Apr 29, 2020

Loblaw sees fleeting stockpiling boost, Q1 sales surge

, Bloomberg News

Q1 food sales surge at Loblaw

Loblaw Cos., Canada’s biggest grocer, saw a sales and income surge in the first quarter as shoppers stockpiled supplies due to the coronavirus but the effect was limited. Costs to fight the pandemic also piled up.

The Toronto-based owner of the Loblaws grocery chain and Shoppers Drug Mart pharmacies reported revenue soared almost 11 per cent to $11.8 billion from the same period the year before, according to a statement Wednesday. Adjusted net income increased about 12 per cent to $1.2 billion while diluted net earnings were $0.97 per share, up 24 per cent. An estimated $0.14 of that was attributed to the COVID-19 effect.

“Loblaw’s response and costs related to COVID-19 have accelerated following the end of the quarter, putting pressure on the business,” Loblaw Chief Executive Officer Galen G. Weston, part of one of Canada’s riches families, said in the statement. Uncertainty over the outlook make reliable estimates for the rest of the year “impossible.”

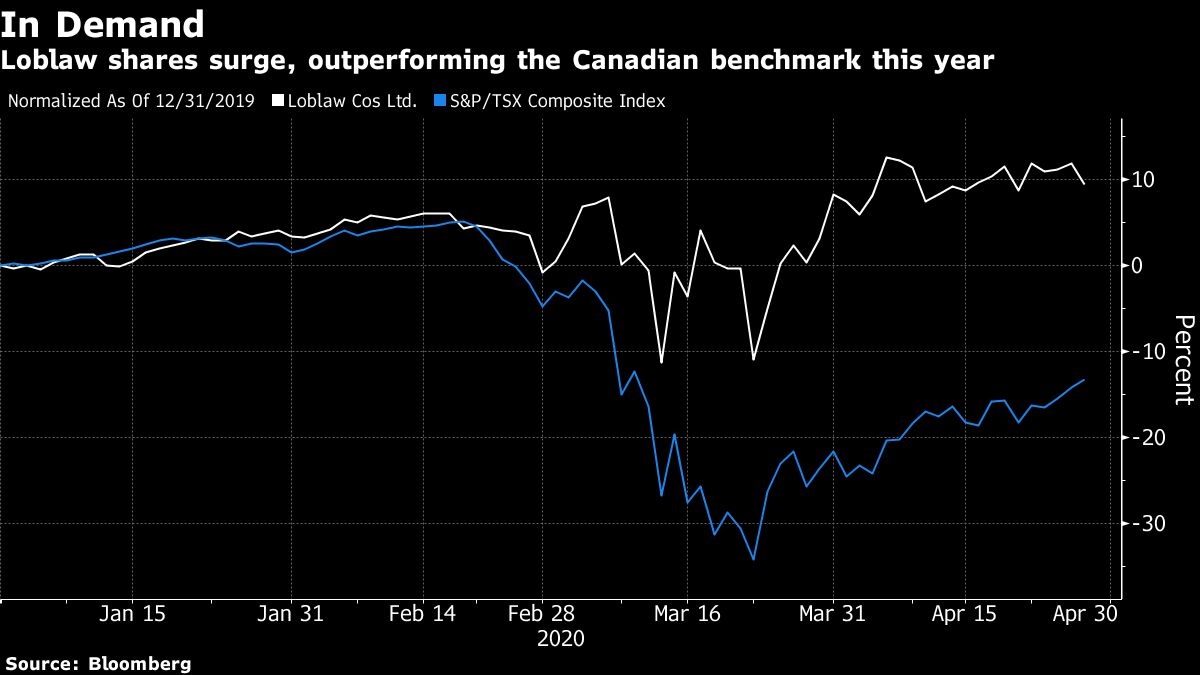

Loblaw shares fell three per cent to $71.83 at 10:36 a.m. in Toronto, even as the company also announced it would buy back up to 17.9 million shares or about five per cent of its outstanding float. The shares are up 7.1 per cent this year.

The company estimates that additional investments related to additional staffing, cleaning, security and temporary pay premiums, are running at approximately $90 million.

Food retail same-stores sales rose 9.6 per cent while same-store at the drug-store division jumped 10.7 per cent.

Earlier this month, Loblaw withdrew its outlook for the year because of the volatility triggered by the coronavirus pandemic.

--With assistance from Michael Bellusci.