Mar 10, 2022

Logan Plans Asset Sales; Debt Financing Woes: Evergrande Update

, Bloomberg News

(Bloomberg) -- Logan Group Co. plans to dispose of about 6 billion yuan ($949 million) of assets amid a liquidity squeeze, The Paper reported, joining other builders that are seeking to raise money through divestments.

As worries mount about debt repayments from multiple property firms, Bloomberg Intelligence says the shutting of onshore and offshore bond markets to distressed developers for fundraising could threaten their survival. Fitch Ratings on Thursday cut Times China Holdings Ltd.’s debt scores to B+ from BB-, citing the firm’s “weakened financial flexibility.”

A gauge of Chinese property developers plunged as much as 4.7% to the lowest intraday price since July 2016, alongside weakness in risk assets across Asia. Dollar bonds of higher-rated names such as Country Garden Holdings Co. and CIFI Holdings Group Co. were poised for record weekly declines and led fresh drops Friday for Chinese developer notes.

Key Developments:

- Debt-Refinancing Halt Pushes China Developers to Breaking Point

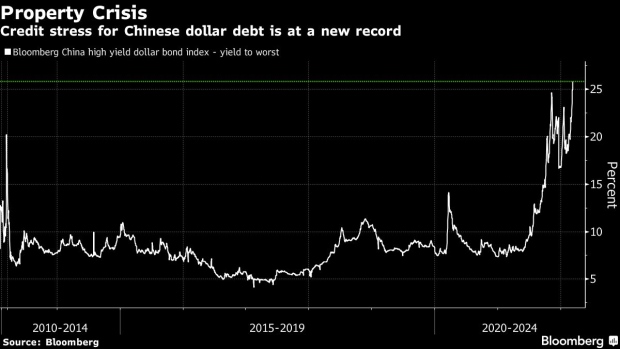

- Junk Yields Are About to Hit Record 25%: What to Watch in China

- Times China Downgraded to B+ by Fitch (1)

- China Developers’ Credit Stress Might Not Have Peaked Yet

- Logan Group Said to Have Made Coupon Payment on 2024 Dollar Bond

- Shimao Group Faces $2.5 Billion in Bond Payments This Year

- Logan to Seek 18-Month Delay of Full Local Bond Repayment

Sunac Unit Gets Approval to Add Put Date for 2024 Onshore Bond (11:52 a.m. HK)

Sunac’s key onshore unit got bondholder approval this week to add a 2023 put-option date on a 4 billion yuan bond due 2024, according to a document disclosed Thursday with Shanghai Stock Exchange’s private information disclosure venue and seen by Bloomberg.

Logan Plans to Dispose of 6 Billion Yuan of Assets: The Paper (9:31 a.m. HK)

Logan Group plans to dispose of about 6 billion yuan of assets amid tight liquidity though there is no detailed list about the assets involved, The Paper reported late Thursday, citing an unidentified executive from the property developer.

The company has “voluntarily” halted construction of some projects, the executive was cited as saying at meeting with creditors Thursday.

Debt-Refinancing Halt Pushes Developers to Breaking Point: BI (8:18 a.m. HK)

Distressed China developers barred from accessing the bond markets for refinancing are set to face mounting default risk amid a slump in home sales, the slow pace in asset disposals and banks’ reluctance to extend loans, according to Bloomberg Intelligence.

State-backed firms, along with Longfor Group Holdings Ltd., CIFI and Country Garden, are set for market-share gains if their funding channels stay open, analyst Kristy Hung wrote.

Times China Cut to B+ by Fitch (5:08 p.m. HK)

Times China’s ratings were downgraded by Fitch to B+ from BB-, citing the real estate firm’s “weakened financial flexibility” due to slower cash collection and limited access to capital markets.

Fitch has a negative outlook on the ratings, reflecting “uncertainty about its ability to refinance its capital-market maturities due in 2023 as the offshore bond market remains inaccessible to the company.”

©2022 Bloomberg L.P.