Mar 11, 2019

Larry Berman: Crude and late economic cycles

By Larry Berman

Last week I took a look at the late-cycle base metals outlook. I have not done a deep dive on my long-term energy outlook for a while. I thought that it would be timely to take a look this week, given the heightened focus on OPEC, Russia and Venezuela, supply and demand, and Canada rapidly losing its global prominence due to complicated pipeline politics. I do not see a material change for Canada unless there is a shift to a government that understands that we need to balance economic and environmental considerations. The good news for Canada is that I expect a change of government in Alberta and federally. Longer-term, the world is serious about reducing the carbon footprint and the Canadian markets will likely lag due to the fact that energy is such a huge weight.

Currently, 18 per cent of the S&P/TSX Composite is in the energy sector, compared to 5 per cent in the U.S. and 5.85 per cent in the world index. The Russian ETF, RSX, has 39.3 per cent in the energy sector and the U.K. is close to Canada’s weighting at 17.2 per cent. Norway is 30.8 per cent energy, so it’s not too surprising that their sovereign wealth fund is divesting from the sector.

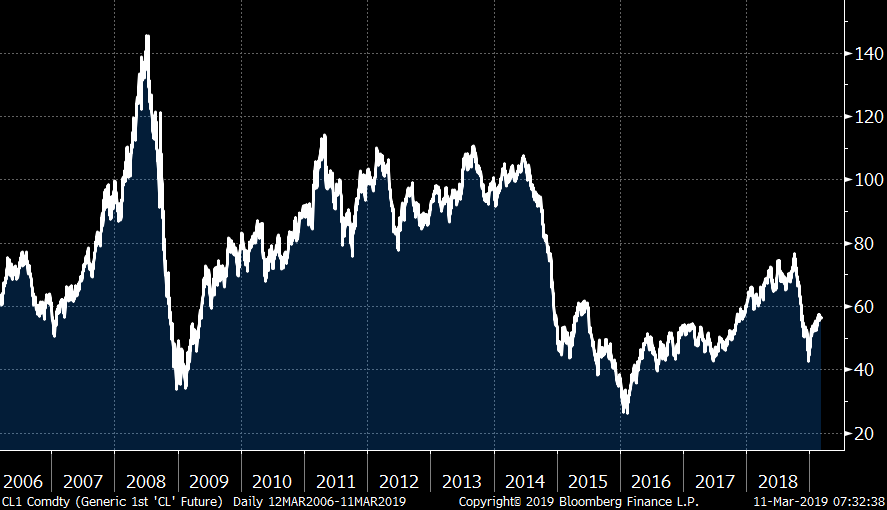

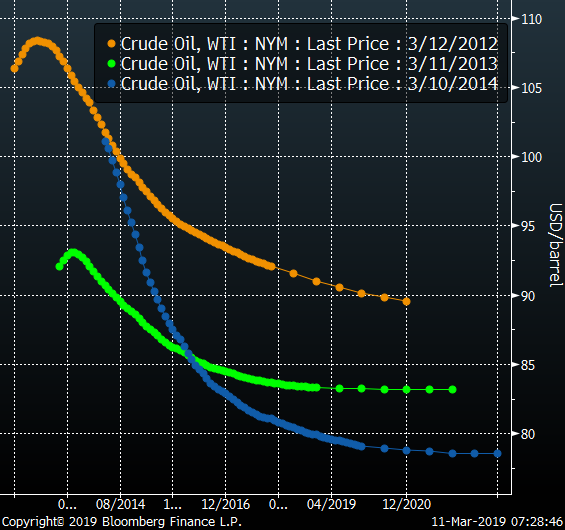

The first chart below shows the front-month price of crude over the past 13 years and the second is the five-year forward price over the same period. Looking back at 2012, the weight of energy in the world index was 10.7 per cent. For the US it was 10.45 per cent and for Canada it was 26.1 per cent. I do not see a scenario where energy regains its leadership in the world as an investment theme.

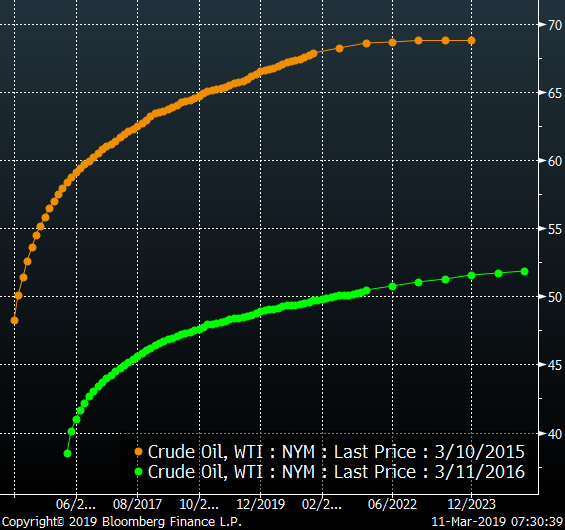

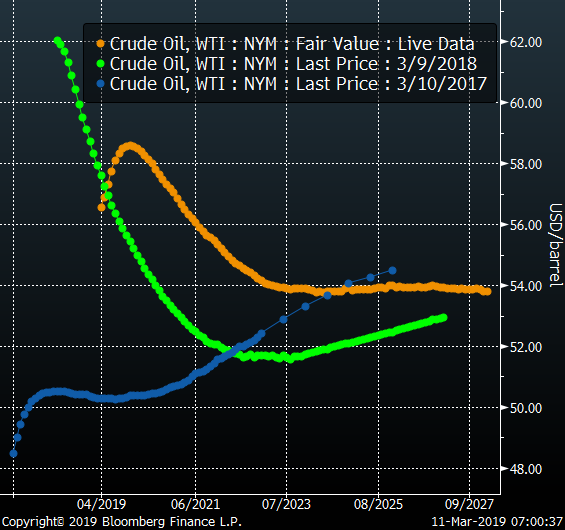

Prior to the boom in fracking that really began to take hold around 2011 - and has exploded over the last few years to the upside in terms of production - the longer-term outlook was much more tied to the current price. In the past five years U.S. supply has increased rapidly and Canadian distribution has been choked off, so the longer- term price has anchored around the US$50-60 range. I see that continuing beyond the next five years. The big question, as always in the sector, is depletion versus investment and the bigger picture supply-and-demand factors. I see a future where all the cars and trucks in the world will have some combination of battery and other clean energy sources. I’m not sure airplanes will get there, but fuel economy improvements should continue. And even factoring in world population growth around 1 per cent annually, peak demand for oil is closer than most would think.

We can see the shape of the forward curves changing over time in the following graphs:

Currently, energy is one of the biggest weights in my portfolios. There is a difference between investing for the long-term like Warren Buffett and shifting exposures opportunistically as I do. The energy sector is a bad long-term bet when you compare it to technology or consumer stocks in the coming decades. That debate would not last too long.

For the next five years, U.S. pipelines will be filled to capacity and beyond … the U.S. is now one of the growing exporters in the world. I’ve liked the value and yield of U.S. pipelines in the past few years. So while I’m clearly a longer-term bear on the sector - and in the coming recession WTI will surely hit the US$25-30 range again - we will see periods where the sector is tactically tradeable. I’m a buyer on dips in the sector. See the XLE ETF from SPDR, which is a U.S. play. And, if we see a change in government federally, which increasingly looks likely, we should see some of that land-locked excess supply making its way to market (read: more pipelines). If we reach that point, Canadian energy looks to outperform for a while. And while I consider myself greener than average (I drive a hybrid car), balancing the economic impact and the environmental impact of investment in the energy sector is just the prudent approach.

I’m pro pipelines for Canada. There is some value in the sector, so it’s tradeable, but I would not make a bet that we go back to the boom days for Alberta. Sorry!

SEE LARRY LIVE

| City | Date |

|---|---|

| Kelowna, B.C. | Wed. March 13 |

| Victoria, B.C. | Thu. March 14 |

| Vancouver, B.C. | Sat. March 16 |

| London, Ont. | Wed. March 20 |

| Halifax, N.S. | Thu. March 28 |

| Markham, Ont. | Sat. March 31 |

| Montreal, Que. | Thu. April 11 |

| Ottawa, Ont. | Sat. April 13 |

| Edmonton, Alta. | Wed. April 24 |

| Calgary, Alta. | Sat. April 27 |

Follow Larry Online:

Twitter: @LarryBermanETF

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com