Oct 31, 2022

Larry Berman: Does the U.S. election outcome matter for markets?

By Larry Berman

Larry Berman's Educational Segment

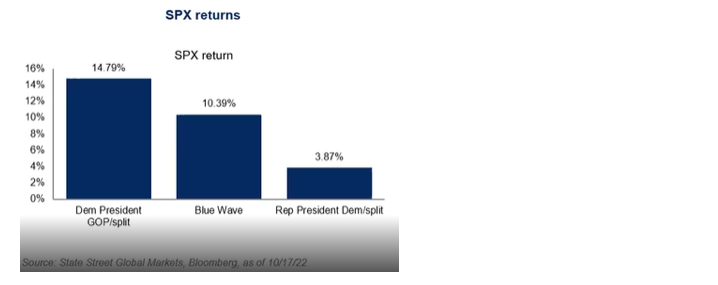

Yes. In general, the configuration of Congress relative to the White House has a meaningful impact on spending patterns, which has longer-term implications. The Trump tax cuts in 2018 had a meaningful impact on corporate profits for example. The way it's looking today, a Biden White House and a GOP Congress is possibly the best outcome for markets given the likelihood of a gridlock and less spending. This could have a cooling impact on the economy and inflation.

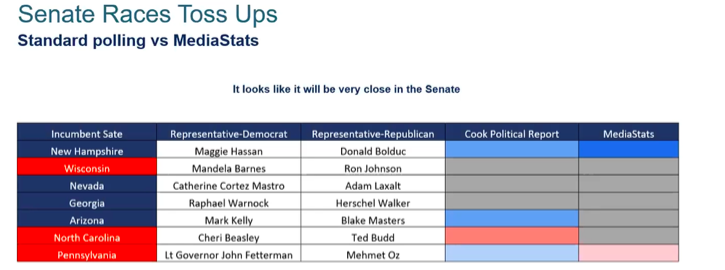

Keeping in mind, the 1990's Clinton White House is skewing this data during his second term where the technology led bubble market caught a trend that had very little to do with the White House or Congress. The Senate race is very close, but in recent weeks it's tilting towards the GOP. I attended a webinar this week where State Street research highlighted the following key close races.

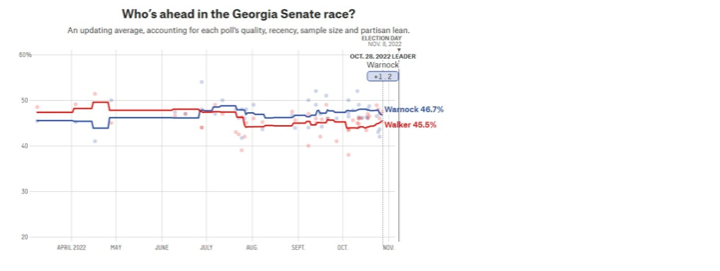

Georgia and Nevada could be the key swing seats away from the democrats. According to FiveThirtyEight we are in a statistical tie with the democrats slightly ahead. The other similar race in a statistical tie is Pennsylvania. Post debate where Fetterman showed some health concern vulnerability, Dr. Oz has pulled ahead in recent surveys. But this was a GOP seat to lose. In Nevada, there is a statistical tie as well with the more recent surveys tilting towards the GOP.

The bigger issue for markets over the next year is not the election outcome, but inflation and growth outcome. All may know that the key three month versus 10-year bond curve finally inverted last week and the probability of a recession in 2023 is very high. This may be why the FOMC is closer to the terminal rate than some think. But cutting rates before inflation drops below at least three per cent will be difficult for the FOMC. The effect that quantitative tightening (QT) has on interest rates and how the U.S. Treasury funds massive deficits going forward matter much more. Obviously, a split White House and Congress means less fiscal spending and therefore less stimulus. This could be a welcome outcome for inflation pressure.

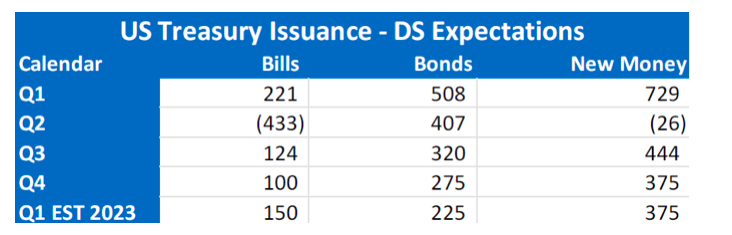

We follow a research service called Damped Springs (DS). The table below is from their most recent report for funding expectations for the US Treasury, which we will see this week. The total funding need we find out on Oct. 31 and the distribution of the issuance we find out on Nov. 2 in the quarterly refunding announcement. DS expects that tax receipts will be stronger than expected and funding needs will begin to issue more bills and less bonds (coupons). Secretary of the Treasury, Janet Yellen, has a latitude to change the mix of funding. Market liquidity and lowering the cost of funding is the Treasury mandate. This will likely help offset some of the negative implications of QT. But make no mistake, this will likely be a headwind for asset prices in 2023 as a reversal of what the expansion of the Fed balance sheet did for asset prices in 2020 and 2021.

We continue the Fall 2022 virtual roadshow on YouTube and GoToWebinar. Sign up at https://investorsguidetothriving.com/. We will focus on the U.S. election and the impact of quantitative tightening (QT) and recession on markets for 2023. Over the past decade, we have raised over $500,000 for brain health, dementia, and Alzheimer's research at the Baycrest Hospital. You can add your donation here. I match all BNN viewer donations up to $25,000. Please help out with an assist.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com