Oct 24, 2016

Larry Berman: A look at quality vs. volatility smart beta strategies

By Larry Berman

This week’s Guest is Kevin Prins, vice-president of BMO exchange traded funds (ETFs). Last week we introduced the idea of smart ETFs and looked at alternative “factor” based indexing methodologies compared to the traditional market capitalization indexes. BMO ETFs are the largest provider of Smart Beta ETFs in Canada (AUM) and 11th in the world.

As a reminder, the idea of beta is the market capitalization return. A beta of one means that if the market index goes up by 10 per cent, the ETFs would be tracking the index and would rise by 10 per cent. If the index went down 20 per cent, the ETF would decline 20 per cent. In Canada, the BMO S&P TSX capped composite ETF (ZCN) would have a beta of one versus the index.

We are going to look at two types of smart beta strategies this week:

Volatility is a risk measure indicating by how much the price of a stock fluctuates. Evidence that less volatile stocks, with less price fluctuations, generate at least comparable returns to riskier stocks renders low volatility stocks much more attractive for investors: Same returns in the medium to long-term with less uncertainty. Low beta stocks (<1) will go down less than the market index when they fall and often go up less than the market when they rise. Volatility is a measure of risk in an individual stock’s returns, while beta is comparing the volatility to that of the market.

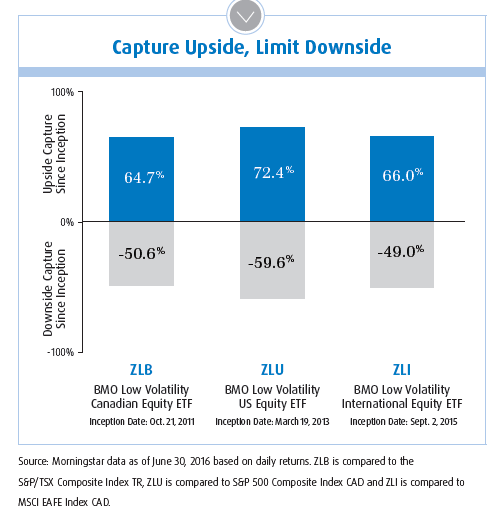

BMO has three low beta ETFs that pick stocks from within their regions. ZLB is picking the best low beta stocks in Canada and combine them in an index ETF. BMO has a unique approach to selecting the low beta stocks as Kevin explains.

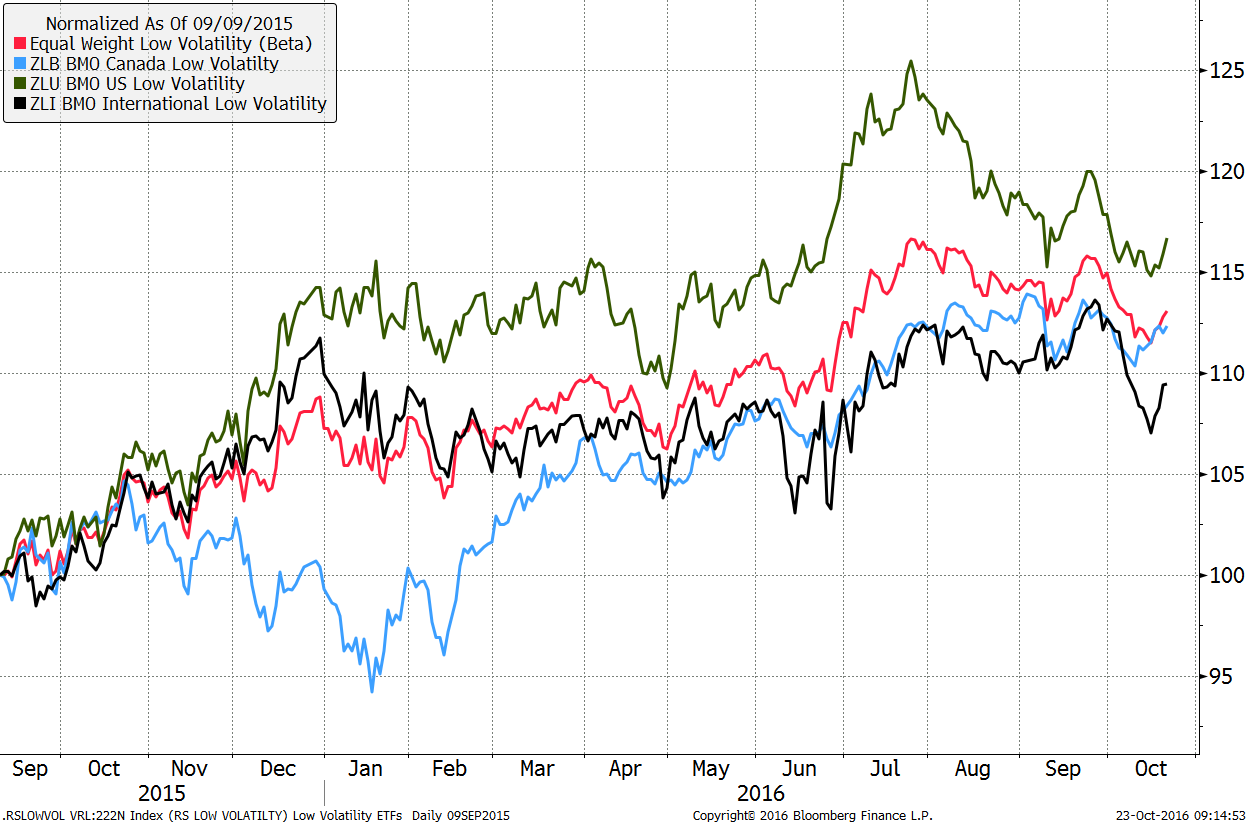

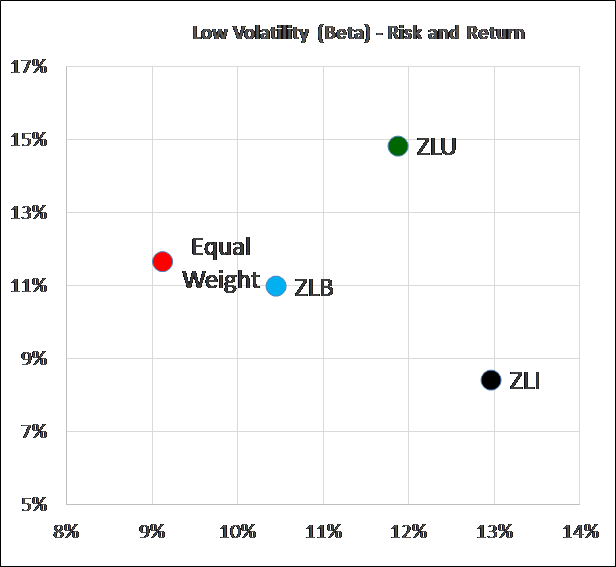

ZLU is a low-beta approach to the U.S. market and ZLI is the same methodology for international markets. As always, we should think globally and make sure portfolios are diversified. A simple strategy of equally weighting the three ETFs improves risk-adjusted returns (higher average return, with lower average risk) and who doesn’t want that. The benefits of diversification are your only free lunch when it comes to investing, so while smart index ETFs can considerably help to improve your risk-adjusted returns, it’s diversification that helps the most. It’s probably the most important factor to consider when investing.

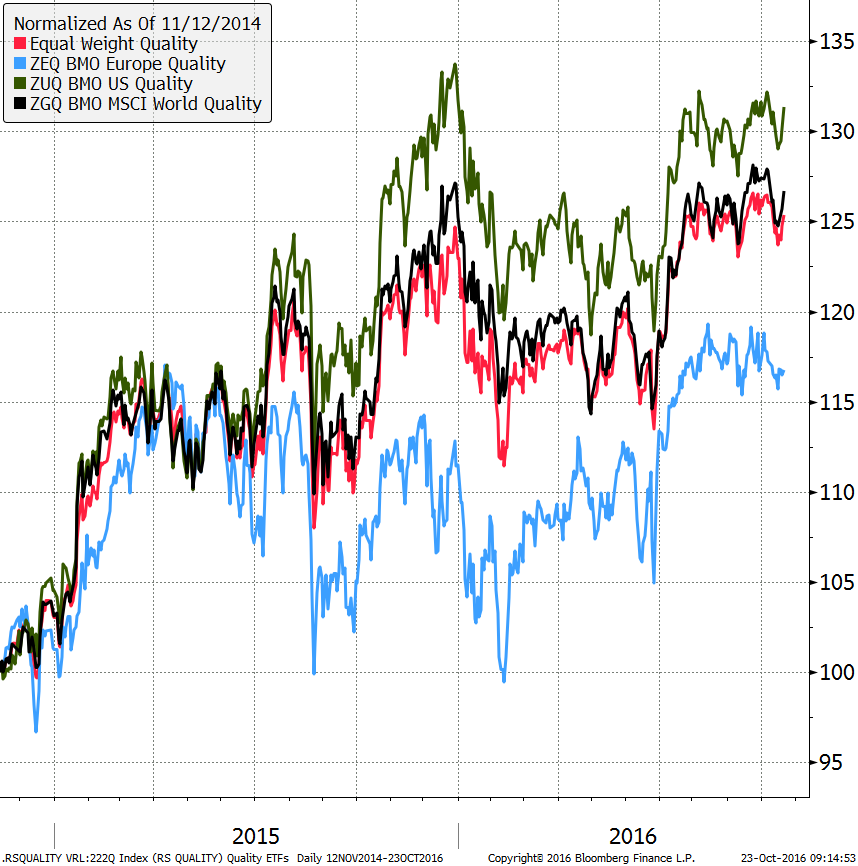

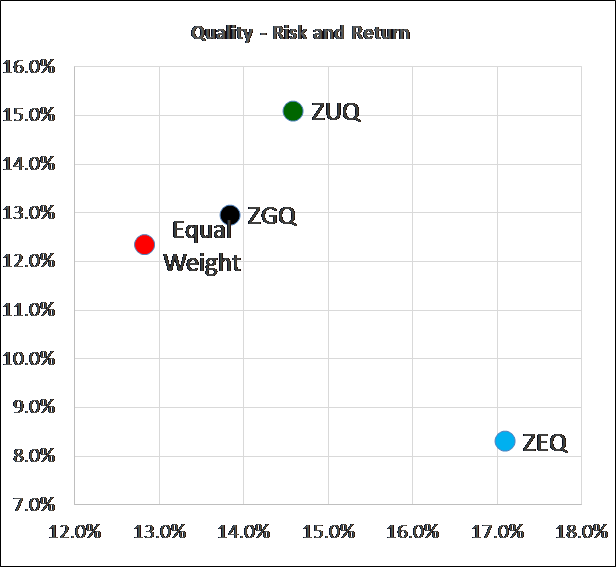

The Quality or profitability factor tends to generate higher returns than other stocks, when compared to the least profitable companies. Different measures of profitability can be used, e.g. return-on-equity, financial leverage, free cash flow, dividend growth, etc. The graphic shows the long-term risk and return of several factors from 1996 to 2015. The MSCI World index (cap-weighted) had a Sharpe ratio less than half the average of these factors. Since 1926, the S&P 500 has a Sharpe ratio of 0.34 for comparison purposes.

Quality shares some characteristics with low volatility. Companies that have low volatility tend not to have lots of financial leverage and tend to have more stable earnings, which are quality factors. The return on equity factor and stable earnings factor, provide the growth attribute that you would expect in good quality companies. BMO links their quality ETFs to the MSCI index methodology.

Increasingly, you don’t need portfolio managers to pick stocks. Computer-based screening techniques are packaging up these tried-and-true methodologies that you used to have to pay 2.5 per cent for in a mutual fund. The average ETF cost in Canada for these smart indexing approaches are closer to 60 bps and in the U.S. around 56 bps. The range of fees in the BMO ETFs are between 30 and 50 bps. I would not get hung up on the higher MERs compared to the traditional market cap weighted indexes that average closer to 12 bps.

As Warren Buffett famously said:

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Learn how to be a smarter investor in our 7th season across Canada speaking tour. Free registration at www.etfcm.com. Help us raise money to fight Cancer and Alzheimer’s by making a voluntary donation with your registration. Over the past few years, Berman’s Call roadshows have raised over $175,000 for charity thanks to BNN viewers and our sponsors.

Follow Larry Online:

Twitter: @LarryBermanETF

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com