Fancy Apartment Rentals for Paris Olympics See Poor Demand and Price Cuts

Locals who’d hoped to turn a big profit by renting out their posh apartments are now slashing prices by 30%-60%.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Locals who’d hoped to turn a big profit by renting out their posh apartments are now slashing prices by 30%-60%.

The kingdom must overcome a conservative image and concern about human rights. Visit the desert oasis town of AlUla to understand the challenge.

Jury selection was completed Friday for Donald Trump’s first criminal trial, setting the stage for opening arguments Monday in a New York case accusing the former president of falsifying business records to conceal a sex scandal before the 2016 election.

Higher-than-expected interest rates amid persistent inflation are perceived as the biggest threat to financial stability among market participants and observers, according to the Federal Reserve.

Fifth Third Bancorp jumped the most in four months, leading bank stocks higher, with Chief Executive Officer Tim Spence predicting that income from lending has bottomed out.

Dec 23, 2020

, Bloomberg News

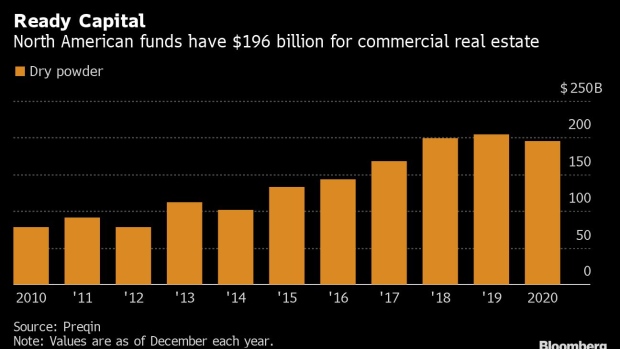

(Bloomberg) -- Private credit funds, sitting on $196 billion for U.S. commercial real estate deals, are poised to pounce as struggling property owners seek loans to ride out the pandemic.

About $430 billion in commercial and multifamily debt, more than half of which is held by banks, is maturing in 2021, with fresh capital needed to head off a tsunami of defaults.

Read more: Commercial Real Estate Set for Pain With $430 Billion Coming Due

As banks look to unload shaky debt and owners of struggling offices, hotels and retail properties resist selling at distressed prices, private credit funds are expecting a busy 2021, with plenty of opportunities to put capital to work.

“At the 30,000-foot level, it’s that capital need that’s going to draw a lot of demand for debt,” said Jonathan Pollack, global head of real estate debt strategies for Blackstone Group Inc., which raised a record $8 billion for a debt fund that closed in September.

Commercial real estate sales plunged 40% this year through November, led by a 72% drop in hotel transactions. The market remains frozen in large part because buyers and sellers of buildings are far apart on price, according to Real Capital Analytics Inc.

Private credit fund managers anticipate a pattern similar to the global financial crisis, when distressed debt began changing hands one or two years before buying opportunities emerged.

Madison Realty Capital, a New York-based private equity lender with $5.6 billion in assets under management, is among the firms offering new debt to struggling borrowers after acquiring their troubled loans from banks and other lenders.

“In the last 90 days, I’ve had lots of dialogue directly with banks and debt funds in terms of loan sales,” said co-founder Josh Zegen. “We’ve executed on some of it, but I see a lot more going into the first and second quarters of 2021.”

Runway Ends

New debt financing for distressed properties can generate returns of 10% to 12% for lenders, according to Russell Gimelstob, chief executive officer of Ascendant Capital Partners, a Los Angeles-based finance firm with $20 billion in investments.

Read more: Commercial Property Prices Jump With Distressed Deals on Hold

That’s less than the potential returns for directly acquiring distressed properties, but those deals will remain scarce until current owners run out of money or lenders run out of patience. That could take at least another year.

“We think equity and real estate trades are going to be more prevalent when the runway ends,” Gimelstob said.

Debt can be a path to acquiring properties at a discount, with lenders positioned to foreclose and assume ownership when borrowers default. Legal actions in New York courts to seize property from delinquent borrowers have already begun, led by “the loan-to-own guys and the loan-we-don’t-mind-owning guys,” Neil Shapiro, a real estate attorney with Herrick Feinstein LLP, said.

“I’d expect, like every other cycle, that these actions will accelerate because this stress will have been going on more than a year,” he said.

Bank Void

Private capital is filling a void left by traditional lenders. Commercial real estate loan originations by banks fell 68% in the third quarter from a year earlier, according to the Mortgage Bankers Association. Banks, which hold $1.5 trillion in commercial and multifamily debt, have also been slow to shed delinquent loans. So far, regulators have allowed them to delay recognizing nonperforming debt.

The fiscal relief bill passed by Congress gives them another year to account for those potential losses, extending the deadline until Jan. 1, 2022.

Read more: Deutsche Bank Selling $814 Million in Commercial-Property Loans

The lack of distressed loans coming to market so far has surprised Kingsley Greenland, CEO of the Debt Exchange, who said about $700 million has come up for auction on his platform in the second half of 2020, little changed from the pre-pandemic volume. But now, there are more buyers.

“It’s a classic demand exceeds supply scenario and it pushes up prices,” Greenland said. “It’s a seller’s market.”

©2020 Bloomberg L.P.