Oct 18, 2019

London Bankers Ready for Wave of Debt Deals If Johnson Wins Vote

, Bloomberg News

(Bloomberg) -- Britain’s junk-rated debt market could be on the verge of a deal bonanza if the U.K. Parliament backs Boris Johnson’s Brexit deal on Saturday.

“The U.K. market is still one of the deepest in Europe for corporate finance and M&A, and given the lack of issuance in the past 18 months, there’s a lot of transactions waiting to happen,” said Stefan Povaly, co-head of leveraged finance origination in EMEA at JPMorgan Chase & Co. in London. “Some sort of resolution or deal could be a catalyst for incremental deal activity in the sterling market.”

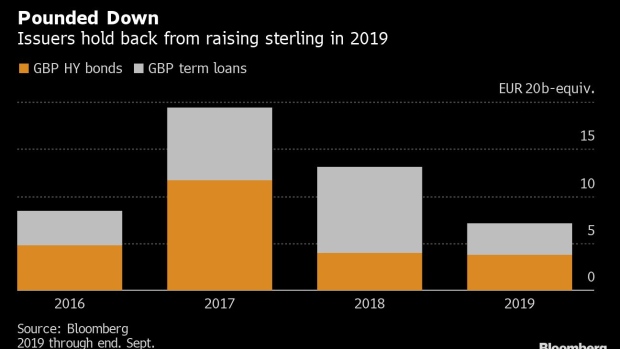

Issuance volumes of leveraged loans and high-yield notes in pounds are down 58% on the same period of 2017, a record year for bonds, data compiled by Bloomberg show. Investors have been less inclined to buy sterling credit in recent months given a lack of visibility around Brexit and all the headline risk, according to syndicate bankers.

But if the U.K. prime minister fails to win the crucial vote this weekend, the country will be on course to leave the bloc without a deal on Oct. 31, or to delay exit day for a third time. Arranging banks say either of those scenarios could freeze sterling issuance for the rest of the year.

“An extension would mean the sterling market remains in limbo, and the risk premium that U.K. companies have to pay to raise financing will remain higher than what you would see in normal times,” said Paul Watters, head of corporate research at Standard & Poor’s. “Investors may be quite reluctant to provide financing to U.K. companies in a no-deal Brexit.”

Brexit Premium

While the March deadline extension for leaving the EU brought some leveraged borrowers back to the U.K. market, funding costs in sterling have continued to creep up. This so-called “Brexit premium” versus euro equivalent debt financing has kept many potential issuers on the sidelines.

Used-car dealer BCA Marketplace Plc and outsourcing firm Webhelp SAS paid premia of 125 to 150 basis points this year on sterling M&A loans raised alongside euro tranches. Borrowers raising both euro and pound loans typically paid 50 basis points more for sterling in 2016 and 75 to 100 basis points extra last year, according to data compiled by Bloomberg.

In the bond market, William Hill Plc and Cabot Financial Ltd. sold sterling-denominated bonds with coupons that were higher than those on the debt being refinanced. More broadly, high-yield credit spreads in sterling are currently 89 basis points higher than their euro equivalent, Bloomberg Barclays index data show.

A resolution on Saturday could erode these relatively higher funding costs, paving the way for a spate of refinancing and M&A debt deals in pounds, according to a syndicate manager in London. Arrangers also point to pent-up pockets of demand for sterling credit, especially in the bond market.

“Deals have been accelerated to get done before the Brexit deadline,” said Jeremy Duffy, a partner at the law firm White & Case London Ltd., who specializes in bank finance. “The pipeline has been preemptively cleared.”

“But there is a lot of capital, both equity and debt, and there is a decent number of deals -- mainly opportunistic -- on ice that are waiting to see what happens and will come to market when there is any clarity,” Duffy said.

To contact the reporters on this story: Marianna Aragao in London at mduartedeara@bloomberg.net;Ruth McGavin in London at rmcgavin1@bloomberg.net

To contact the editors responsible for this story: Vivianne Rodrigues at vrodrigues3@bloomberg.net, Charles Daly

©2019 Bloomberg L.P.