Feb 5, 2019

Lifeless U.S. Treasury market needs a jolt from the pile of parked cash

, Bloomberg News

Across U.S. interest-rate products — from cash Treasuries to futures to eurodollar options — indications abound that conviction is in short supply. With the Federal Reserve in transition from hiking to pausing and no clear direction in market rates, investors and traders appear to expect narrow ranges to persist.

Positioning data from the U.S. Commodity Futures Trading Commission is still delayed in the wake of the U.S. government’s partial shutdown. But several corners of the market are signaling that money is waiting on the sidelines.

CASH

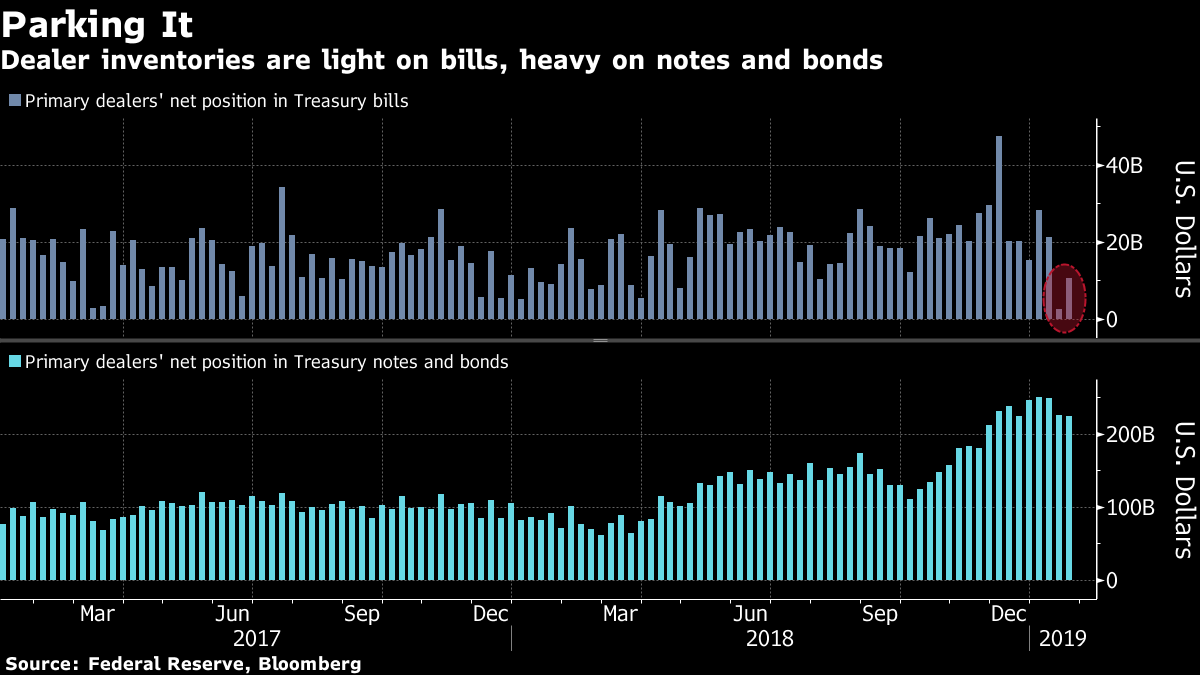

Primary dealer holdings of U.S. Treasury bills this month plunged to a three-year low, according to New York Fed data, suggesting that customers, in response to the Fed’s shift into neutral, want to park cash in risk-free assets.

Over the same period, primary dealer holdings of U.S. Treasury notes and bonds ballooned to over US$200 billion, outpacing the growth in Treasury supply and suggesting investment managers have limited appetite for risk further out the curve. The 10-year note’s yield at about 2.70 per cent is not too far above the middle of its 25-basis-point range year-to-date.

INVESTMENT-GRADE BONDS

Fund managers appear to be gravitating toward investment-grade credit for their duration needs instead. Order books for new issues have been notably strong, a sign of pent-up demand. Four issuers priced US$5.7 billion of new debt on Monday, against expectations of US$20 billion for the week; Tuesday’s slate includes US$1 billion from Verizon Communications (VZ.N), and Altria Group (MO.N) is marketing a jumbo offering in euros and dollars.

FUTURES AND OPTIONS

CME Group Inc. (CME.O) open interest data since the turn of the year suggest aversion to entering short positions in U.S. Treasury futures. Rallies have coincided with increases in open interest, and selloffs with declines, indicative of an expectation that yield ranges will hold. On Monday, as 10-year yields climbed nearly four basis points, futures open interest declined by almost 50,000 contracts.

In listed options, heavy selling of front-end eurodollar straddles based on a neutral Fed scenario has led to notable cheapening of short-dated volatility structures. Overnight indexed swap rates price in very little policy action from the Fed this year, followed by a shift toward rate cuts in 2020.