Dec 2, 2021

Lira Wipes Out Central Bank-Fueled Rally as Minister Is Replaced

, Bloomberg News

(Bloomberg) --

Any chance that the Turkish central bank’s first lira intervention in seven years would shore up the currency has been blown away by President Recep Tayyip Erdogan’s latest ministerial change.

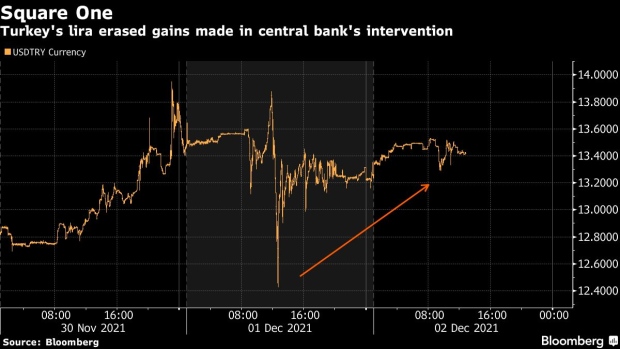

The currency weakened as much as 2.1% Thursday, erasing all the previous day’s gains, after Erdogan replaced the country’s Treasury and Finance Minister Lutfi Elvan amid a growing rift over interest-rate cuts. The central bank sold dollars on the open market Wednesday for the first time since 2014, briefly helping to stem a selloff that has seen the lira depreciate almost 45% this year.

“The trajectory is unsustainable,” said Cristian Maggio, head of portfolio strategy at TD Securities in London. “The market cannot be stopped from doing its job, and other players that have no interest in speculating activity cannot be stopped from trying to hedge their risks.”

Untroubled by data showing inflation running close to 20%, Erdogan has recently intensified calls for lower borrowing costs. The central bank, led by Sahap Kavcioglu, has responded, enacting a cumulative 400 basis points of rate cuts since late September, during which time the lira has depreciated more than 36%, by far the biggest retreat in emerging markets. The currency rallied as much as 8.5% after the central bank intervention, before resuming its declines Thursday.

The worry for investors is that the departure of Elvan, who had opposed rate cuts, will further diminish the likelihood of a quick return to orthodoxy. His replacement, Nureddin Nebati, 57, has been a deputy finance minister since 2018 and is perceived to be close to former economy czar Berat Albayrak, a son-in-law of Erdogan.

The change “further reduces already low probability that the Erdogan administration will make a pivot toward orthodox policies,” said Piotr Matys, a senior currency analyst at InTouch Capital Markets Ltd. in London.

Central Bank Call

Kavcioglu said in an analyst call on Thursday that “excessive” currency volatility is undesirable. The impact of current monetary policy will be seen in the first half of next year, a senior official with direct knowledge of his remarks cited him as saying. Inflation is expected to decelerate because current price increases are transitory, he said.

Some of the inflationary impact may fade over the next year, but the question remains as to what will happen going into the second half of 2022, according to Ima Sammani, a foreign-exchange analyst at Monex Europe.

If the turnaround that Erdogan is hoping for doesn’t materialize, “there will be sustained lira pressure and higher inflation, which will eventually force the Turkish central bank to hike rates again or use more unconventional ways to tighten policy,” she said.

©2021 Bloomberg L.P.