Nov 28, 2016

Larry Berman: What are maximum diversification index ETFs and why do you need them?

By Larry Berman

Think Outside The Box Asset Management (TOBAM) is a global investment manager with over $10 billion in AUM. They use a patented portfolio process for analyzing and diversifying portfolios. In Canada, they have partnered with MacKenzie ETFs. Today’s guest is Faizan Dhanani, managing director at TOBAM.

While everybody has no doubt heard of diversification, this is the first I have ever seen in a statistical process to prove maximum diversification—I love the concept! At a high level, they will take the 247 stocks in the S&P TSX composite index and create a new sub-index that combines the stocks that create a group that maximizes diversification. By doing this, they have shown outperformance by one to four per cent annually with less volatility. What I like to call the sleep-at-night factor—higher average return with lower risk. These smart index ETFs strategies do not eliminate risk; they strive to offer better average returns with less risk than the traditional market cap index.

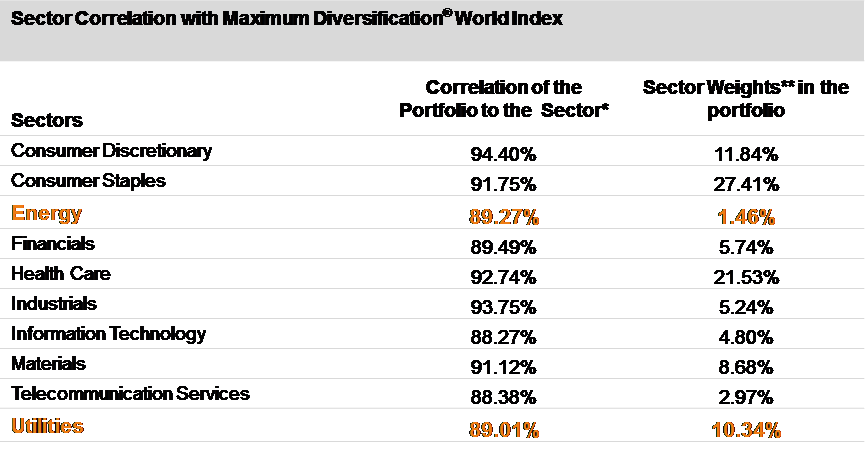

The key to building these indexes are the stock’s correlations relative to each other (i.e. How much Suncor (SU.TO) should we have so that our correlation to the other stocks in the TSX is minimized and should we own SU at all)? Another way of thinking about it is asking what stocks we can eliminate from the broad index that makes the portfolio more risky and less profitable.

Over time, the weight of any sector in the index changes as it impacts returns and volatility. In Canada or the U.S., the best example is in the energy sector where exposure went from 16 per cent in the early 1960s to 30 per cent following OPEC’s trade restrictions in the mid-to-late 1970s. Energy fell to 5 per cent of the index in the early 2000s when technology spiked to 33 per cent. When oil spiked above $140 in 2008, energy again jumped to 16 per cent and currently sits at about 7 per cent. The market cap index at the mercy of sector changes while the maximum diversification factor avoids this problem. The TOBAM methodology adjusts for this in their process.

The ETFs were launched on Sept. 8, 2016 and they have an average MER is 60 bps. They fall on the expensive side of the smart ETF index, but they have tremendous promise for helping investors navigate the next phase of the cycle. The MER should not be the main criteria in using the ETFs. Due to their maximum diversification methodology, they will further help reduce overall volatility when combined with other factor strategies we have discussed in recent weeks.

MEU – Maximum diversification Europe

MUS - Maximum diversification U.S.

MWD - Maximum diversification World

MKC - Maximum diversification Canada

MXU - Maximum diversification World (x-North America)

They also have some fixed-income versions of the strategy, which also look promising.

This will be my last show for 2016, but I will pick up on the topic again in January as I continue my current educational speaking tour across Canada. Learn how to be a smarter investor in our seventh season across Canada speaking tour. Free registration at www.etfcm.com. Help us raise money to fight Cancer and Alzheimer’s by making a voluntary donation with your registration. Over the past few years, Berman’s Call roadshows have raised over $175,000 for charity thanks to BNN viewers and our sponsors.