Nov 9, 2020

Larry Berman: Gold remains the most attractive asset class with steep U.S. equities and bonds

Presented by:

By Larry Berman

Gold remains the most attractive asset class right now: Larry Berman

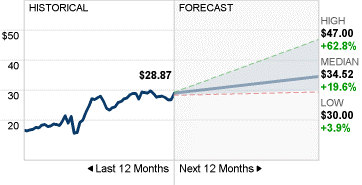

Gold equity analysts just do not believe that gold prices are going to stay high. The 18 analysts offering 12-month price forecasts for Barrick Gold Corporation have a median target of $34.52, with a high estimate of $47 and a low estimate of $30. The median estimate represents a 19.56 per cent increase from the last price of $28.87.

The primary reason is that they do not believe the price of gold will generally keep rising. According to Bloomberg, the median average price forecast for the next few years is lower than it is today.

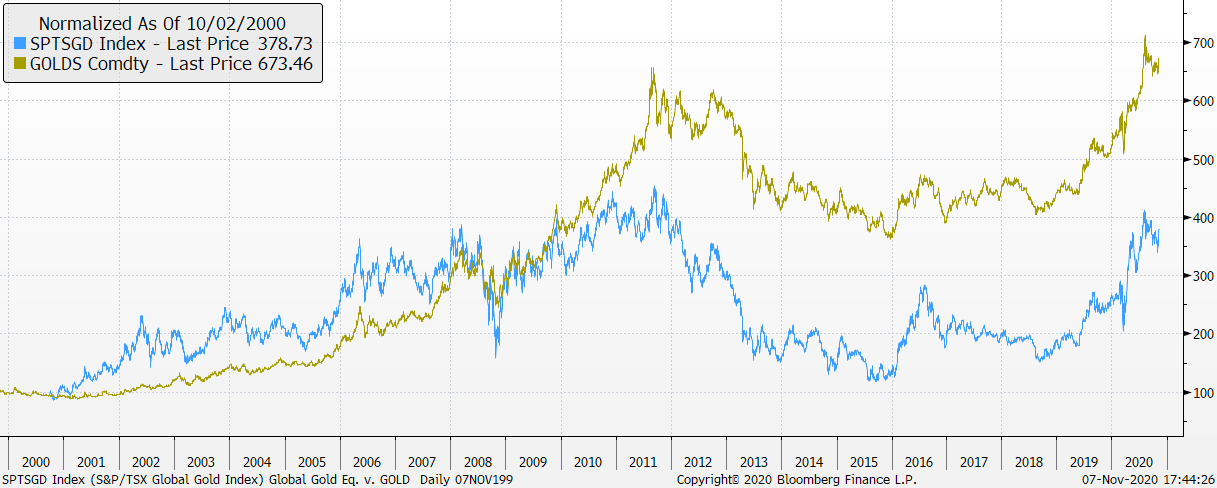

Over the past 20 years, we can see spot gold is up 670 per cent and gold equities are up 380 per cent, gold stocks are 7.7 per cent versus 10.3 per cent annualized.

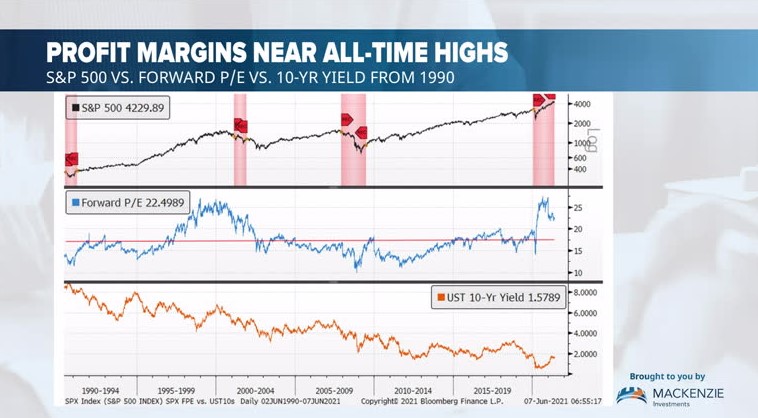

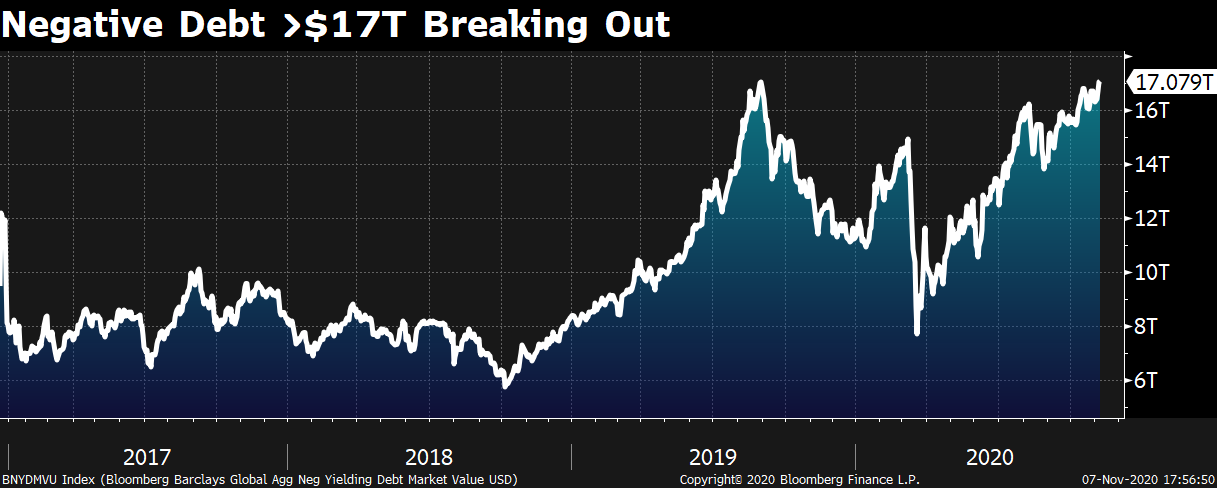

There are two driving factors for gold’s rise: Negative absolute yields and negative real yields. Gold has virtually no competition from fixed income in terms of a yield. And gold stocks now yield about 0.8 per cent, which is the same nominal yield that we see in the U.S. 10-year bond. Globally, I see more than US$17 trillion in negative yielding debt again.

When you adjust for inflation, real yields are negative and there are not too many charts with this type of correlation. So the 24-carat questions are: When does this end? And what changes it? With central banks needing to monetize most of the new debt and seeking higher inflation, the recipe is there for more negative real rates and a marketplace that does not believe gold prices can be sustained, let alone keep rising.

This week in my Berman’s Call virtual roadshow, we look past the election and into tax loss selling season for some value opportunities. If you missed one, you can see all the replays here. Sign up for the series at www.etfcm.com every Thursday at 7 p.m. ET through Dec 3. There will be lots of opportunity to ask questions of markets and your favourite ETFs and stocks.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com