operational costs in the recent quarter. That continued into the third quarter.

“Public miners are still dumping their Bitcoin holdings at a higher rate than their production rate,” Jarand Mellerud, an analyst at Arcane Crypto, wrote in a research note. “Public miners sold 6,200 coins in July, making July the second highest BTC selling month in 2022.”

The miners weren’t the only industry participants to take significant hits last quarter. Coinbase Global Inc., the largest US crypto exchange, registered a US$1.1 billion loss, while MicroStrategy Inc. also had a net loss of more than US$1 billion.

Top public miners sold 14,600 coins in June whereas they produced 3,900, Mellerud said. Core Scientific sold nearly 80 per cent of its coins to cover operational costs and fund expansion in June. Bitfarms sold nearly half of its holdings to pay down a US$100 million loan in the same month.

The miners are raising more debt and sell their holdings and mining rigs to stay afloat. Marathon added an additional US$100 million term loan with crypto-friendly bank Silvergate Capital Corp., while refinancing its existing US$100 million line of credit in July. The miner also sold its mining rigs for US$58 million. Core Scientific has entered a US$100 million common stock purchase agreement with B. Riley Principal Capital II.

The US Securities and Exchange Commission has told public companies with large Bitcoin holdings on their balance sheets they can’t strip out the price swings while disclosing results. The losses aren’t realized unless there is an actual sale of the tokens.