May 12, 2022

Lira Drops as Turkish State Bank Dollar Sales Fail to Stem Slide

, Bloomberg News

(Bloomberg) -- Sign up for our Middle East newsletter and follow us @middleeast for news on the region.

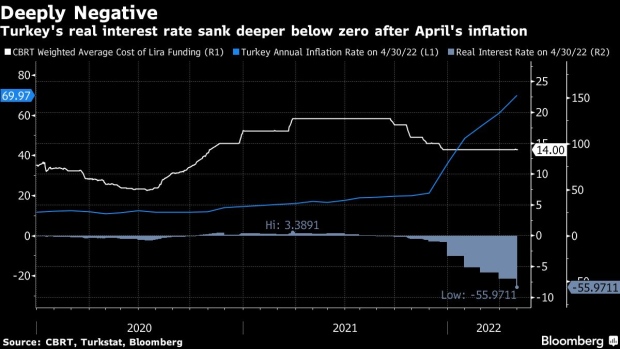

Turkey’s lira extended declines for a sixth day, despite heavy selling of dollars by state lenders in recent days, as rising US yields and deeply negative domestic real interest rates spur investors to dump the currency.

The lira dipped 0.5% to 15.3923 per dollar as of 12 p.m. in Istanbul, extending declines since the end of the Eid holiday on May 5 to more than 4%. The currency is down 13.5% this year, the worst performer among its emerging-market peers.

State lenders sold around $5 billion in the last six trading days, according to an estimate of traders who asked not to be identified because they’re not authorized to speak publicly. That failed to stem the lira’s decline as concern about soaring inflation at home and the impact of rising interest rates on global growth, combined with the war in Ukraine and Covid lockdowns in China, pummel riskier assets.

State banks don’t comment on their interventions in the foreign-exchange market, but a former Turkish central bank governor said in 2020 that government-owned lenders carry out transactions in line with regulatory limits and may continue to be active in the currency market.

While government efforts to protect the currency, including FX-indexed deposit accounts, are providing support, deeply negative real rates and concerns over a widening current account deficit are also adding to pressure amid uneven capital flows.

Interventions by the state lenders resulted in a shortage of lira liquidity offshore, spurring wild volatility in the cost of overnight funding that has lurched from 5% to as high as 160% this week.

Market Metrics

- 10-year benchmark lira bond yield +8bps to 25%

- 5-year CDS +8 bps to 695bps

- Borsa Istanbul 100 Index -1.5% to 2,415.21

- U.S. Treasury 10-year bond yield -8bps to 2.83%

- Brent crude -2% to $105.40 per barrel

What to Watch:

Key News:

- Major China Developer Sunac Defaults as Debt Crisis Spreads

- TURKEY DAYBOOK: Minister Meets Industrialists, Capital Flows

- Ruble Surpasses Brazil’s Real as Year’s Best-Performing Currency

- Qatari Investor Acquires McDonald’s Operations in Turkey

- Turkey April Cash Budget Deficit Widens to TRY43.7b

- Carrefour Applies to Make 3.83m CarrefourSa Shares Tradeable

©2022 Bloomberg L.P.