Sep 30, 2020

Lira’s September Swoon Is No Problem for Turkey Stock ETF Flows

, Bloomberg News

(Bloomberg) -- The Turkish currency may have plunged to successive record lows in September, but the country’s stocks still managed to attract support from investors who flocked to the largest exchange-traded fund focused on Istanbul equities.

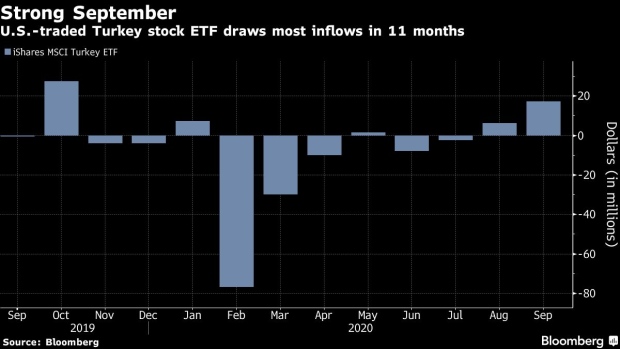

Investors have poured $17.1 million into the New York-traded iShares MSCI Turkey ETF in September, setting it up for the strongest month of flows since October 2019. The benchmark Borsa Istanbul 100 Index has climbed 5.2%, the fourth-best performance this month among 93 major gauges tracked by Bloomberg.

The biggest boost for the ETF came in the week that preceded a surprise central bank rate increase on Sept. 24, when the fund drew $14.1 million of inflows. The rate move and a separate relaxation of curbs on foreign exchange swaps followed a slump in the lira to its lowest-ever value against the U.S. dollar, and the decisions triggered a surge in Turkish banking stocks.

The surge in flows that week suggests that some investors anticipated action by policy makers, as they expected the weakening lira to “prompt an answer,” according to Mathieu Racheter, an emerging-market strategist at Bank Julius Baer in Zurich. “So they may have wanted to get ahead of others instead of waiting for the real step.”

The rate increase, coupled with the banking watchdog easing the limits on lenders’ foreign currency transactions and lowering the asset ratio, all point to “a better environment for banks, which make up a large part of the MSCI Turkey index,” Racheter said.

Hedge Fund Wager

The flood of cash into the ETF contrasts with the general pattern set by investors in 2020, which has seen foreigners sell $5.6 billion in Turkish equities in the first nine months. The outflows are already the most for any year since records began in 2005, and the share of Turkish stocks held by non-residents has dropped below 50% for the first time since 2004.

That explains why some money managers may react with caution to news of a spurt of buying.

“The Turkish market is very thin and any foreign hedge fund or local player can move the market significantly,” said Anastasia Levashova, a fund manager at Blackfriars Asset Management in London. “ETF shares mostly tend to mimic the moves in the banking stocks though, so it is a clear move of someone buying the ‘most under-owned assets’ in global emerging markets,” she said in emailed comments.

Levashova suggested that the market participant driving inflows into the iShares MSCI Turkey ETF was most likely “a hedge fund that’s taking a contrarian bet on the nation’s stocks along with a parallel hedge in the Turkish currency.”

The lira has slid 5.5% against the dollar this month as a flare up in tensions between Azerbaijan and Armenia increased geopolitical risks, the worst performance among emerging-market currencies. The Borsa Istanbul Banks Index, meanwhile, is still up 3.8% and on course for its best month since June.

©2020 Bloomberg L.P.