Feb 22, 2021

Largest Indian Bank Calls on RBI to Make Shorting Bonds Costlier

, Bloomberg News

(Bloomberg) -- India’s central bank should consider steps to disincentivize short selling, which may have triggered the recent sell-off in the nation’s sovereign bond markets, according to the chief economic adviser at the nation’s largest lender.

Banks and primary dealers resort to such short-selling when they expect bond prices to fall, and this becomes a ‘self-fulfilling prophecy’ sometimes with traders borrowing securities from the repo market and rolling them over till yields rise, Soumya Kanti Ghosh of State Bank of India, wrote in a note to clients on Monday.

“The only way to break such self-fulfilling expectations is for RBI to conduct large scale open market operations to provide necessary steam to the bond market to rally and with the increase in price many short-sold positions will trigger stop losses and market players will scramble to cover open positions,” Ghosh said in the note.

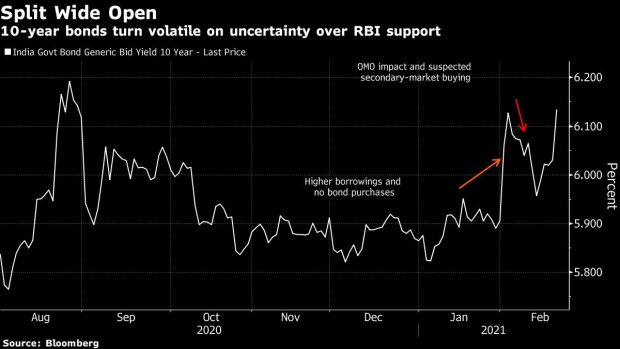

Yields on the benchmark 2030 debt rose 14 basis points last week amid fears about how the central bank plans to manage the huge government borrowing program and a rise in global bond yields. The 2030 yield was up 6 basis points to 6.20% on Monday.

Short selling of bonds typically involves selling security which the seller borrows from the repo market. Funding rates for the benchmark 5.85% 2030 bond have slid to as low as 0.1% in the recent days as traders are even offering free money to borrow the securities due to a scarcity of outstanding stock. It hit a low of 0.01% on Monday on the RBI’s CROMS platform.

The central bank should consider steps to disincentivize short selling, including asking sellers to cover the sale in 30 days instead of the current 90 days and by introducing negative interest rates to make the trade costlier, according to the note. The RBI can also supply bonds in the repo market if it has stock, and consider high margin requirements for borrowing the securities for covering the shorts, Ghosh said.

©2021 Bloomberg L.P.