Nov 7, 2016

Larry Berman: Multi-factor smart indexing models

By Larry Berman

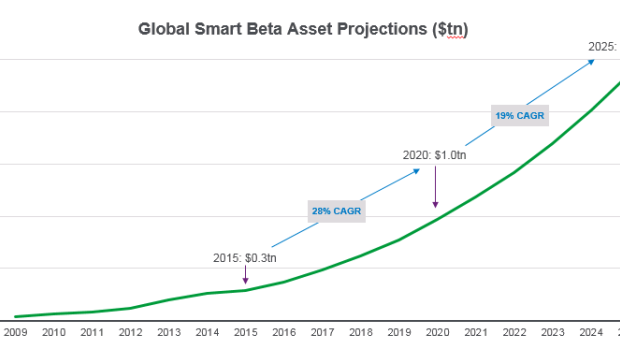

Multi-factor models have been increasingly popular in recent years. The whole smart indexing space has been the fastest growing area for the past few years and is projected to be the fastest growing area for the next decade. iShares expects an annual global growth rate of 20 per cent or more, leading to assets of $2.4 trillion by 2025.

Increasingly, investors are recognizing the low return world we are heading into and are looking for ways to extract better returns. Market capitalization indexes (S&P 500 or S&P TSX), which have been the most popular, are being replaced by smart indexing strategies. Don’t expect these indexes to go away, the most arcane form of indexing in a price weighted index like the Dow Jones Industrial Average is still quoted daily in the media and it’s a horrible way to index. Goldman Sachs that trades at about $176 has more than six times the weight in the index compared to General Electric trading at $28. Surely, GE is a much better representation of the broader economy than GS.

Enter the smart index technology that filters the entire universe of stocks for all the important characteristics of a good company and put it in a passive index. This is most of what you would expect your high-cost portfolio manager to do:

Quality: ROE, Earnings consistency, Leverage (debt to equity)

Value: Forward P/E, EV/Operating cash flow, P/B

Momentum: Based on MSCI Barra momentum factor weighting relative strength

Low Size: Market cap based on MSCI Barra size factor

In the iShare world, they bring this type of passive smart indexing to you for a management fee of 45 basis points. While this is more expensive than the five to 10 basis points in the traditional market cap index, the historical performance has been impressive from a risk adjusted return perspective. They have five ETFs in Canada that use these multi-factor smart indexes.

- XFC Canada

- XFS US

- XFA US (hedged)

- XFI EAFE

- XFF EAFE (hedged)

When evaluating investments, the most important thing you need to understand is the cost of the average expected return. That has very little to do with the MER as the popular media would lead you to believe. The most important cost is the ride. What I mean by that is the volatility of returns. In the investment world, we measure that by standard deviation. In the iShares version of smart multi-factor indexes, you will likely experience slightly higher volatility as seen in the table, but your risk-adjusted return (return/volatility) is far superior to the traditional market cap indexes. The secret to your success is if you can handle the ride. The vast and increasing majority of investors have lower risk tolerance and the tragic part of low interest rate policies is that the lower volatility in bond portfolios will not yield you anywhere close to what you will need in retirement.

These smart index approaches will help. The excess index performance we have seen over the past decades is real. These smart approaches on average have delivered superior returns over time. While they have only recently been put into ETF structures, you can trust the longer-term efficacy versus the market cap approach. You just need to understand how to use them in your portfolios so that you can sleep better at night. This is the topic of my current educational speaking tour across Canada.

Learn how to be a smarter investor in our seventh season across Canada speaking tour. Free registration at www.etfcm.com. Help us raise money to fight cancer and Alzheimer’s by making a voluntary donation with your registration. Over the past few years, Berman’s Call roadshows have raised over $175,000 for charity thanks to BNN viewers and our sponsors.

Follow Larry Online:

Twitter: @LarryBermanETF

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com