Aug 20, 2018

Larry Berman: Dimon’s interest rate view doesn’t add up

By Larry Berman

Last week highly-influential JPMorgan Chase CEO Jamie Dimon warned that longer-term U.S. interest rates would be rising significantly. I think he’s out to lunch. He sees the equity bull market extending two to three more years and thinks the economy is strong enough to handle higher rates.

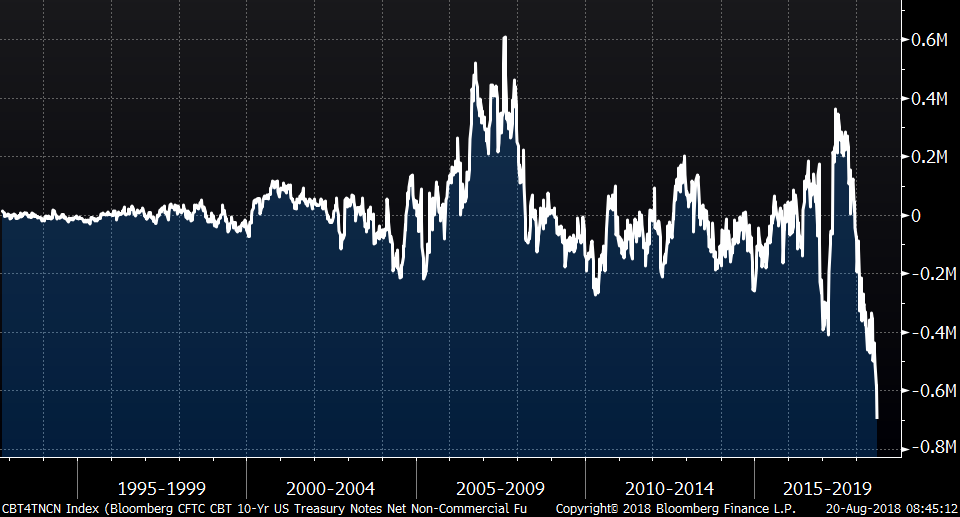

Speculative positions in the 10-year futures markets may agree with him, but this is seen as a contrary indicator by market analysts at extremes. And it’s never been more extreme!

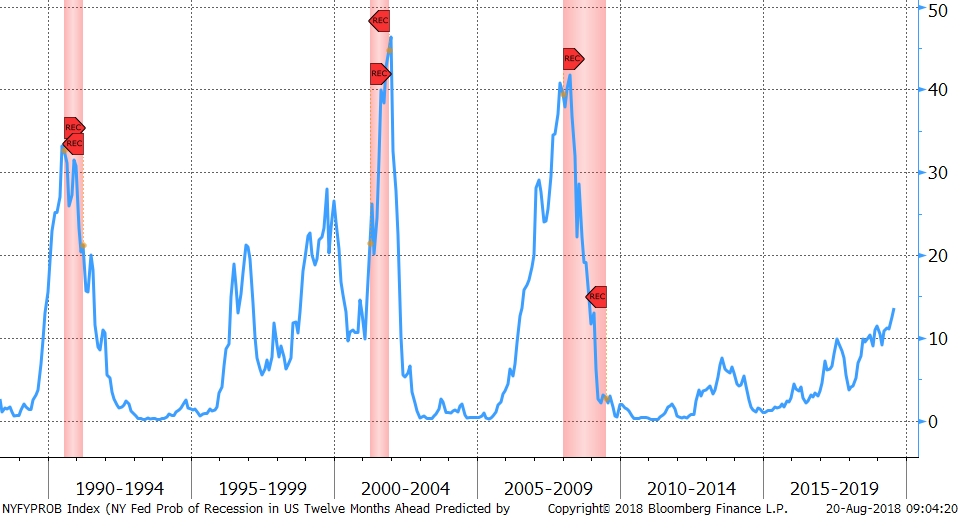

The yield curve - the slope of where banks borrow (short) versus lend (long) - is extremely flat. Banks refer to this as net interest margin, or the profitability of their lending business. The New York Federal Reserve recession probability index suggests we do not need to be concerned about a recession in the next year. But, when projecting where yields will be by mid 2019, the probability of a recession is extremely high unless you believe Dimon’s call for 10-year yields to go to five per cent.

For this to happen, the U.S. economy must be robust. Today, the yield curve is forecasting stagnation and the equity market is forecasting exuberance.

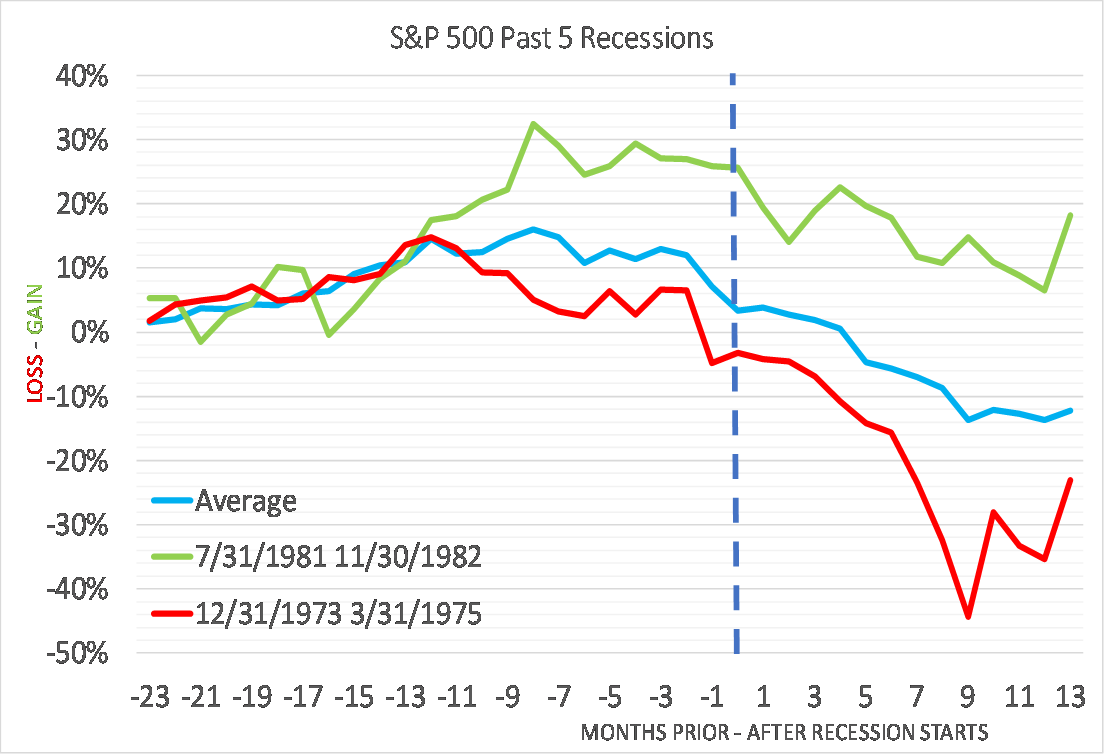

What history tells us about recessions and U.S. equities is that the market discounts bad news. By the time a recession is officially labelled by the National Bureau of Economic Research (NBER), the damage is done. Since World War II, the average peak to trough recession has seen U.S. large caps fall an average of 29 per cent with a peak about eight months before the recession begins. While the markets tend to do well in the years leading into recession because the economy is strong, the debate continues as to if we saw the best of that in 2017.

Don’t panic that bond yields are going to move significantly higher. Be more concerned that the economy would shut down and we would see more quantitative easing and negative interest rates perhaps during the next recession.

Follow Larry Online:

Twitter: @LarryBermanETF

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com