Jun 2, 2020

Latest Satoshi Nakamoto Candidate Buying Bitcoin No Matter What

, Bloomberg News

(Bloomberg) -- Adam Back’s name has surfaced again in the crypto community’s favorite guessing game: Who is the anonymous creator of Bitcoin who went by the pseudonym Satoshi Nakamoto.

In mid-May, YouTube channel Barely Sociable, with nearly 400,000 subscribers, released a 40-minute video claiming that 49-year-old Back is Satoshi. The video has since raked up nearly 300,000 views.

Back does check off a lot of the boxes: He is a British cryptographer with a PhD in computer science, who, back in the 1990s, invented Hashcash, a system of verification that Bitcoin uses. He is also the first person Satoshi contacted online in 2008, asking about Hashcash. So is he Satoshi?

“No, I am not,” Back said in a June 1 phone interview from Malta. But he also pointed out it’s better for the creator of the world’s largest cryptocurrency to remain a mystery.

“It’s generally viewed at this point as better that the founder of Bitcoin is not known, because a lot of people have a hierarchical mindset,” Back said. “If you read about a technology, you try to figure out who is the CEO of a company, and people want to ask questions. Because Bitcoin is more like a digital gold, you wouldn’t want gold to have a founder. For Bitcoin to keep a commodity-like perception, I think it’s a very good thing that Satoshi stays out of the public.”

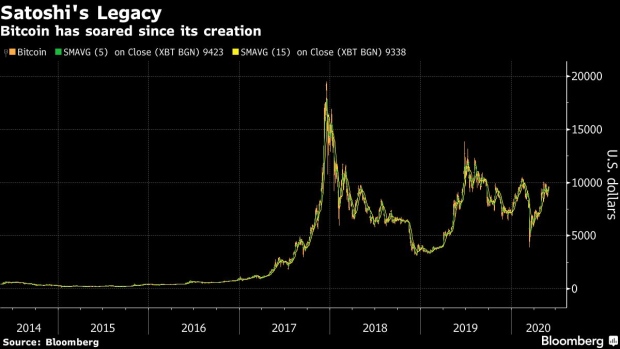

Satoshi is believed to hold more than 1 million Bitcoins, currently valued at about $10 billion, but the anonymous creator hasn’t been heard of in about five years.

For his part, Back remains a huge Bitcoin believer. He is the chief executive officer of Blockstream Corp., which sells equipment to support Bitcoin-related operations, and also helps others -- Fidelity Investments and investor Reid Hoffman among them -- mine Bitcoin. Back also mines Bitcoin -- only Bitcoins -- personally, and he keeps what he mines.

“I don’t sell them,” he said.

One reason is, Back believes Bitcoin will go to $300,000 from the current approximate price of $10,000 within five years -- without any additional adoption by institutional investors. Retail investors, who’ve carried the torch for the last 10-plus years, since Bitcoin’s debut, will continue to show support as institutions remain cautious, he said.

“It might not require additional institutional adoption because the current environment is causing more individuals to think about hedging,” Back said. “And retaining value when there’s a lot of money printing in the world.”

With more people working from home amid the Covid-19 epidemic, real-estate investments are more risky, he said. Bonds may be overvalued. And so some investors may be turning to Bitcoin, even though it too could see some headwinds as more people lose jobs, he said.

“It is causing people to think about the value of money and looking for ways to preserve money,” Back said. “It’s a difficult environment to get any yield.”

One reassuring sign of demand is that Grayscale Investments alone has bought more Bitcoin in the past few weeks than the amount of new coins that has been mined, Back said.

Among institutional investors, Bitcoin is still largely misunderstood, he said, pointing to last month’s take from Goldman Sachs Group Inc., which said the coin is “not a suitable investment for our clients.”

“The Goldman report was interesting because it showed some misunderstandings about digital scarcity and what’s useful about Bitcoin,” Back said. “It indicates it’s still early in terms of the adoption curve. You have a major sophisticated market player like that with unclear understanding of the value. To me that indicates there’s still a lot of headroom for price appreciation and adoption in the market.”

To prepare for, and to rev up this adoption, Blockstream has garnered $90 million to date from investors including Khosla Ventures and Digital Currency Group, and may be looking to raise more funds to expand its mining capacity, among other things, he said.

Even with the denial, Back hasn’t been able to avoid being caught up in the borderline obsession with who actually created Bitcoin. In April, Australian Craig Wright, who claims that he is Satoshi, abandoned a defamation lawsuit against Back, and had to pay his legal fees. Back was sued because he has the nerve to say Wright is not Nakamoto.

©2020 Bloomberg L.P.