Jul 11, 2022

Leveraged ETFs Betting Against US Stocks Draw in $1.4 Billion

, Bloomberg News

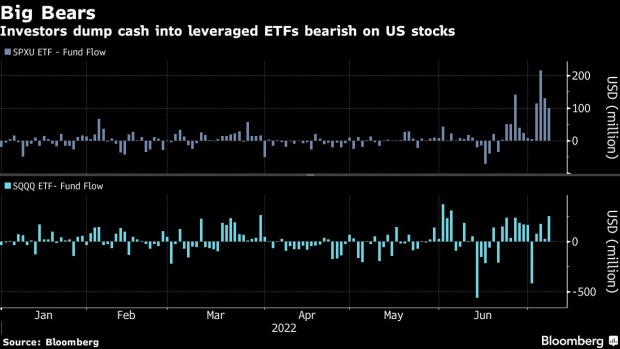

(Bloomberg) -- Traders are piling into exchange-traded funds that bet against US stocks as the risk of recession and disappointment from the upcoming earnings season bolsters bearish sentiment in the market.

Investors added a net $247.5 million to the ProShares UltraPro Short QQQ ETF (ticker SQQQ) in the latest session tracked by Bloomberg. This was the biggest one-day increase in over a month for the fund -- which is a bet against the tech-heavy Nasdaq 100 -- and the fourth straight day of inflows, which totaled roughly $518 million.

The bearish bets reach beyond just technology stocks. The $1.6 billion ProShares UltraPro Short S&P 500 ETF (SPXU) has roughly doubled in size since the beginning of June. Investors have poured cash into the fund for 12 straight sessions, with flows totaling $875 million over that time span.

“People are getting more bearish,” said Steve Sosnick, chief strategist at Interactive Brokers Group Inc. “It is sensible to think that aggressive traders would shift their focus to hedging or speculating on the downside.”

SQQQ seeks investment returns that correspond to three times the inverse of the daily performance of the Nasdaq 100 index. While the Nasdaq 100 has slumped roughly 27% year-to-date as rising interest rates batter growth prospects for technology stocks, SQQQ has soared over 77%. SPXU, which tracks three times the inverse daily performance of the S&P 500, is up 53% in 2022, compared to the US equity benchmark’s 19% slump.

Price pressures from the highest US inflation in decades, a wave of monetary tightening and the risk of a slowing global economy continue to keep investors bearish, even after an $18 trillion first-half wipeout in global equities. Morgan Stanley’s chief US equity strategist forecasts the S&P 500 could fall to 3,000 in a recession. That’s a 22% downside from current levels.

“Buying the dips hasn’t been working. And when it has worked, it’s generally been for a short period of time. Smart traders adapt if they want to stay in the game,” Sosnick said.

©2022 Bloomberg L.P.