Jan 22, 2021

Latest Turkish Loan Revamp Plan Ensnares $730 Million Hospital

, Bloomberg News

(Bloomberg) -- A consortium that won a contract to build and operate a 600 million-euro ($730 million) hospital in Turkey is gearing up to restructure loans after bouts of lira weakness forced construction delays.

The venture, in which Samsung C&T Corp. is the biggest shareholder with a 26.5% stake, is in the process of choosing consultants to first help resolve governance issues among the partners and then to manage talks with creditors, according to people with knowledge of the matter.

The group is looking to renegotiate loans totaling 483.5 million euros that were used to fund the project, said the people, who asked to remain anonymous because the matter isn’t public.

The goal of a possible restructuring would be only to extend the maturity of the existing loans, while avoiding new borrowings, they said. The consortium also consists of Italy’s Webuild SpA, Kayi Insaat AS and Actus Asset Management, each of whom controls 24.5%.

Webuild, previously Salini Impregilo, and Actus declined to comment. No one at Kayi Insaat was available to comment. A Samsung C&T spokesperson only said that there have been no discussions on specific details related to the Turkish project.

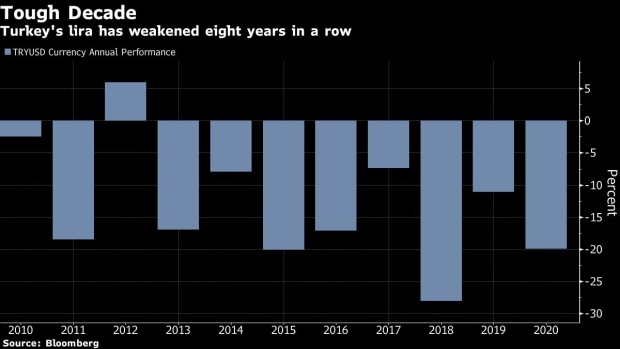

The lira took a nosedive last year, stabilizing only after President Recep Tayyip Erdogan cleared out his economic management team in November. Still, a depreciation of about 20% against the dollar in 2020 made foreign-currency debt more expensive in lira terms, forcing many Turkish businesses to restructure credit.

The coronavirus pandemic also contributed to a wave of debt reorganizations as banks stepped in to help customers hit by the fallout from lockdown measures.

As the lira’s downswing ripped through the Turkish economy, it led to construction delays at some of the 17 hospital projects started since 2015, developed under a private-public-partnership model at a total cost of $10 billion. The government extended guarantees for the loans and provided medical staff, while private companies pledged to supply non-medical equipment and services over the course of 25-year contracts.

The Samsung C&T-backed group signed the 18-year loan deal in 2016 with lenders including Export-Import Bank of Korea and the European Bank for Reconstruction and Development among others, according to data compiled by Bloomberg. The hospital in the southern city of Gaziantep will have 1,875 beds and is expected to be completed this year, according to the Health Ministry.

Another consortium, made up of Gama Holding AS and Turkerler Insaat AS, in December restructured a total of 900 million euros of debt, which was used to build hospitals in Izmir and the northwest city of Kocaeli.

Boston-based General Electric Co. has a stake of around 10% in the venture. The hospitals have a total investment value of nearly 1.2 billion euros, according to Gama Holding’s website.

Turkerler and its international partner Astaldi SpA -- which was taken over by Webuild -- reached a restructuring deal with lenders for 883 million euros of debt for another hospital project in Ankara’s Etlik district, adviser EY Turkey said on Tuesday.

The Etlik hospital will have around 3,600 beds when completed, and is one of the largest of hospitals constructed under the PPP model.

©2021 Bloomberg L.P.