Jun 5, 2023

Larry Berman: Are we in a new bull market?

By Larry Berman

Larry Berman takes your questions

A simple definition of a bullish trend is a series of higher highs and higher lows. A simple definition of a bull market has been a rally of more than 20 per cent from a low (silly definition as it was derived just as silly as the opposite of a 20 per cent bear market decline).

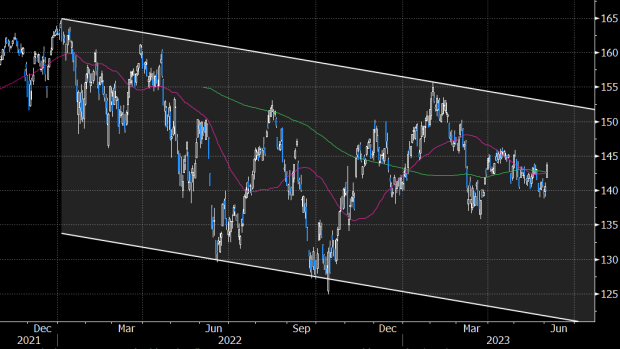

We have now seen the confirmation that resistance at 4,200 has broken and both conditions are now in place. We also saw a broadening of the rally late last week with the equal weight S&P 500 showing some relative strength, which is encouraging, but far from bullish.

But not all bull markets are created equally, and the extremely weak breadth suggests a degree of caution is warranted if fear of missing out (FOMO) is driving your emotions to get back into the market. The same look at the equal weight S&P 500 index shows that a downtrend (bear market) is still in place, and it is far from the beginning of a robust bull market. Is the economy strong if most stocks are not performing well? Is the stimulus coming to drive earnings higher? This will come, but not until inflation is well contained—we do not think we are there yet.

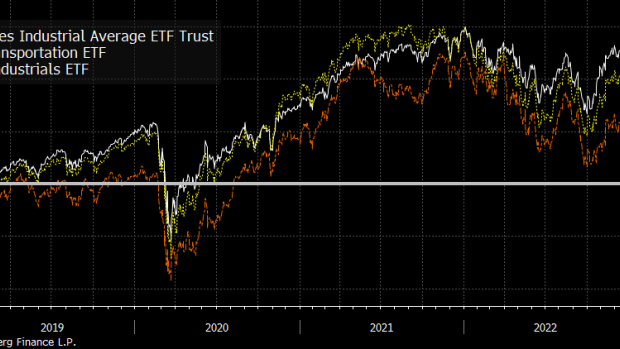

Another degree of caution comes from Dow Theory, which shows the relative strength in the Dow Jones Industrial Average (DJIA) is not being confirmed by the Dow Jones Transportation (IYT) average.

The theory here is that if the companies that produce products are doing well than the companies that take those products to the consumers should be doing well too. This of course made sense when the make up of the DJIA was far more industrial than it is today, but the principle still applies. Because of this, we now compare the pure industrial ETF (IYJ) to the transport only ETF (IYT) and we see a similar relative weakness.

Bottom line: The jury is out, but the strong close above 4,200 last week was a plus. The theory of support and resistance states that what was resistance should provide support once broken.

A strong close back below 4,200 (confirmed below 4,100) would be a bearish warning signal (nothing more bearish than a failed bullish signal). Is it just FOMO or is the soft landing and inflation outcome what the market has been telling us for months now going to play out?

I’m not convinced, but I’m not looking for a crash either. I do think we should test the area (3,500-3,600) 2022 lows again and I was bullish in October when valuations were not stretched in that range. The consensus of the Street has the yearend price target closer to 4,000 with an eight per cent decline in EPS (US$206 vs. $223 current trailing EPS).

We have yet to see the pain of job losses hit Main Street and I maintain that this bear market cannot end until we see it in absence of central bank stimulus. The U.S. Federal Open Market Committee will not likely cut rates until inflation is at their targets or financial conditions are very tight (the 2022 lows were not enough). The higher EPS forecasts for 2024 ($246) and beyond (2025-$267) need stimulus and a strong economy to get us there.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com