Mar 26, 2020

Larry Berman's Top Picks: March 26, 2020

By Larry Berman

Berman's Call for Thursday, March 26, 2020

LOTS OF SUPPORT, NOT A LOT OF CONFIDENCE

Please, make sure you do your part in the global pandemic. Not to participate would be selfish. Sacrifice is needed by all to preserve as much life as possible. Take care of yourself and your loved ones.

The post-Lehman playbook is still in effect. The U.S. Congress dropped the ball in their first attempt at the Troubled Asset Relief Program (TARP) and it seems they did it again this week. This time, while a blank cheque policy is needed, it will not get done without checks and balances. Last week I wrote that this would take 5 to 10 per cent of global GDP’s worth of fiscal measures (US$3.5 to US$7 trillion) to get us through this period (I may have been wrong by a factor of two or three). I wrote that we need nothing less than a blank cheque policy. I believe that more than ever.

Q2 US GDP HIT:

- JPMorgan -14%

- Goldman Sachs -24%

- Morgan Stanley -30%

Worse than the great depression or the U.S. Civil War.

This is what I would do:

Forbearance (the action of refraining from exercising a legal right, especially enforcing the payment of a debt). Individuals and businesses who are suffering here through no fault of their own need to keep their incomes and make their payments. So the lender of last resort (central bank money printing) should cover all payments for as long as it takes. Here is a good report on what might be needed. This, in a major way, should limit the worst of the credit contraction. But make no mistake: there will most certainly not be a “V bottom” most still expect. It will be a “U” at best, but most likely an “L.” Not unlike the 2000-2003 bear market, there will be many tradable rallies. But as we noted last week, the VIX needs to fall below 40 for at least one week to suggest the bottom is likely in.

Governments should provide unlimited access to unemployment insurance for as long as it takes. I don’t love the idea of dropping cheques to everyone. If you were not working before or if you have ample resources, you do not need the support. The support should get to those that need it the most as fast as possible. This will mitigate personal stress and health side effects. Inequality will become a major social issue coming out of this crisis. Policy needs to help the bottom half more than the top half. Any policy seen helping large companies will not likely be politically palatable.

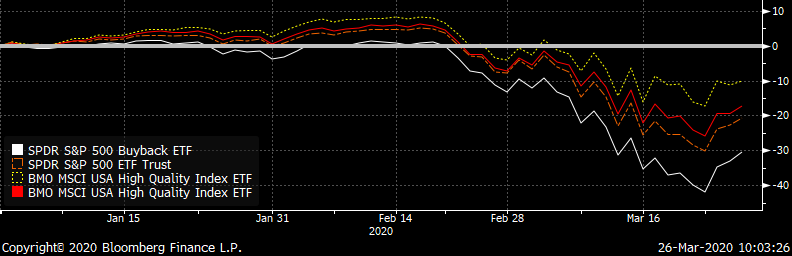

The share buyback gang (see SPYB’s holdings) that needs help should either have to take preferred equity support from private equity (lots of cash here) or government or be forced to dilute the shareholders to pay back their debt. Some may go bankrupt. I will highlight the airlines as the worst abusers of financial engineering, which enriched officers and directors. They should not be allowed to buy back stock or pay dividends until creditors are paid off for 10 years. The C-Suite should take an 80 to 90 per cent pay cut. No stock options for 10 years. I’m sure they will find lots of qualified people willing to work for only $1 to $2 million per year. This basket remains a short against good quality ZUQ companies with clean balance sheets.

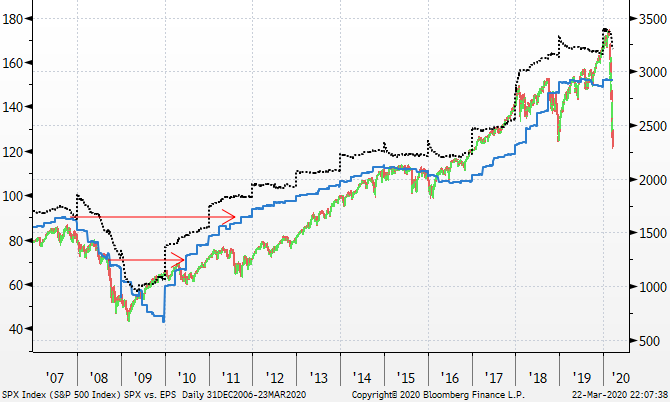

So where do earnings bottom? This is the next phase of the cycle for markets. It took two to four years for earnings to recover after 2008. This is a reasonable expectation this time around too. But it’s where the multiple settles that’s the key to the bottom. Earnings will likely fall about 50 per cent give or take at the trough.

Prior to Trump’s tax cut, the S&P 500 earned $120. A huge part of earnings growth post 2018 was tax cuts and share buybacks. So at a minimum we should see $120 at a 16-times multiple, 1,920 on the index. Those looking for when to start buying stuff you like, this is my minimum target. But hang on to your seats.

My worst-case scenario is earnings fall 50 per cent not from $150 “fake earnings,” but rather from the $120 real earnings. That leaves $60, about the same as the bottom in 2009. If the multiple is 11 times like back then, we go back to 666. If 16 times is the bottom, it’s 960.

Technically, the 2000-2007 highs of 1,550-1,575. The 61.8 per cent retracement is 1,708. Somewhere in that zone you plug your nose, buy your favorite companies, come back in three to five years and you’ll be quite happy.

We are getting close, but we are not there yet. Congress will likely fumble the ball and mom and pop need to open their Q1 statements first and panic. Some time in April or May perhaps, subject to revision.

It’s time to have your plan to go shopping over the next few months. These will be the best valuations to own in more than a decade.

TOP PICKS

ISHARES GLOBAL CLEAN ENERGY ETF (ICLN:UW)

EMERGING MARKETS INTERNET AND E-COMMERCE ETF (EMQQ:UN)

ISHARES RUSSELL 2000 INDEX (IWM:UN)

Our upcoming Spring BNN Bloomberg Roadshow is being converted to webinars (not live events) for this series. Please still sign up for your cities and you will get notified on the weekly webinars changes. If this unprecedented period of volatility does not convince you that one should be cautious when valuations are unstable so that you can get aggressive into periods of panic, you need to sign up for the upcoming series and learn more about the tools you need to use. We will host a weekly Berman’s Call on line where Larry will update his thoughts on the market and have lots of Q&A and ideas to help you with navigating the markets. As always, we ask for a voluntary donation in support of Dementia and Alzheimer’s research at the Baycrest Hospital to attend. We have raised more than $500,000 in the past decade thanks in part to BNN Bloomberg viewers and a matching donation from Larry.

Sign up for Larry’s weekly Q&A webinar to help you navigate these markets at www.etfcm.com.

TWITTER: @LarryBermanETF

LINKEDIN: ETF Capital Management

FACEBOOK: ETF Capital Management

WEBSITE: www.etfcm.com