Dec 2, 2019

Larry Berman: ESG investing is making an impact — should you care?

By Larry Berman

Larry Berman: ESG investing is making an impact — should you care?

What inspired this week’s topic was in part what I saw at the hotel I was staying at in Nanaimo, B.C.: biodegradable cutlery made from plant starch!

The other thing is that I spent the week in the beautiful sea and sky views of B.C. and it just makes you want a cleaner planet. I’m very bullish on technology solutions and the smart people that are working to solve environmental challenges. Sustainability will most certainly be among the top demographic investment themes as we age. ESG investing stands for environment, social, and governance factors that have an impact on corporate bottom lines.

Should a company with more diversity and proportional representation (balanced male female) in the C-Suite perform better than one with a skew? Will paying everyone the same make companies more profitable? The answer is maybe. For me, the best person for the job is more important than choosing an inferior person based on anything but their skill set and ability to execute. And one should be paid on a merit basis only and noting to do with gender or race. Any idea of balance should only be a tiebreaker at best. The SHE ETF was the first diversity-based ETF. It launched in 2016 and has had mixed results. At times, it’s out performed and at times it’s under performed. Why?

| Sector / ETF | SHE (gender diversity) | ACWI (market cap) |

|---|---|---|

| Technology | 20.8% | 16.9% |

| Financials | 13.5% | 16.6% |

| Healthcare | 13.2% | 11.7% |

| Cons. Disc. | 10.8% | 10.7% |

| Energy | 4.5% | 5.1% |

So has SHE outperformed over the past few years because more women are in the C-Suite or because they are getting paid more now, or is the index is skewed to sectors that have performed better? The two highest underperforming sectors in the past decade are financials and energy and these are big underweights for the SHE ETF while technology is a huge overweight. The more detailed attribution answer is very reveling and interesting. AAPL (2.45 per cent and MSFT (2.25 per cent), the biggest two weights in the MSCI World Index and some of the best equities in the past few years, are not in the SHE Index ETF. The biggest technology weight in SHE is V (5.11 per cent). A close look at the stock level performance and we can see that V was not as good as AAPL and MSFT, but they were all significantly better than SHE was overall. So the “Alpha (out performance by security selection)” in SHE mostly came from sector weights than it did security selection. That suggests it’s probably not a gender-driven success and a case of being right for the wrong reason. I expected as much several years ago when we did an educational segment on the SHE ETF winning ETF of the year. Some aspects of the feel good part of ESG can make you feel better, but may not help your investment performance.

The whole topic of ESG investing can become polarizing for these reasons. We have seen this play out politically in Canada with the the carbon tax debate and the obvious policy disagreement between the energy-rich Prairies and the environmentally-rich coastline.

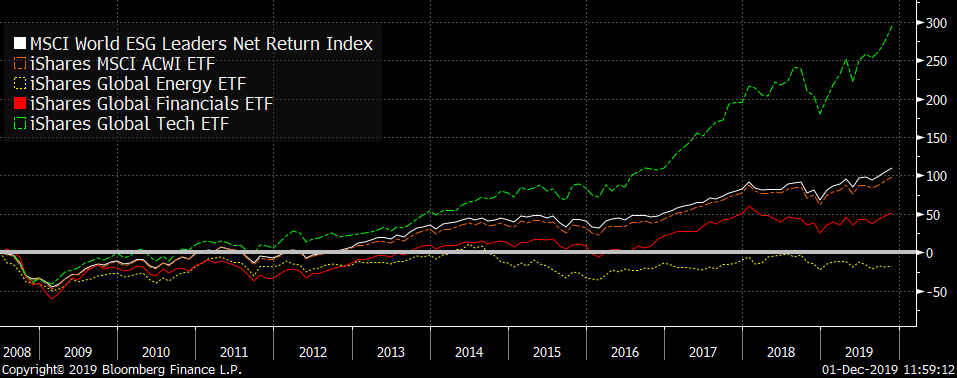

Since the ESG investment theme was defined in 2005, there have been indexes developed to track the trends. The MSCI global ESG leaders index was born. ETFs in the sector are popping up all over the place. BMO will be adding a suite of ESG ETFs early in 2020. So I compared the most politically-polarizing (for Canada) part of ESG (the environment) by isolating the global energy sector returns (all USD). While ESG has outperformed the market cap weighted world index, it is almost exclusively the poor returns in the energy sector the past decade that has been the single biggest factor. A decade ago, the energy sector represented 11.25 per cent of the world index and today it’s about five per cent. I think if you asked a question on the importance of a clean and healthy environment, we would all generally agree it’s a place we should be investing. We just seem to disagree when we ask the politically opposite question. Do you support burning carbon-based fuels for energy? To be sure, building pipelines in Canada, if done properly, will raise more money for green initiatives than will a carbon tax.

There are other areas that fall under the umbrella term of ESG factors. We looked at climate and diversity. Each factor over time is believed to add ever so slightly to investor returns as society strives to improve quality of life. I like the overall idea of being an activist investor, but the jury is out that some of these factors will matter to profitability.

It’s unlikely ESG factors are much behind financials relative performance, but would have more influence in consumer discretionary choice areas. Beyond Meat has been beyond belief since its IPO and is at the core of this new exciting area. So too is Tesla, which has been anything but a sleep-at-night ride. And you know how I like sleep-at-night investing.

For those that could not make it out to our live version of BNN Investors Guide to Thriving tour (Fixing Fixed-Income), we have an upcoming webinar. With bond yields likely to remain low for many reasons, some of which are global demographics and the massive existing debt burden, we explore the history of fixed-income and inflation and look at reasons yields are likely to remain low. As we age, we need our money to last longer and low real interest rates (after inflation eats away your purchasing power) are a huge tax on incomes. And while rising stock markets help, they only really help the top third of the population that benefits from exposure. So the average person is doing OK, but the median person is increasingly worse off. The bottom half of people have little to no income impact from the wealth effect of rising asset prices due to low savings rates, but are hurt most from low rates in retirement as they require the safest retirement income. The safe bond part of your portfolio is broken, perhaps permanently impaired for decades. You will need to learn to get creative to enhance your REAL return on your fixed-income. Join the webinar on Dec 10th and learn how.

Register free at www.etfcm.com and make your donation here.

| Place | Date |

|---|---|

| Webinar | Tuesday December 10, 2019 |

Follow Larry Online:

Twitter: @LarryBermanETF

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com