Mar 24, 2023

Latin America Sees Return of Chinese Bank Lending After Covid Pause

, Bloomberg News

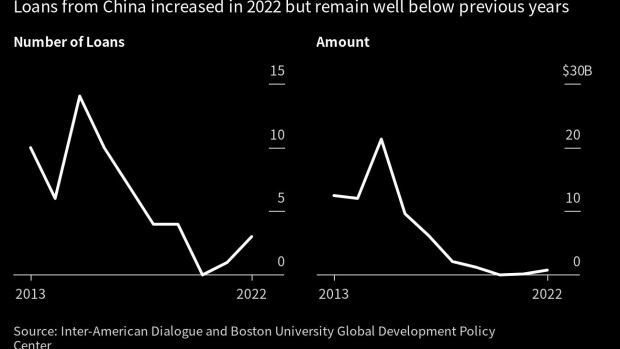

(Bloomberg) -- Latin America is again becoming a destination for Chinese loans, after the Covid-19 pandemic had zeroed such deals in a region where state-run banks of the Asian giant have issued some $136 billion of debt.

Brazil, Barbados and Guyana received a total of $813 million from China Development Bank and the Export-Import Bank of China last year, according to a report published Friday by US-based think tank Inter-American Dialogue and Boston University. While far short of what they were lending a decade ago, the new deals — focused on social and infrastructure projects — are a sign that the banks are re-engaging in the region.

China is focusing more on a geopolitical approach to how it issues debt, said Margaret Myers, a director at the Inter-American Dialogue and fellow at the Woodrow Wilson Center, who wrote the report with Rebecca Ray, a researcher at the Boston University Global Development Policy Center.

“There has been a reassessment both on the part of the Chinese government and within the banks themselves of how to do business,” Myers said.

The approach is a drastic change from the previous era. In 2010, China Development Bank alone issued more than $35 billion in loans to the region. Many of the banks’ deals — including some of the $60 billion it sent to Venezuela — ended up in drawn out restructurings. The lenders are still in talks on debts accrued by Ecuador, Argentina and Suriname, and may face fresh negotiations with Costa Rica and Guyana, according to the report.

Lending to the region stopped altogether in 2020 during the Covid-19 pandemic. They made one loan in 2021, for Trinidad and Tobago to buy vaccines and medical equipment. In the past year, the banks lent to Banco do Brasil SA, and the governments of Barbados and Guyana.

Latin American and Caribbean nations are managing an increasingly challenging balance between measuring China’s geopolitical and economic interests, their own needs and reactions from the US, Myers said. At the same time, governments in the region are weighing large debt obligations against a need for more capital to stimulate growth at a time the global economy seems on shaky ground.

“For some of the region’s more debt-burdened economies, even low-interest Chinese loans could be problematic,” the paper read.

©2023 Bloomberg L.P.