Oct 7, 2022

LG Energy Profit and Sales Easily Beat Forecasts on EV Demand

, Bloomberg News

(Bloomberg) -- LG Energy Solution Ltd.’s operating profit was 522 billion won ($369 million) in the three months through September, comfortably beating expectations as demand for electric vehicles and a weak Korean won offset high commodity prices.

Analysts had on average expected operating profit of 372 billion won for the battery maker. Sales rose 90% to 7.7 trillion won, Seoul-based LG Energy said, also beating the 6 trillion won average forecast. The company posted a loss in the same quarter last year.

LG Energy’s shares rose 0.9% before the results, which were preliminary and released after the Korean stock market closed Friday. That took their gain in a holiday-shortened week to 13%. The company has yet to announce a date for final results.

The strong quarter came despite challenges that LG Energy has faced since its initial public offering in January, with the whole industry battling supply-chain disruptions and rising raw material prices. There are some concerns about the strength of EV sales: Tesla Inc. issued a disappointing deliveries report this week, interest rates are rising and used-vehicle sales are weakening, a sign that new-car sales could take a hit too.

Toyota’s CEO Says EV Adoption Will Take Longer Than Expected

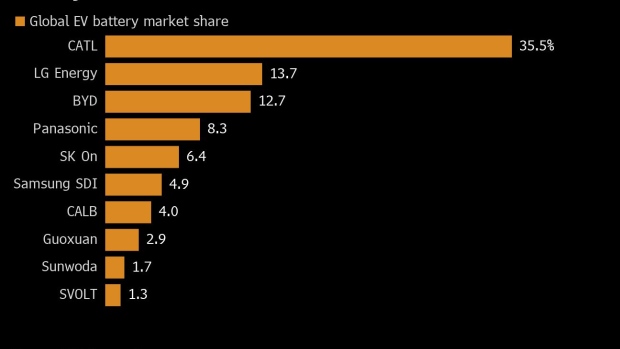

LG Energy also became entangled in a trade dispute between Washington and Seoul over a US clean-energy law aimed at reducing EV makers’ dependence on Chinese minerals. South Korea’s three battery manufacturers -- LG Energy, Samsung SDI Co. and SK On Co. -- secure most of their minerals from Chinese suppliers.

Still, the US law could eventually be an opportunity for LG Energy because its supply chain is more diversified than rivals, Jeon Hyeyoung, an analyst at Daol Investment & Securities in Seoul, wrote in an Oct. 4 note.

Foreign investors have bought net 619 billion won of LG Energy shares since Aug. 8, when the US Senate passed the bill, making it the most favored stock on the benchmark Kospi.

The Korean won weakened about 9% against the dollar during the quarter.

Jeon said LG Energy’s outlook should be positive as production at Tesla’s Shanghai plant, which it supplies, has accelerated since September, while its Ultium Cells LLC joint venture with General Motors Co. is starting pilot production of batteries in the fourth quarter.

©2022 Bloomberg L.P.