Dec 4, 2017

Larry Berman: U.S. tax plan — who wins, who loses, and how much is priced in?

By Larry Berman

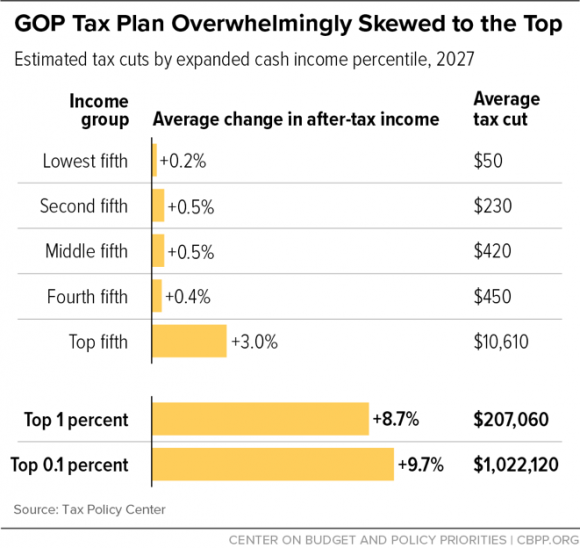

The after-tax income of the top one per cent would rise by 7.5 per cent in 2018 under the bill's provisions, according to several estimates The bottom 80 per cent of the income distribution would see their after-tax income increase by between 0.8 per cent and 2.4 per cent. By 2027, the very highest income households will do best, with an average 3.3 per cent bump in after-tax income. The bottom 90 per cent of households, meanwhile, would see a small boost of between 0.4 per cent and 1.1 per cent.

To say there is a wide disagreement on how this plays out is a massive understatement. The Tax Foundation’s dynamic analysis, which considers the economic growth effects and assumptions about how behaviour would change, could create higher growth, higher wages and 975,000 more jobs.The big assumption is that workers would benefit greatly from the corporate tax cut because CEOs would increase wages and invest more. If I’m a CEO, do I pay people more (not likely), and do I invest more (only if demand increases).

Overall, everyone’s taxes should go down by about $1.5T, but the biggest beneficiaries are not the folks that at the margin elected Trump.

Many economists and tax policy experts agree that a lower U.S. corporate rate would attract more money to the United States, as the White House asserts. But there is far less consensus on how companies would use that money and on how much tax savings would directly benefit workers. For instance, companies may opt to use a significant part of their tax savings to increase dividends or buy back shares instead of making new investments that can create jobs and raise wages. This is what is boosting markets.

The Joint Committee on Taxation estimates that in 2016, while the corporate income tax raised $300 billion in revenues, targeted subsidies delivered to companies through the corporate tax code cost about $270 billion. As a result of these subsidies and other tax avoidance measures, many large U.S. companies pay very low rates. For example, Pfizer paid a rate of about 7.5 per cent on its $12 billion in worldwide pre-tax income in 2014. Studies generally also find that U.S. companies’ tax rates vary widely by industry and type of investment. I’ve seen estimates that S&P 500 companies on average pay about 26 per cent tax.

The case for slashing corporate tax rates is thin: U.S. companies are posting near-record profits, and little suggests that corporate taxes — or poor corporate profitability — are a major constraint for the U.S. economy. Most of the benefit of corporate rate cuts flows to high-income investors rather than “trickling down” to workers in the form of higher wages, and the cuts are costly.

Expectations for earnings growth in the next few years is off the charts relative to what we have seen. The room for disappointment is HUGE! We expect the Bill will add about five per cent to after-tax income and EPS. Shortly after the Bill gets passed, the markets should focus back on the fundamentals of rising rates and central banks pulling back on liquidity.

For those of you who missed this round of my Investor’s Guide to Thriving roadshow, or are in parts of the country we did not get to, we are wrapping up this series with a Live Webinar on Dec 5. at 1 p.m. ET. It will feature BMO ETFs discussing the myths of ETFs. This will be an enjoyable 45-minute presentation looking at demystifying and the Fake News in the ETF marketplace. I will look at the science of decision making and help you determine what your investor type is and look at what kind of ETF portfolios may suit your investor behaviour. There will also be a 15 minute Q&A. Register at www.etfcm.com and scroll to the Education section.

Follow Larry Online:

Twitter: @LarryBermanETF

LinkedIn Group:ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com