Feb 8, 2021

Larry Berman: What is volatility telling us about the markets?

By Larry Berman

Larry Berman's Market Outlook

This week in the ongoing rollout of the Probable Return on Investment Index, PRO-II I want to focus on two aspects in regards to volatility:

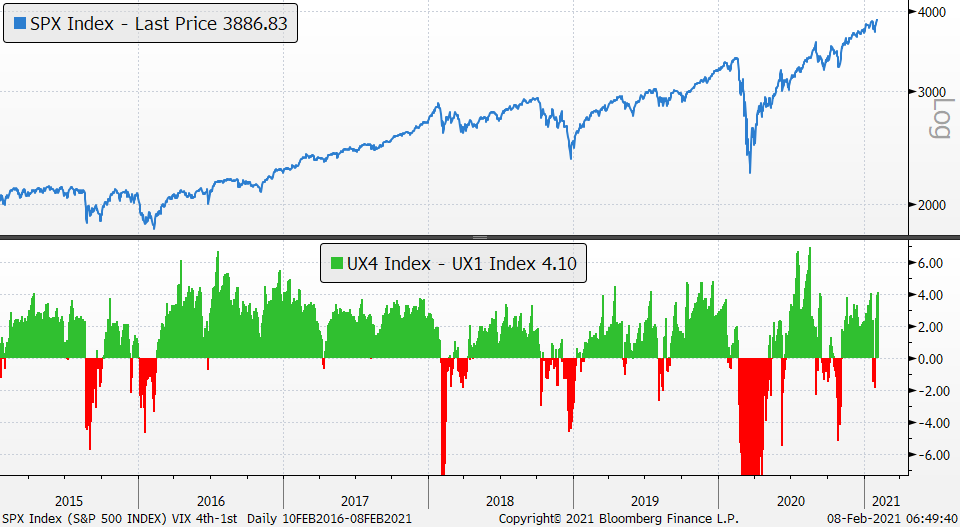

- Expectations for volatility for the next month vs. the expected volatility four months from now.

- The current level of volatility relative to recent trends (specifically, quarterly average)

Last week these indicators showed signs investors should be concerned, as current volatility spiked relative to expectations for where it will be a few months from now. This week the forward curve is back to normal levels. A period of higher risk did not develop this time. But, historically, when the volatility curve inverts, it tends to bring the markets closer to a buying opportunity.

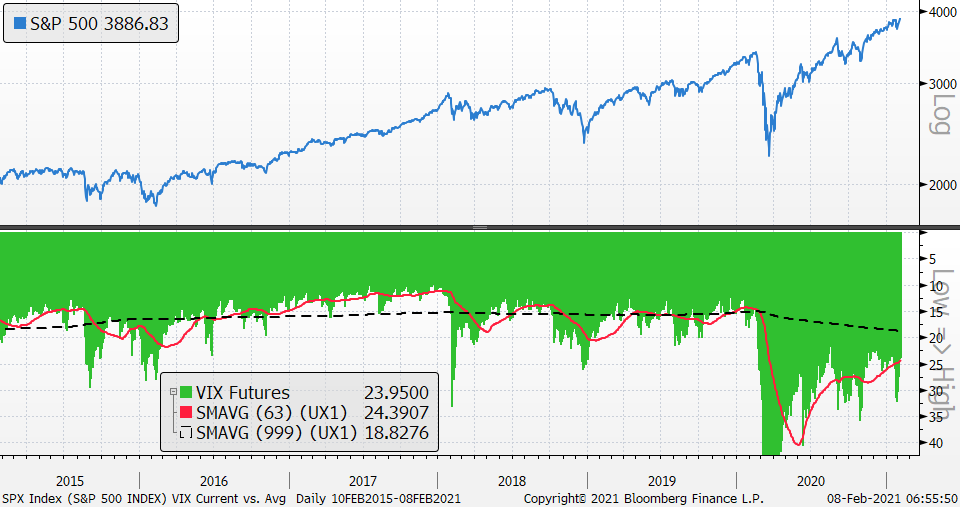

Volatility is keeping overall levels elevated and suggests the quality of the market rally is of much higher risk than just looking at the new price highs would suggest. Considering stocks are at all-time highs, one would think volatility would be close to all time lows, which is the norm, as seen in the 2017 rally.

The fact that volatility remains elevated overall speaks to the more speculative nature of the current market environment. When does the asset bubble that central banks have created pop? When they stop inflating it with stimulus I would suspect. That does not appear to be happening any time soon.

The very long-term average volatility reading (VIX) is in the 15-18 range, in line with the annual 100-year standard deviation of returns. The black dashed line on the chart below shows that longer-term four-year average. Additionally, the VIX futures level is inverted, as evidenced by the green lines, contrasted with the three-month average of the VIX in red.

In 2017, during the rising market, the average VIX was well below the historic number. When the Fed started to raise rates in 2018 following the passage of U.S. President Donald Trump’s substantial tax cut bill, the average level of volatility began to increase. It is still far from a normal healthy volatility level. Market-makers are demanding much higher risk premiums both on both the call and put sides.

It’s truly a remarkable situation. It speaks volumes to the moral hazard the central banks have created to reflate asset markets. Any hint of them raising rates or backing away from stimulus may be the next signal that the bubble is about to break.

We will be launching the new PRO-II website soon so that BNN Bloomberg viewers can follow along with the various risk and opportunity factors we follow.