Jun 26, 2020

Larry Berman: Global bear market should uncover more Wirecard fraud, not stress tests

By Larry Berman

Larry Berman on Wirecard fraud and Fed stress tests

Remember Enron, Bernie Madoff, Worldcom… In what has to be a colossal poster child for how laughable the audit process can be, Ernst & Young (E&Y) accused their client Wirecard of “an elaborate and sophisticated fraud” that allowed more than US$2 billion to go missing. E&Y are rejecting responsibility for their role in the debacle and preparing for the inevitable avalanche of lawsuits. For those that do not remember, parts of Arthur Anderson’s business - the firm that missed Enron’s fraud - were snapped up by E&Y. Coincidence?

My goal here is not to beat up on E&Y. Well… maybe a little since their only job as an auditor is to vet the accuracy of the numbers. My larger point is that market and economic stress often lifts the veil and uncovers who’s wearing what clothes. It’s harder to hide when cash flows are stressed.

There will be more.

We have had an unprecedented run on the economy which is now over and is being masked by colossal money printing. Remember, Goldman Sachs helped Greece hide its true liabilities “off book” on the eve of its admission to the European Union.

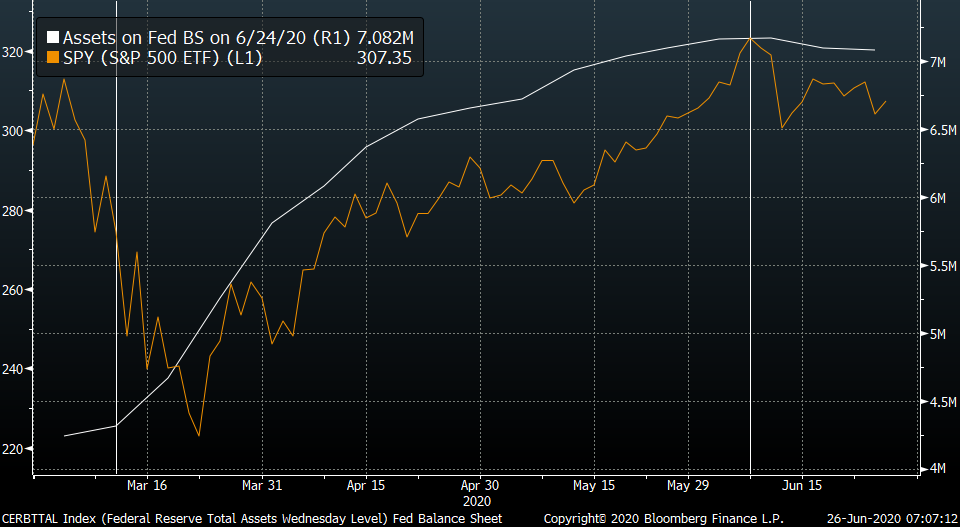

That leads me to the Federal Reserve’s bank stress tests and a look under the hood of the market behaviour in the past few weeks as it pertains to the Fed’s balance sheet. It turns out the Fed has stopped the net new purchases of debt in the past few weeks. The Fed suggested in a worst-case scenario banks could lose US$700 billion. Frankly, that’s laughable. The off-balance-sheet risks are far greater than the Fed would like us to believe. But they can’t tell us that or Congress would have to make a new Dodd-Frank type law to make it even harder for them to do business. They just voted to relax the Volcker Rule this week.

What concerns me the most is the chart below. The market can seemingly only rise on money printing (debt monetization). We know there is more to come, but I want to underscore that this is not bullish. It’s actually a sign the system is fragile — very fragile. It most certainly will end badly, especially for the newly minted Robinhood gang. I just can’t say when, and that is the most difficult part of weighing the fear of missing out versus real fundamentals. This should never be the reason you buy stocks, but often is the greatest overwhelming driver of investor decision-making.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com