Jan 16, 2017

Larry Berman: Sustainable dividend ETFs

By Larry Berman

Joining me today is Keith McLean, president and chief investment officer at Sphere Investments. Sphere is one of the newest (April 2016) independent and dedicated Smart Beta (Factor) based managers in Canada. Sphere has developed their own unique indexing approach in a factor they call Sustainable Yield. There initial family of ETFs are global and are all priced at the same 54 basis points, because they believe all portfolios should be global in scope.

WHY SUSTAINABLE YIELD?

The Sustainable Yield approach was developed to address a number of shortcomings in the high dividend yield investment space. Most high-yield strategies expose investors to extreme-yielding equities that may be at risk of cutting their dividend. These dividend cutters expose investors to higher volatility and risk of loss. The main goal of their process is to build a portfolio of companies that avoids dividend cutters and offers a HIGH and SUSTAINABLE yield.

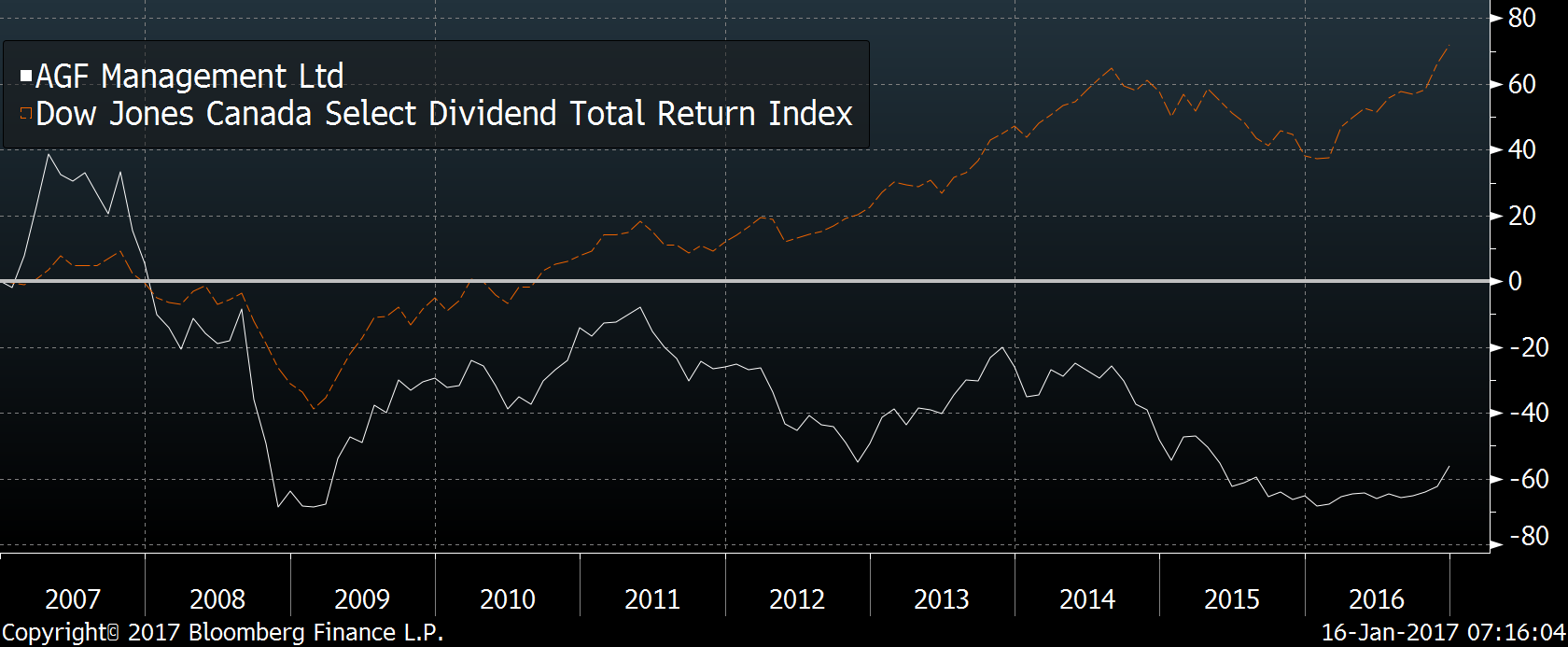

To illustrate the point of sustainable dividends, the best example in Canada in recent years is with (AGF.B). They have been a perennial high dividend payer and caught many investor eyes because of it. However, for years their payout was exceeding their free cash flow and thus unsustainable. A smart index strategy like this is going to avoid some of these chronic underperforming stocks.

The search for sustainable yield is done by following a number of screens – each of which helps us to avoid dividend cutters:

- Reasonable yields: Eliminate extreme yielders - top one per cent yielders in each sector.

- No dividend cuts: 12-month hurdle to get back in.

- Sustainable payout ratio: Not higher than 70 per cent of earnings

- Piotroski - Financial & Operational Strength: 4+ of nine factors:

- Profitability – ROA, Change in ROA, CCO, Accruals, Net Margin

- Capital Structure – Change in Leverage, Change in Current Ratio, Stock issuance

- Operating Efficiency – Change in Turnover, Change in Margin

- Liquidity: Ensure high liquidity with weighting approach

The back-tested performance shows a significant outperformance over time versus comparable benchmarks.

They offer the following global suite of sustainable yield ETFs

SHZ Emerging Markets

SHE Europe

SHC Canada

SHU United States

SHA Asia

On a risk-adjusted return basis, I looked at the 10-year backtest of the underlying indexes they track and compared them to the broader market cap total return index; we see about a 2 per cent average annual increase in return and about 5-10 per cent less volatility. That said, most dividend weighted ETFs have less volatility than their broader index equivalents, so on this score they are doing what they should be. I compared the sustainable dividend indexes to two well-known high dividend ETFs that have been in the market for years; the Vanguard High Dividend (VYM) and the SPDR High Yield Dividend Aristocrat (SDY). In this comparable test, SHU held up well. The main differences over time are going to be the cost of hedging the U.S.-dollar exposure versus the U.S. dividend ETFs where your biggest risk is a stronger Canadian dollar. The MER’s are very different for all three ETFs. The lowest Vanguard was the worst performing over the past five years. It’s not always about buying the lowest cost ETF. Know what you are buying and what is under the hood.

I love the idea of using smart indexing strategies to add returns and lower volatility in portfolios. Learn how to use techniques like this and how to be a smarter investor in our 7th season across Canada speaking tour. Free registration at www.etfcm.com. Help us raise money to fight Cancer and Alzheimer’s by making a voluntary donation with your registration. Over the past few years, Berman’s Call roadshows have raised over $200,000 for charity thanks to BNN viewers and our sponsors.