Nov 4, 2019

Larry Berman: Is it time to buy Canadian energy? There are options

By Larry Berman

How to build a portolfio in the Canadian energy sector

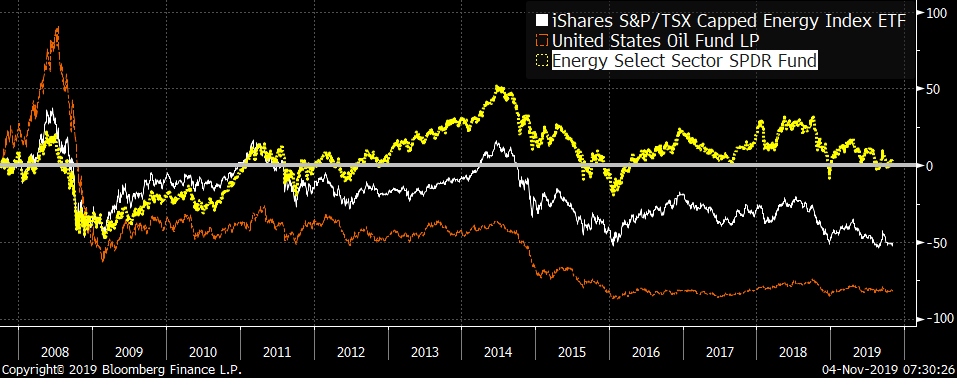

It’s not a surprise that I think traditional energy demand should be replaced by low-carbon alternatives over time. The vast majority of people believe that we should do something about climate change. Therefore, longer-term, the energy sector is an underperform. That said, there will likely be tradable rallies along the way. For me, I want to overweight a sector when I believe it can add value and underweight or avoid a sector that performs poorly. That’s basically called ALPHA, or the outperformance one can achieve by actively selecting a security versus just buying exposure to the market (BETA) with a low-cost ETF. This week’s Berman’s Call roadshow is in Alberta, and while the topic is fixed income, the energy sector always inspires discussion. I’m currently long the Energy Select Sector SPDR Fund (XLE) (with a covered call) and short a put spread in crude oil through the United States Oil Fund (USO). If you are wondering what that means, read on.

Politically, the left-leaning parties in Canada believe that fighting carbon is far more important than the economic prosperity it historically has delivered. That has been painfully obvious, from Trudeau’s comments about shutting in the oil sands, to Bill C-69, to the cancellation of Energy East. With the NDP vote now critical to the Liberal minority, odds are that we will get even less political support for Canada’s biggest natural resource. So, sad to say, Canada is an underperform; the energy sector in the S&P TSX is still very large but is rapidly shrinking. While Trans Canada (now TC Energy) has kept its home office in Calgary, Encana (now Ovintia) is re-domiciling to the U.S. Watch for Ovintia to be dropped from the TMX index. One risk it may have not fully thought out is an Elizabeth Warren presidency.

A decade ago (before the fracking revolution), with oil prices over US$100 and WCS differentials relatively tight to fundamentals, the TSX energy sector was 26 per cent of the index, and Encana was 1.08 per cent of the index. After Encana left Canada last week, the energy sector was 16.1 per cent of the index and Encana was 0.3 per cent of the index. If that is not an underperform, I don’t know what is.

So with all that in mind, how could you earn the approximate three-per-cent yield the sector offers, with less risk of underperformance and upside potential should the Trans Mountain expansion actually get built? A minority government typically falls in about two years, the catalyst usually being budget priorities. My guess is the 2021 budget could fail and an election in the spring or summer of that year seems most likely.

Learning to utilize options on the ETF representing the Canadian energy sector — the S&P/TSX Capped Energy Index ETF (XEG), which has been around since 2001 — is key. Sadly, the ETF has earned a total return of about three per cent since inception. So to be fair, I’m not sure why anyone would want to own it unless you see the future of energy changing. Basically, you’ve earned the dividend and little more.

Options are listed on the XEG as far out as March 2022. You can sell two units of an $8 put for about $1 (maybe a bit more). That earns you a 12.5-per-cent yield for the next 2.5 years, or about five per cent annually — way better than the dividend. If the ETF falls by about two per cent or more than from where it is today (below the $8 strike), you must buy it at $8. You can use about half of that yield to buy one unit of a $9 call for about $1. If we get a Warren presidency in the U.S., best-case scenario is WTI prices rise back to US$100 as millions of barrels of supply come off the market if she bans fracking. If TMX gets built (still questionable), then we could see the ETF back to about $13 to $14.

Come out to my fall roadshow this week in Alberta. While energy is not the focus, option strategies are. I’ll show you the important roll fixed-income plays in your portfolio and some ideas for how to deal with the low-rate environment and potential inflation in the future, through use of options. Option strategies are likely to become a bigger part of portfolio construction in the coming years.

Register free at etfcm.com and make your donation here.

| Market | Date |

|---|---|

| Edmonton | Thursday, November 7, 2019 |

| Calgary | Saturday, November 9, 2019 |

| Markham | Sunday, November 24, 2019 |

| Victoria | Wednesday, November 27, 2019 |

| Langley | Thursday, November 28, 2019 |

| Vancouver | Saturday, November 30, 2019 |

Twitter: @LarryBermanETF

LinkedIn: ETF Capital Management

Facebook: ETF Capital Management

Website: www.etfcm.com