Nov 21, 2016

Larry Berman: Momentum and liquidity factors

By Larry Berman

Continuing our focus on building smart ETF portfolios, we have with us today Tim Huver, head of product at Vanguard Canada.

Following significant losses by large-cap and growth stocks during the 2000–2002 bear market, investor interest has increased in non-market-capitalization index-weighting strategies that intentionally divorce a security’s index weighting from its price, according to a Vanguard white paper on smart indexing.

Such rules-based alternatives to market-cap-weighted indexes are strategies labeled alternative indexing, fundamental indexing, or, the more commonly used, smart beta. Vanguard believes strongly that, by definition, smart-beta indexes should be considered rules-based active strategies because their methodologies tend to generate meaningful security-level deviations, or tracking error, versus a broad market-cap index.

Vanguard correctly points out that all smart indexes are not so S.M.A.R.T. To illustrate that it’s very important to know your product – Vanguard created a “not-so-smart” index by using stocks with tickers S, M, A, R, and T. They show strong performance, but, of course, the reason for the superior performance is spurious at best.

Today we are going to look at two global liquidity and momentum factors that Vanguard has brought to Canada.

Liquidity: Captures the potential premium for bearing the risk of investing in less liquid stocks. Investors have a tendency to overpay for liquidity, leaving a potential premium for less liquid stocks.

Momentum: Stocks with the strongest price trends, i.e. stocks with the strongest out-performance relative to other stocks as measured over the previous 12 months also tend to continue to outperform.

This does not mean that small cap stocks always beat larger cap stocks, but the liquidity or size premium has very different return characteristics than other factors like value, quality, volatility, and momentum. One of the most important learning lessons from using smart index factors over the traditional market cap indexes is that we see significant benefits from using multi-factors in building portfolios.

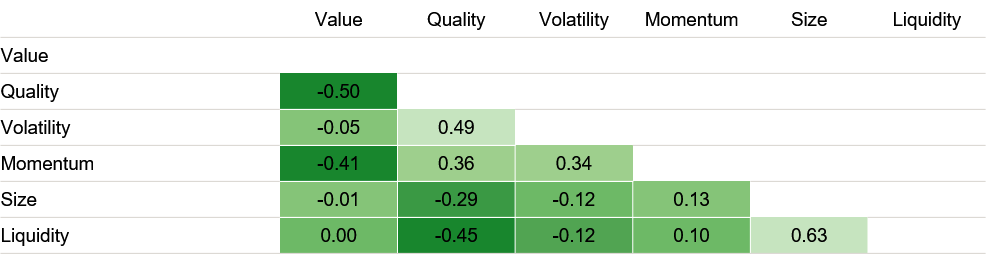

Low correlation of excess returns can diversify active risk, 2002-2015

Looking at how best to benefit from diversification in portfolios by combining these smart factors in portfolios, Tim shares with us some ideas on how best to use these in your portfolios:

- Use many factors for maximum diversification

- Don’t try to guess which one will perform best

- Tilt portfolio in direction of cheap factors

Learning how to use these smart index approaches will help. The excess index performance (compared to traditional market cap) adjusted for risk is notable. These smart approaches on average have delivered superior returns over time, while on average reducing risk through style diversification.

While they have only recently (five years) been put into ETF structures, you can trust the longer-term efficacy versus the market cap approach. You just need to understand how to use them in your portfolios so that you can sleep better at night. This is the topic of my current educational speaking tour across Canada.

Learn how to be a smarter investor in our seventh season across Canada speaking tour. Free registration at www.etfcm.com. Help us raise money to fight Cancer and Alzheimer’s by making a voluntary donation with your registration. Over the past few years, Berman’s Call roadshows have raised over $175,000 for charity thanks to BNN viewers and our sponsors.

Follow Larry Online:

Twitter: @LarryBermanETF

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: etfcm.com