Sep 22, 2021

LNG Suppliers Focus on Spot Deals in Price Jump, Gail India Says

, Bloomberg News

(Bloomberg) -- Liquefied natural gas suppliers are limiting the volume they deliver under long-term contracts in favor of higher-priced spot sales, according to GAIL India Ltd., a major LNG buyer.

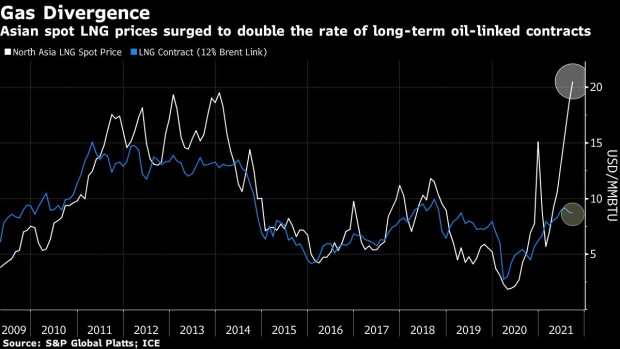

Spot LNG prices surged to a seasonal record as buyers in Asia and Europe scramble to secure supplies to avoid a looming winter supply crunch. By contrast, long-term supply accords, typically linked to oil prices and with contracted delivery volumes, are now less than half the rate in the spot market.

“Suppliers are trying to limit the supply, the long-term quantities, to get a better price in the spot market and send it elsewhere,” E S Ranganathan, director for marketing at GAIL, said in an interview. “We had to buy spot cargoes at a higher price.”

Gail has to buy spot LNG in order to meet supply contracts with its own customers, even as India’s import needs are typically 80% covered by long-term supplies. As the country’s power demand has increased, the need for gas is rising, too. But soaring prices have also spurred the need to switch to alternative fuels such as naphta, affecting energy-intensive industries such as ceramics and glass.

“Power companies want more gas,” Ranganathan said on the sidelines of Gastech, a major industry conference in Dubai, on Wednesday.

There isn’t currently a risk of blackouts and customers are paying for their supply, improving margins for GAIL, he said.

GAIL is considering a new LNG supply contract for five to eight years, seeking a price linkage to Brent oil. Those terms will likely rule out a U.S. supplier, as American LNG is mainly linked to the local Henry Hub gas benchmark. In addition, the shipping distance is longer and U.S. suppliers prefer deals of 10 years or longer.

GAIL’s current supply is about 60% oil-linked and 40% Henry Hub-linked, according to the executive.

“We are on the lookout,” he said. “For us, Brent is the best because our customers also prefer Brent.”

©2021 Bloomberg L.P.