Aug 19, 2019

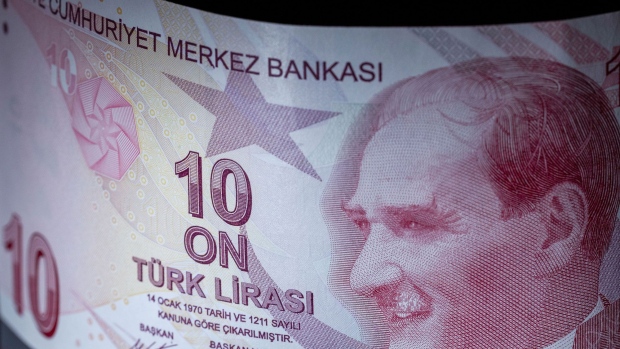

Lira Extends Fall as Reserve Measures Compound Risk-Off Rout

, Bloomberg News

(Bloomberg) -- Turkey’s lira declined the most in the world after the nation’s central bank announced new reserve requirements that will loosen monetary conditions, adding to negative sentiment that dragged most emerging-market currencies down.

The lira weakened as much as 1.5% to 5.6638 per dollar, wiping out this month’s advance, after the policy maker set reserve rules that will inject about about 5.4 billion liras ($957 million), and $2.9 billion of gold and foreign-currency liquidity into the market.

The regulatory change determines the amount of cash lenders have to put aside as reserves depending on how much credit they extend. It comes just weeks after the policy marker slashed its benchmark borrowing costs by a record 425 basis points.

The lira is the only gainer across developing nations so far this quarter and some traders said the currency may have been due for a correction.

To contact the reporter on this story: Dana El Baltaji in Dubai at delbaltaji@bloomberg.net

To contact the editors responsible for this story: Justin Carrigan at jcarrigan@bloomberg.net, Constantine Courcoulas, Alex Nicholson

©2019 Bloomberg L.P.